Analysis of Trades and Advice on Trading the Euro

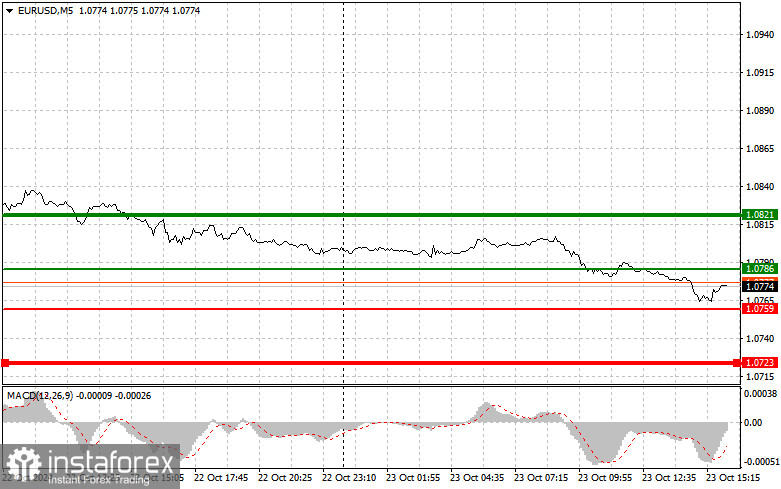

The test of the 1.0788 level coincided with the MACD indicator moving significantly below the zero mark, which limited the pair's downward potential. For this reason, I refrained from selling the euro, despite the downward trend. In the second half of the day, the speeches from FOMC members Thomas Barkin and dovish Michelle Bowman will be in the spotlight, as there are no other economic reports from the US. Against this backdrop, the euro has limited chances for growth, especially considering the position of Federal Reserve representatives, who have been advocating for a gradual reduction in interest rates lately. As for the intraday strategy, I will prioritize Scenario No. 2.

Buy Signal

Scenario No. 1: Today, buying the euro is possible when the price reaches around 1.0786 (green line on the chart), targeting a rise to the 1.0821 level. At 1.0821, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 points from the entry point. Euro growth in the second half of the day is likely only as part of a correction. Note: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.0759 price when the MACD indicator is in the oversold area. This will reduce the pair's downward potential and lead to an upward reversal. Growth can be expected to the opposite levels of 1.0786 and 1.0821.

Sell Signal

Scenario No. 1: I plan to sell the euro after reaching the 1.0759 level (red line on the chart). The target is the 1.0723 level, where I plan to exit and reverse to buy, aiming for a movement of 20-25 points. Pressure on the pair will return today if the Fed representatives maintain a firm stance. Note: Before selling, ensure that the MACD indicator is below the zero mark and just beginning its decline from there.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.0786 price when the MACD indicator is in the overbought area. This will curb the pair's upward momentum, leading to a downward reversal. A decline can be expected to the opposite levels of 1.0759 and 1.0723.

What is on the Chart:

- Thin green line – entry price for buying the trading instrument.

- Thick green line – estimated price for setting Take Profit or manually closing positions, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – estimated price for setting Take Profit or manually closing positions, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it's important to pay attention to overbought and oversold zones.

Important: Beginner forex traders should be very cautious when making decisions about market entries. It is best to avoid trading before important fundamental reports are released to avoid being caught in sharp exchange rate fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

Remember, successful trading requires having a clear trading plan. Spontaneous trading decisions based on the current market situation are typically a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română