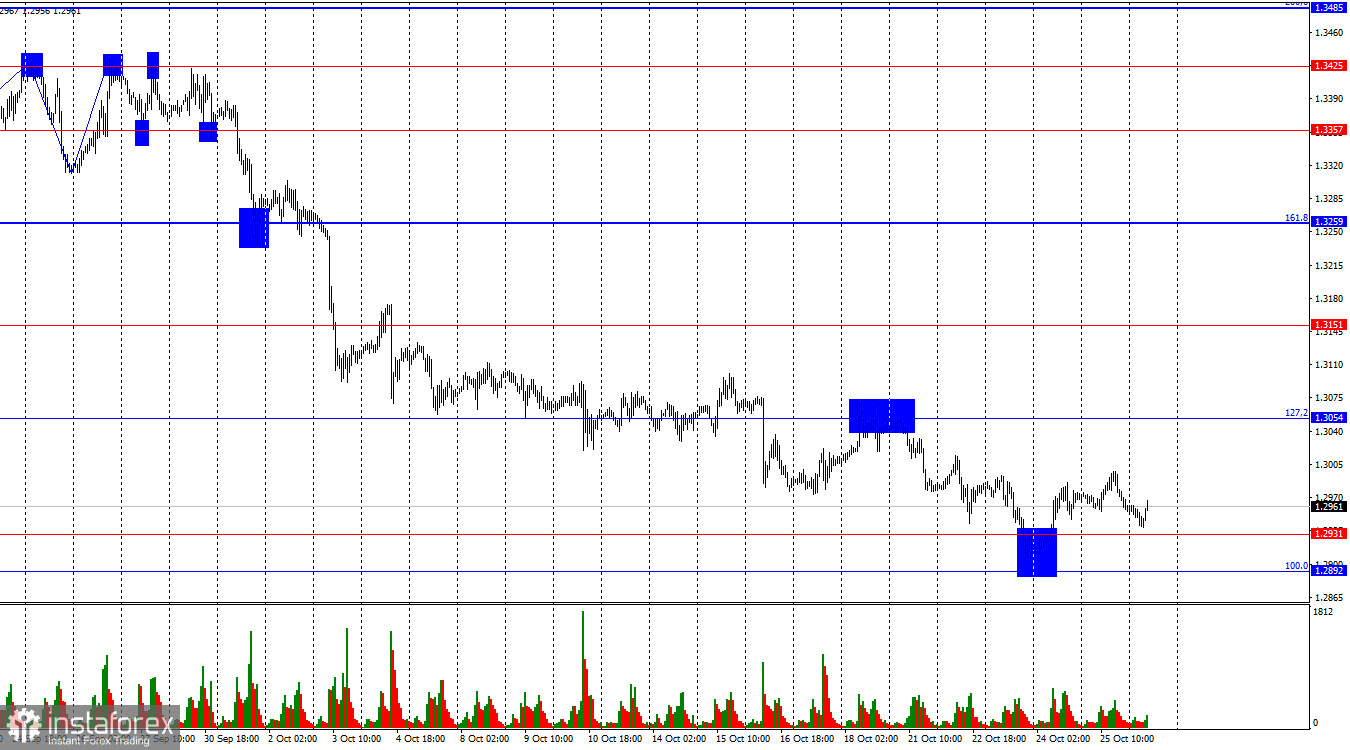

On the hourly chart, the GBP/USD pair returned to the 1.2931 level on Friday, but there was no rebound. Currently, I see no graphical opportunities or justifications for even a slight increase in the pound. The last rebound from the support zone of 1.2892 – 1.2931 triggered almost no growth. However, the U.S. is set to release significant data this week, so bulls can only hope for weaker-than-expected results.

The situation with waves is straightforward. The last completed upward wave (September 26) did not break the peak of the previous wave, while the downward wave, now in its 22nd day, has easily broken the low of the previous wave, which was at 1.3311. Thus, the bullish trend is currently considered complete, and the formation of a bearish trend has begun. A corrective upward wave from the 1.2931 level may be expected, but graphical signals alone won't suffice. Bulls will need substantial momentum to initiate an upward movement.

On Friday, there was no news background in the UK, and two reports were released in the U.S., both mediocre. The University of Michigan Consumer Sentiment Index slightly exceeded forecasts, but durable goods orders were quite lackluster in both September and August, with order volumes declining in both months. Nevertheless, bull traders were unable to capitalize on this data as they are currently quite weak. There will be little news on Monday and Tuesday this week, with the ADP report on private-sector job growth due tomorrow. However, traders are likely waiting for more critical reports on unemployment, labor market conditions, job openings, and business activity, as well as third-quarter GDP data. These data points will determine whether the U.S. dollar continues to rise, or if a corrective wave begins. Bulls are struggling to prevent further decline below the support zone of 1.2892 – 1.2931.

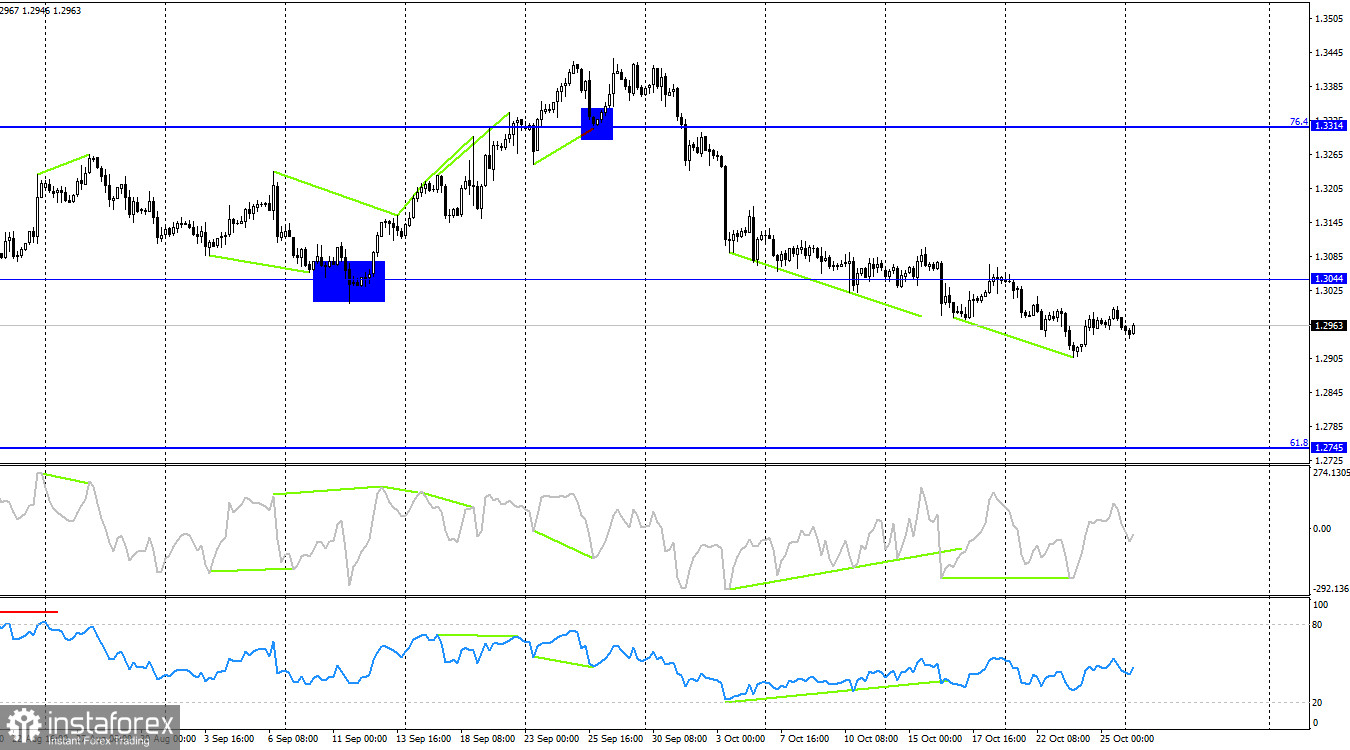

On the 4-hour chart, the pair closed below the 1.3044 corrective level, suggesting further decline toward the next corrective level of 61.8% at 1.2745. However, a bullish divergence on the CCI indicator allowed a reversal in favor of the pound, starting an upward move toward the 1.3044 level. A rebound from this level would support the U.S. dollar and resume a decline toward the 61.8% corrective level at 1.2745.

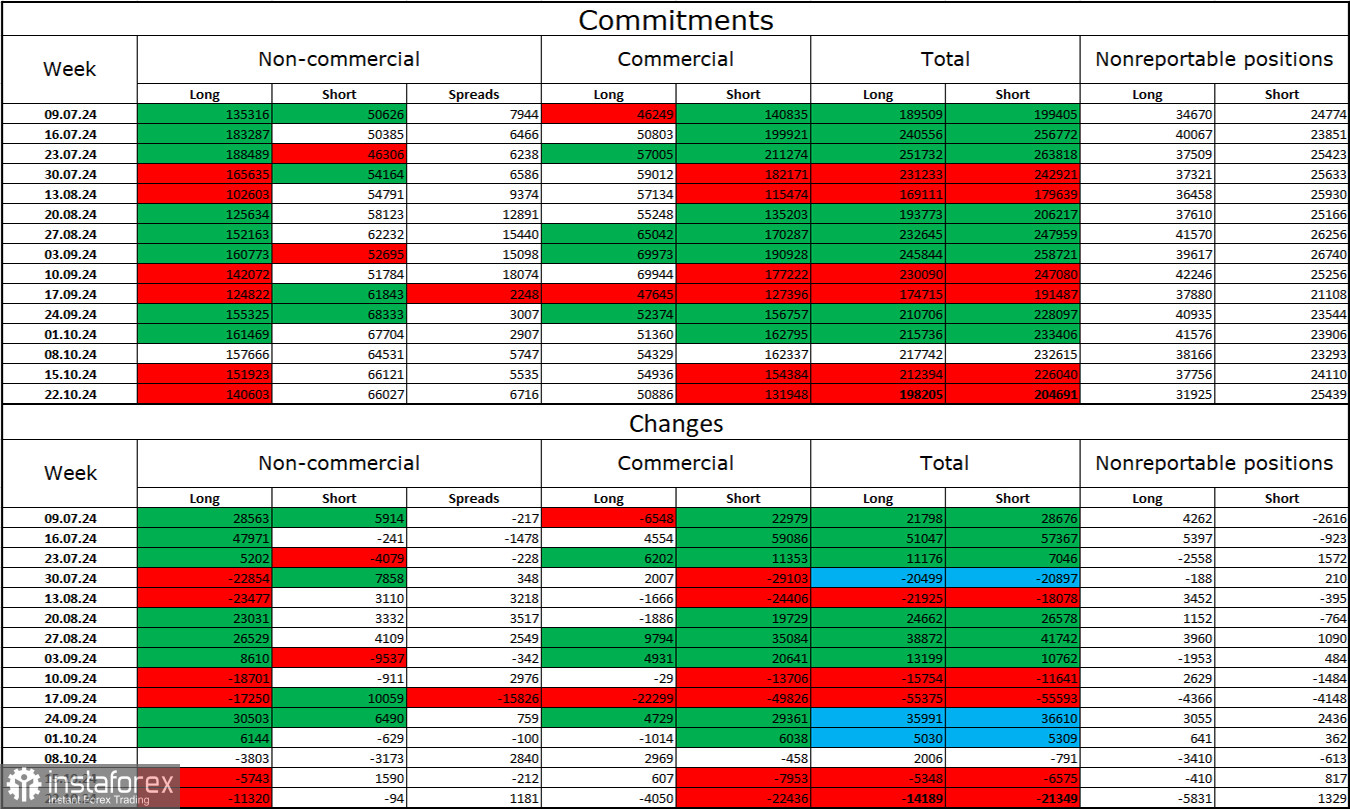

COT Report:

The sentiment among non-commercial traders became less bullish last week but remains positive. Speculators reduced their long positions by 11,320 contracts while adding 94 short positions. Bulls still hold a strong advantage, with a gap of 74,000 positions —140,000 long versus 66,000 short.

I believe the pound retains downward potential, though the COT reports still indicate otherwise. Over the past three months, the number of long positions has increased from 135,000 to 140,000, while short positions rose from 50,000 to 66,000. Over time, I think professional players will begin reducing long positions or increasing short positions (as seen with the euro), as most factors supporting the British pound have already been priced in. Wave analysis suggests a trend reversal may start soon (or may have already begun).

News Calendar for the U.S. and U.K.:

The economic calendar for Monday contains no notable entries, meaning there will be no significant influence from the information background on market sentiment for the rest of the day.

GBP/USD Forecast and Trader Tips:

Selling opportunities may arise from a rebound at 1.3054 on the hourly chart or 1.3044 on the 4-hour chart, targeting 1.2931. Buying the pound is possible in the 1.2892 – 1.2931 zone, aiming for 1.3054, but the bulls are currently very weak.

The Fibonacci retracement levels are based on 1.2892 – 1.2298 on the hourly chart and 1.4248 – 1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română