Monday's Trade Analysis:

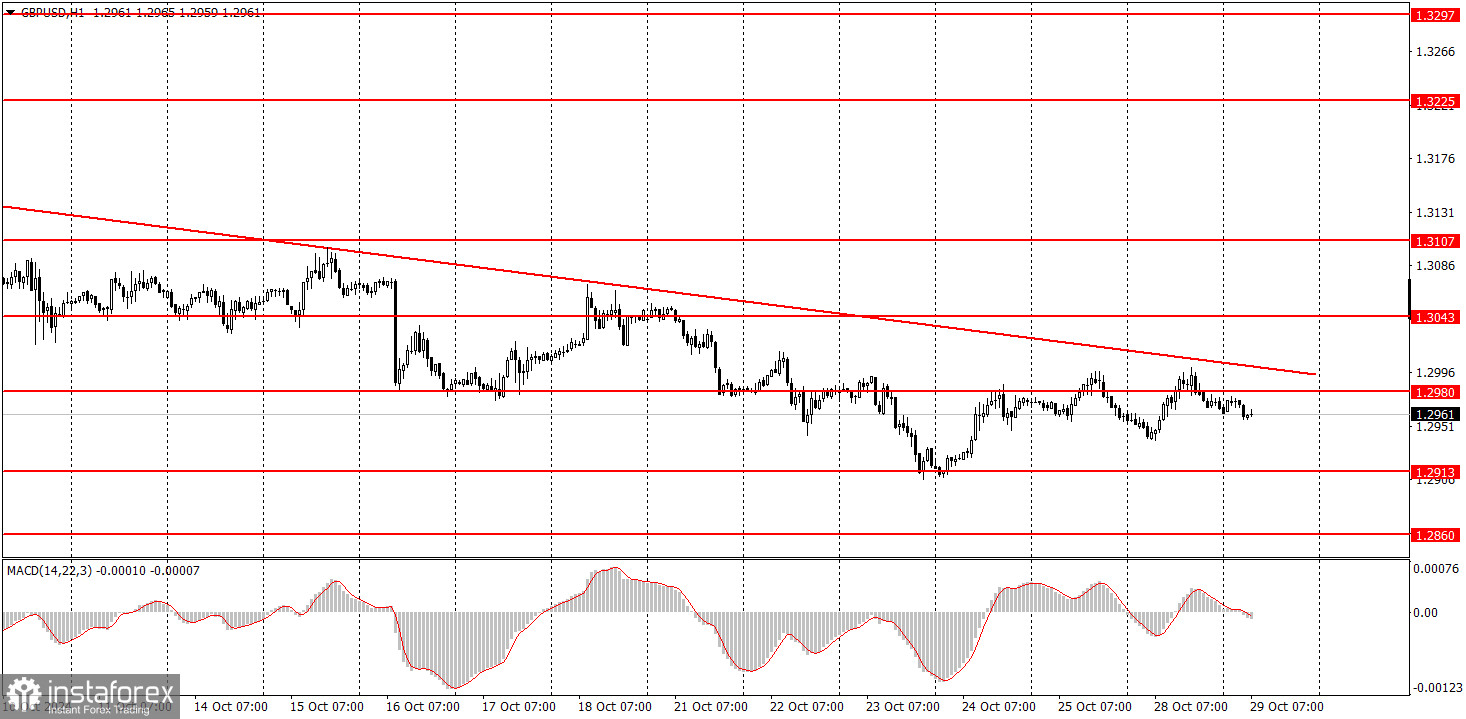

1H Chart of GBP/USD Pair

On Monday, the GBP/USD pair failed to hold above the trendline and didn't even attempt to do so. With no fundamental or macroeconomic news, the sluggish movement was expected. However, despite a month-long decline, the pound shows no inclination to start a recovery. Unlike the euro, there are no technical signals indicating a possible correction. As mentioned, a significant amount of data will be released in the U.S. this week, so the dollar could move in either direction. This week's movements will depend more on macroeconomic data than technical analysis.

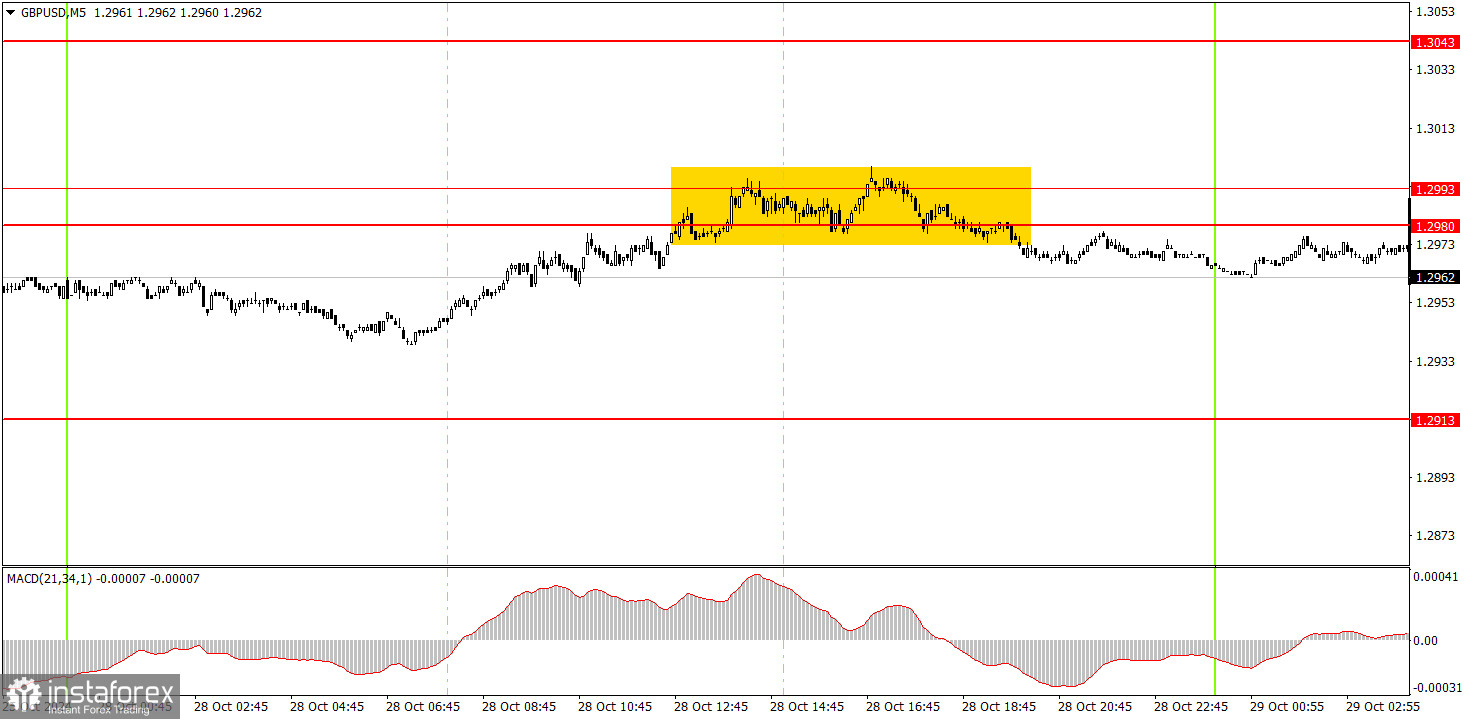

5M Chart of GBP/USD Pair

In the 5-minute time frame, the price reached the 1.2980-1.2993 area at one point and traded within it for five hours before forming a mild rebound. This bounce was weak, so a short position was possible, but it should have been carried over today. Today, a decline in the pound could theoretically be expected, especially if the U.S. JOLTs report exceeds forecasts.

How to Trade on Tuesday:

In the hourly time frame, GBP/USD broke its upward trend and continued to decline. In the medium term, we fully support the pound's decline, which is the only logical path. While the pound may attempt a short-term correction, a close above the trendline would be needed to confirm any potential recovery. In any case, there's currently no basis for a strong upward movement.

The pair may resume its downward trend on Tuesday, as the trendline has yet to be broken. Without a break above the trendline, buying isn't advisable. Even if it does break, this would likely only signal a correction.

In the 5-minute time frame, potential trading levels include 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3225, 1.3272, 1.3365, and 1.3428-1.3440. The primary event on Tuesday will be the U.S. JOLTs job openings report. Although it's not the most critical report, it could still provoke a market reaction.

Basic Trading System Rules:

- The strength of a signal is determined by the time it takes to form (whether a bounce or breakthrough of a level). The quicker the formation, the stronger the signal.

- If two or more trades have been made near a level due to false signals, any further signals from that level should be ignored.

- In a flat market, a pair can generate many false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trading occurs between the start of the European and middle of the US sessions, after which all trades should be manually closed.

- On the hourly time frame, it's recommended to trade MACD indicator signals only when there is good volatility and a trendline or trend channel confirms a trend.

- If two levels are too close together (5 to 20 pips apart), they should be treated as support or resistance areas.

- After the price moves 20 pips in the intended direction, set the Stop Loss to breakeven.

What's on the Charts:

Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed around these areas.

Red Lines: Channels or trend lines that indicate the current trend and the preferred trading direction.

MACD Indicator (14,22,3): Histogram and signal line—an auxiliary indicator that can also be used as a source of signals.

Major speeches and reports (always found in the news calendar) can significantly impact currency pair movements. Therefore, it's advised to trade cautiously or exit the market during their release to avoid sharp price reversals against prior movements.

Beginners trading on the forex market should remember that not every trade will be profitable. A clear strategy and money management are the keys to success in long-term trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română