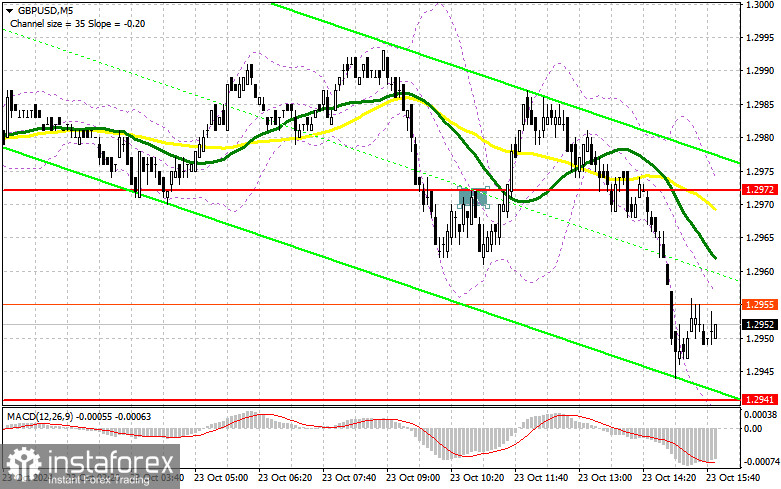

In my morning forecast, I focused on the level of 1.2972 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and see what happened. A breakout and retest of this range allowed entry into short positions, resulting in a drop of the pair by more than 30 points. The technical outlook was adjusted for the second half of the day.

For opening long positions on GBP/USD:

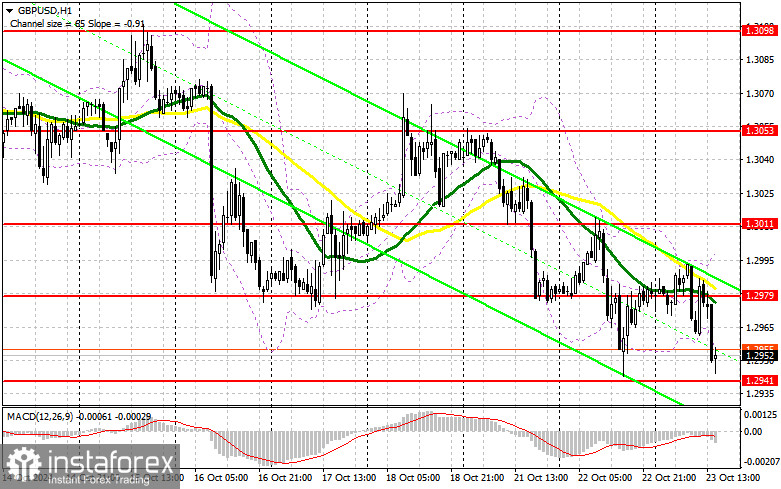

The only speeches likely to draw traders' attention are those from FOMC members Thomas Barkin and Michelle Bowman, after which the dollar may rise further, potentially pushing GBP/USD down to the monthly low. Against this backdrop, it is not advisable to rush into buying against the bearish market. Only a false breakout around the 1.2941 support level, formed yesterday, would provide an entry point for long positions. The target would be the new resistance at 1.2979, formed after the first half of the day. A breakout and retest from above of this range would revive chances for a corrective upward move, leading to the triggering of sellers' stop orders and providing a suitable entry point for buying with the potential to reach the 1.3011 level. A test of this level could disrupt sellers' plans for further declines in the pound. The farthest target would be the area around 1.3053, where I plan to take profits. If GBP/USD continues to decline without bullish activity around 1.2941 in the second half of the day, the market trend will remain bearish. This would also lead to a drop and a retest of the next support at 1.2911. Only a false breakout there would provide a suitable condition for opening long positions. Long positions could be considered immediately on a rebound from the 1.2884 low, targeting an intraday correction of 30-35 points.

For opening short positions on GBP/USD:

Sellers are firmly pressuring the pound. If the pair corrects after the Fed representatives' speeches, the bears will focus on defending the new resistance at 1.2979, supported by the moving averages. A false breakout there would be a suitable scenario for selling with a target of falling to the 1.2941 support – the monthly low. A breakout and a bottom-up retest of this range could impact buyers' positions, causing stop orders to be triggered and opening the path to 1.2911. The farthest target would be the area around 1.2884, where I plan to take profits. Testing this level would reinforce the bearish market. If GBP/USD rises without bearish activity at 1.2979 in the second half of the day, buyers will attempt to regain the initiative. In such a case, the bears will have no choice but to retreat to the resistance area of 1.3011. I will only sell there if the price fails to consolidate above the resistance. If the price fails to decline, I will look for short positions on a rebound from around 1.3053, expecting a downward correction of the pair by 30-35 points.

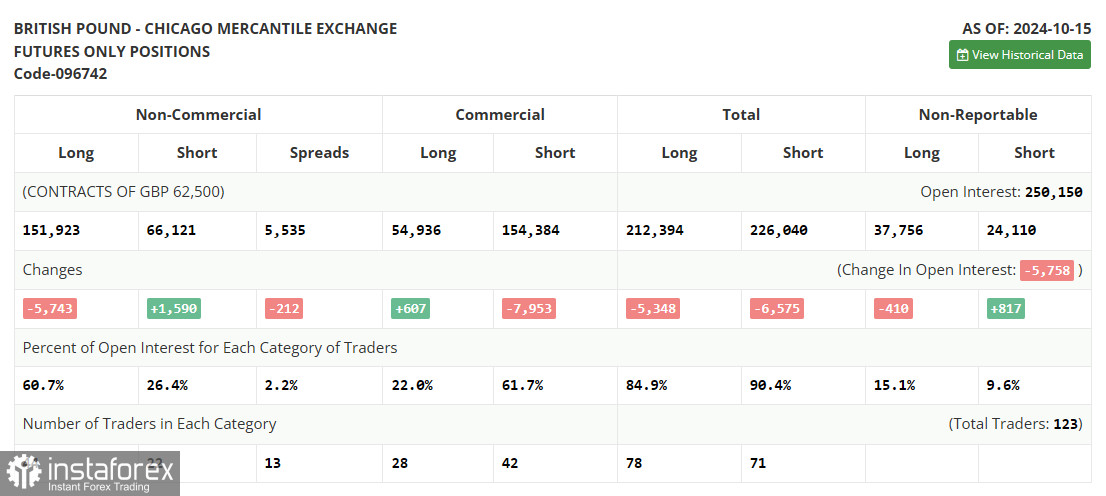

In the Commitment of Traders (COT) report for October 15, there was a reduction in long positions and an increase in short positions. However, this did not significantly affect the balance between buyers and sellers, with the former still outnumbering the latter by almost two and a half times. The data on the UK labor market and inflation have negatively impacted the pound's upward potential, as everything points to further interest rate cuts in the UK, which is unfavorable for the national currency. This week, there is no significant economic data, so all eyes will be on the statements from Bank of England representatives, which could help clarify the regulator's future policy. The latest COT report indicated that long non-commercial positions decreased by 5,743 to 151,923, while short non-commercial positions increased by 1,590 to 66,121. As a result, the gap between long and short positions narrowed by 212.

Indicator Signals:

Moving Averages:

Trading is below the 30- and 50-day moving averages, indicating further declines for the pair.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.2954 will act as support.

Description of Indicators:

- Moving Average (smoothing volatility and noise to identify the current trend). Period 50. Marked in yellow on the chart.

- Moving Average (smoothing volatility and noise to identify the current trend). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română