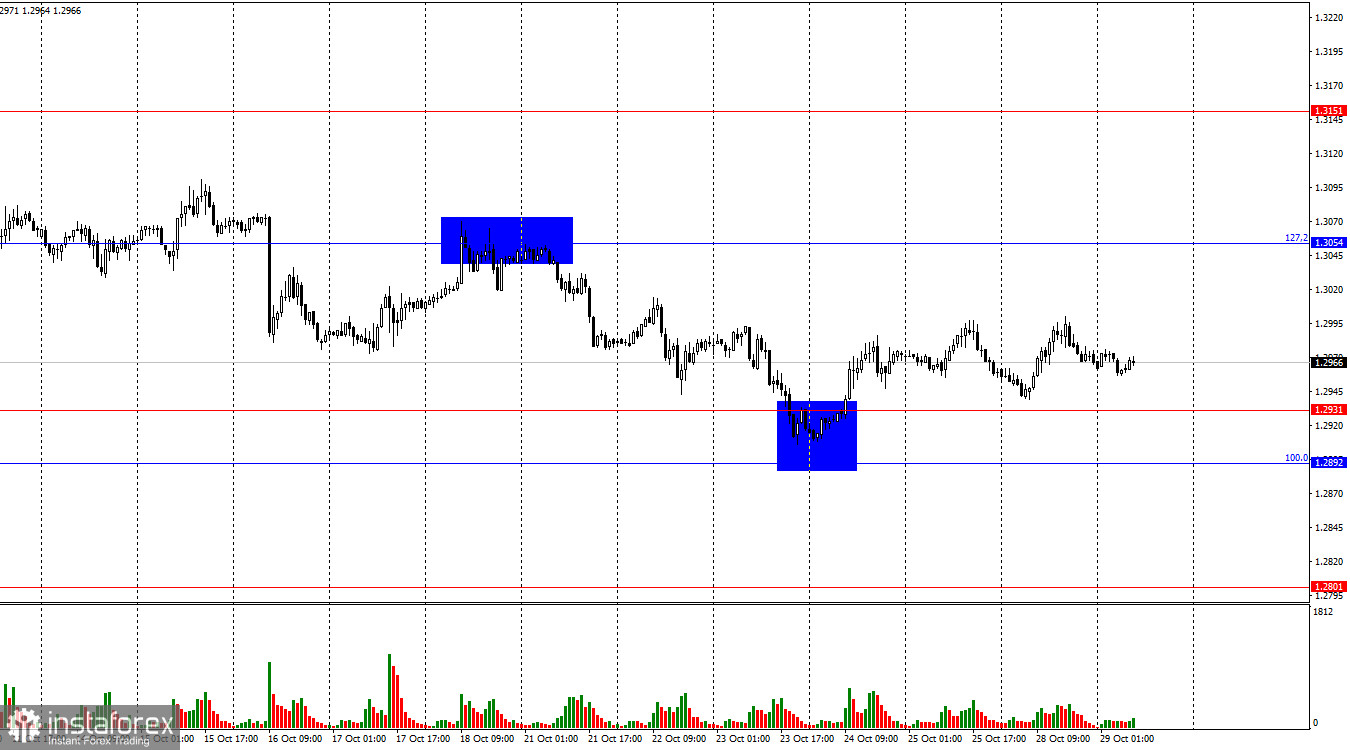

On the hourly chart, the GBP/USD pair traded without much enthusiasm on Monday. After rebounding from the 1.2892–1.2931 support zone, the bulls failed to take control. Currently, their primary aim is to support the pound above the 1.2892 level. The bulls' confidence relies heavily on the U.S. economic news due this week.

The wave structure is clear. The last completed upward wave (September 26) didn't surpass the previous wave's peak, while the current 23-day downward wave easily broke through the prior low at 1.3311. This shift suggests the prior bullish trend has concluded, signaling the start of a bearish phase. A corrective upward wave could form from the 1.2931 level, but technical indicators alone may not suffice. Bulls need to exhibit stronger buying pressure.

On Monday, there was no significant news from the UK or the U.S., placing trading on hold as the market awaits critical U.S. data. I believe trading activity will remain low until this data is released. The pound has technical grounds for an upward correction, but, as mentioned, technical signals alone aren't enough. Bulls need to go on the offensive if we're to see even a corrective wave. Note that the pound has been declining for 23 days in a single wave. This week, U.S. reports on the labor market, job openings, and unemployment are expected, which may help the bulls clarify their intentions. However, so far, it seems they are not even attempting a counterattack.

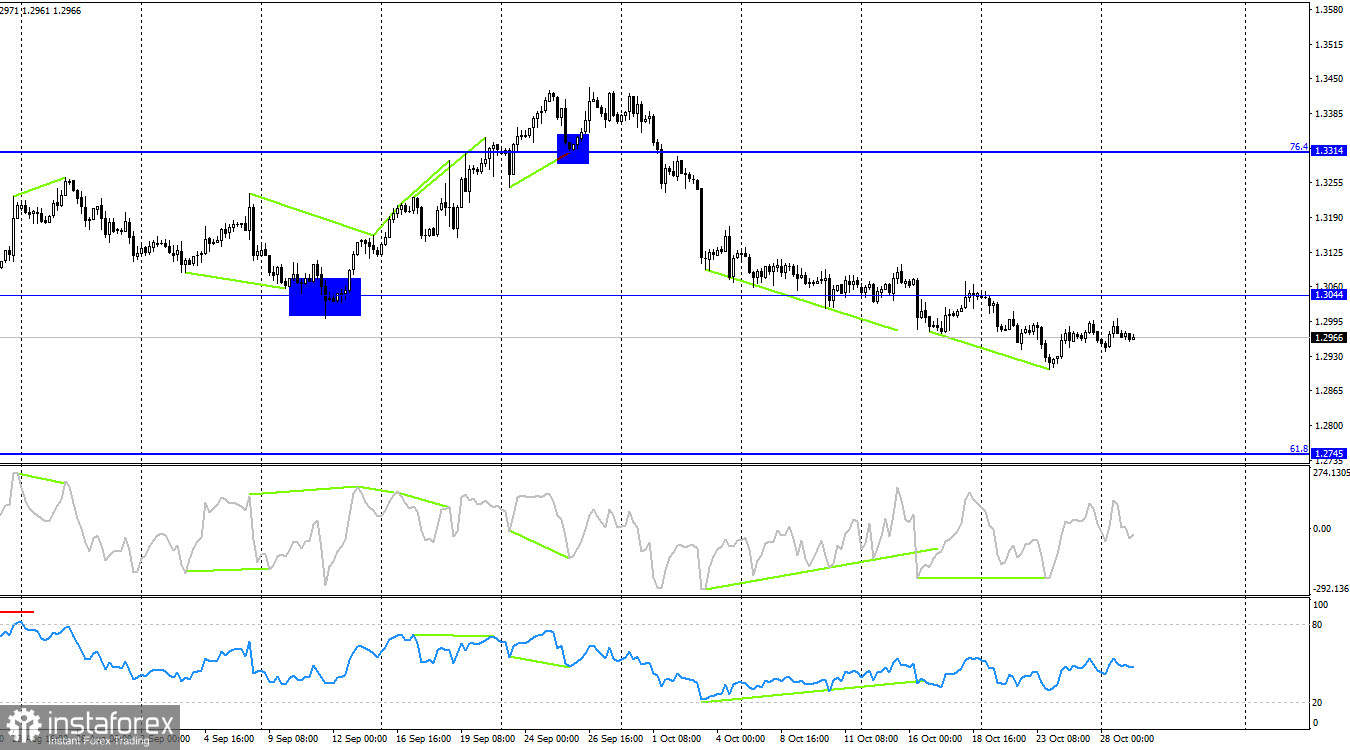

On the 4-hour chart, the pair consolidated below the 1.3044 corrective level, indicating potential further decline toward the next corrective level of 61.8% at 1.2745. However, a bullish divergence on the CCI indicator allowed a reversal in favor of the pound, initiating growth toward the 1.3044 level. A rejection of this level would favor the U.S. dollar and resume the decline toward the 61.8% corrective level at 1.2745.

Commitments of Traders (COT) Report:

Non-commercial traders' sentiment turned less bullish in the past reporting week, though it remains positive overall. The number of long positions held by speculators decreased by 11,320, while short positions increased by 94. Bulls maintain a significant lead with a 74,000-contract difference: 140,000 long positions versus 66,000 short.

In my view, the pound's potential for further decline remains, although the COT reports suggest otherwise. Over the past three months, the number of long positions increased from 135,000 to 140,000, while short positions grew from 50,000 to 66,000. I believe that professional traders will gradually offload their long positions or increase their short positions (as they are with the euro), as the factors supporting the pound have already been exhausted. Technical analysis indicates that this shift may begin imminently (or may already be underway, based on wave patterns).

Economic News Calendar for the U.S. and UK:

U.S. – JOLTS Job Openings (14:00 UTC).

On Tuesday, the economic calendar features only one significant entry. The impact of this news on market sentiment for the remainder of the day is expected to be mild.

GBP/USD Forecast and Trading Advice:

Selling the pair is possible upon a rebound from the 1.3054 level on the hourly chart or the 1.3044 level on the 4-hour chart, with a target of 1.2931. Buying the pound was an option from the 1.2892–1.2931 zone with a target of 1.3054, though the bulls currently appear very weak. It's best to set a Stop Loss to break even.

Fibonacci retracement levels are drawn between 1.2892 and 1.2298 on the hourly chart, and between 1.4248 and 1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română