GOLD

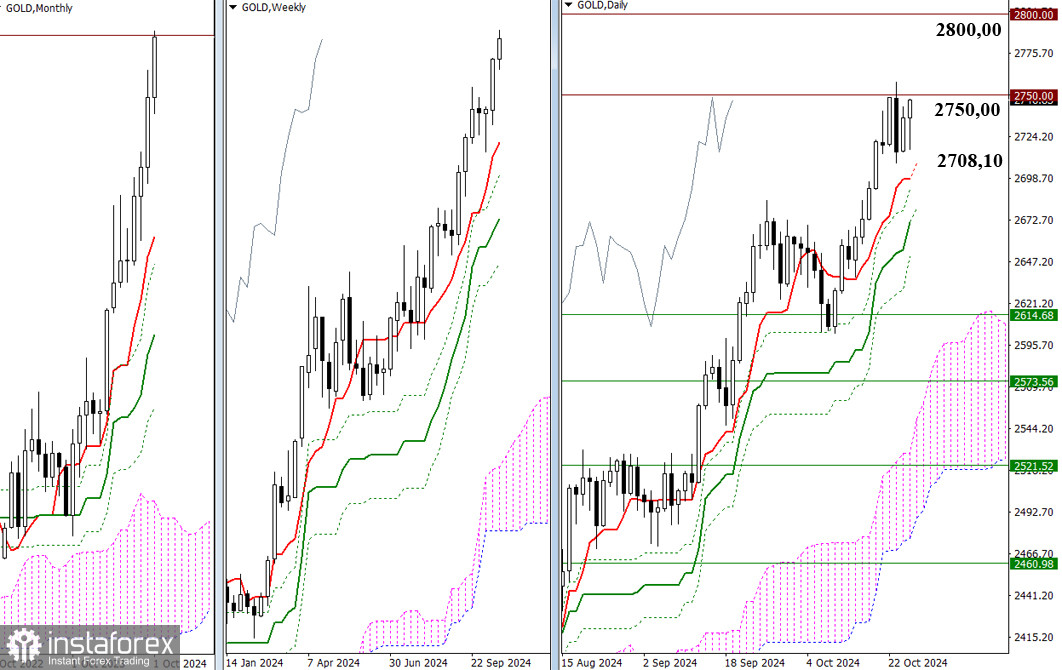

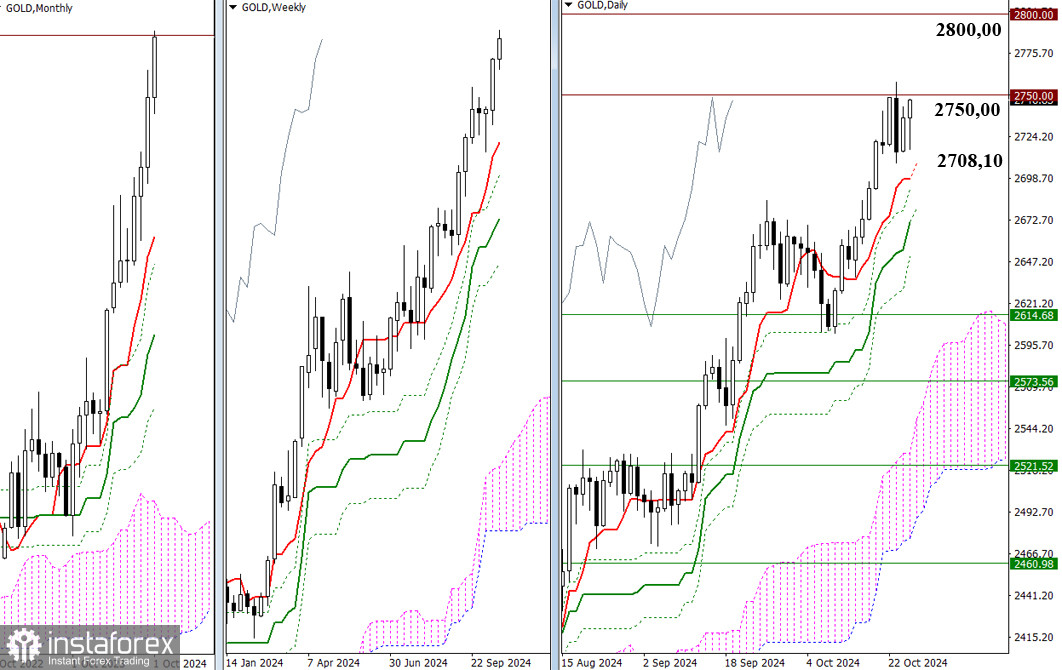

Last week, gold rose to challenge the psychological level of 2750.00. After stalling at this resistance, it continued to test this level throughout the week, setting a new all-time high at 2757.96. If the upward momentum continues, gold could reach new heights. All target levels indicated by the Ichimoku indicator have already been achieved, so the focus can now shift to psychological "round" levels, which historically have proven significant. The following levels are 2800.00, 2850.00, 2900.00, and so on. In a downward correction, the daily Ichimoku cross will receive initial support. On Monday, these support levels are at 2708.10 (Tenkan) and 2680.45 (Kijun). If bearish players actively push lower and quickly break the daily golden cross, their attention will likely shift to weekly Ichimoku support levels. The nearest level from the weekly cross is the short-term trend at 2614.68. If the downward correction is prolonged, the weekly levels will rise closer to the daily cross, providing additional support for bullish interests.

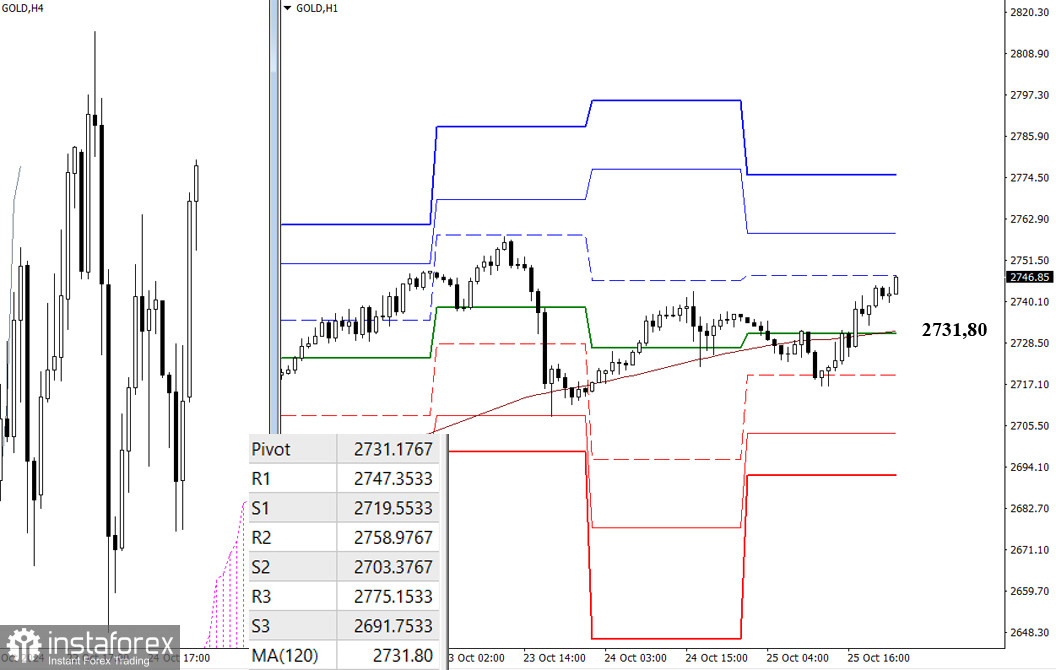

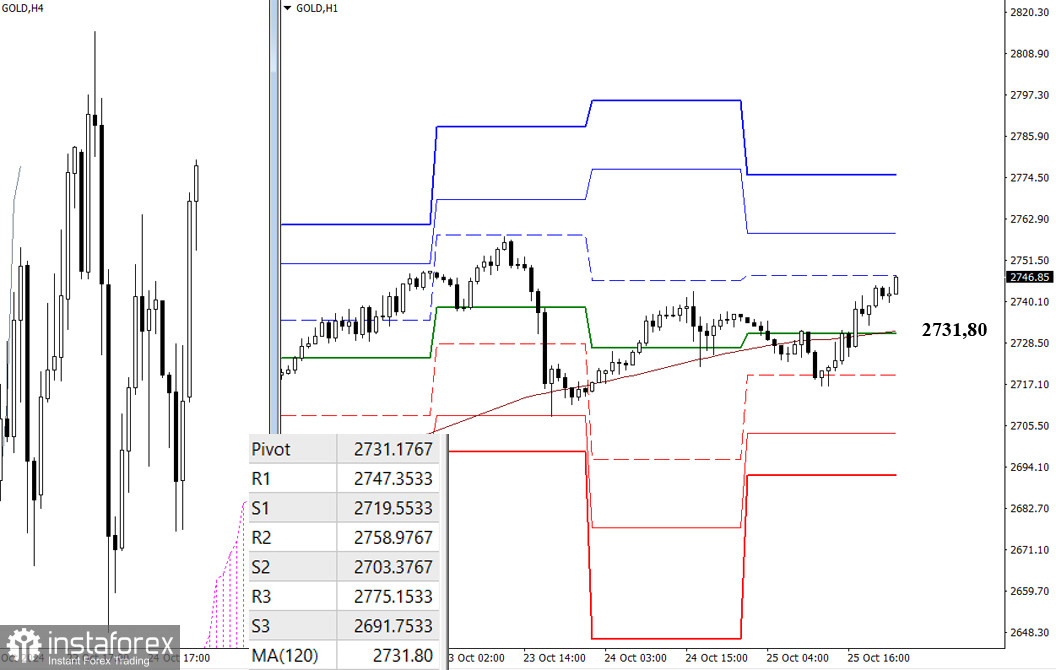

H4 – H1

In lower time frames, the uncertainty seen in higher time frames has led to a lack of clear, decisive movement. However, the advantage still leans towards bullish players. Currently, gold is trading above the weekly long-term trend at 2731.80. Any further rise will need to overcome the resistance of the classic Pivot Points, which provide good intraday guidance. Losing support from the weekly long-term trend at 2731.80 would shift the balance of power, drawing market attention to bearish targets at the support levels of the classic Pivot Points. It's essential to note that the values of these Pivot Points will update upon market opening.

Technical Analysis Components:

- Higher Time Frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

- H1 – Classic Pivot Points + 120-period Moving Average (weekly long-term trend)

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română