The EUR/USD currency pair continued to trade lower on Tuesday. Yes, and this time, the decline was very weak. However, over the past 3.5 weeks, the price has not managed even a single upward correction. Nevertheless, this situation does not surprise us at all. We have repeatedly listed all the key factors for the EUR/USD pair, and they all suggest that the decline of the European currency will continue.

Earlier this year, we wrote that we expected the euro around the 1.0435 level and even lower—in the range of 1.00-1.02$. Even then, it was clear that the euro was overvalued, while the dollar appeared undervalued. Six months later, the euro has risen even more. Yet the conclusions remain the same. If the fundamental background does not change in favor of the euro and continues to increase (even if not too strongly), this only reinforces the expectation of a sharp decline. We also warned that the market had eagerly anticipated the future easing of the Federal Reserve's monetary policy for at least nine months. After September 18, when this easing began, no more factors were left to sell the US dollar. And now the dollar has been rising for 3.5 weeks. Everyone is waiting for a correction; analysts write daily that the euro should not fall any further, and they attribute the rise of the US dollar to anything, even the potential return of Donald Trump to power.

Will a Trump presidency have a tangible impact on the dollar? Theoretically, it is possible that Trump advocates for a weak dollar. At the same time, he would inevitably initiate new trade wars with the European Union and China, which would drive up prices within the US and contribute to rising inflation. In this case, the Federal Reserve would be forced to reduce rates less aggressively, which would be positive for the dollar. However, the market is unlikely to respond to the "Trump factor." The easing of the Fed's monetary policy was well-known and certain; the only question was the timing. But whether Trump will return to power for a second term remains a big question. Current exit polls and surveys show that there is no clear advantage for either Kamala Harris or Donald Trump in the key US states (those that will determine the election outcome). Therefore, just a few hundred votes may decide the election results. Predicting in whose favor these "hundreds" will go is impossible.

Thus, we still believe that the euro is declining entirely deservedly and should continue to fall, at least to the lower boundary of the horizontal channel on the weekly timeframe, that is, to the level of 1.0435. Since the global trend is still downward, it's not out of the question that the price may return to parity.

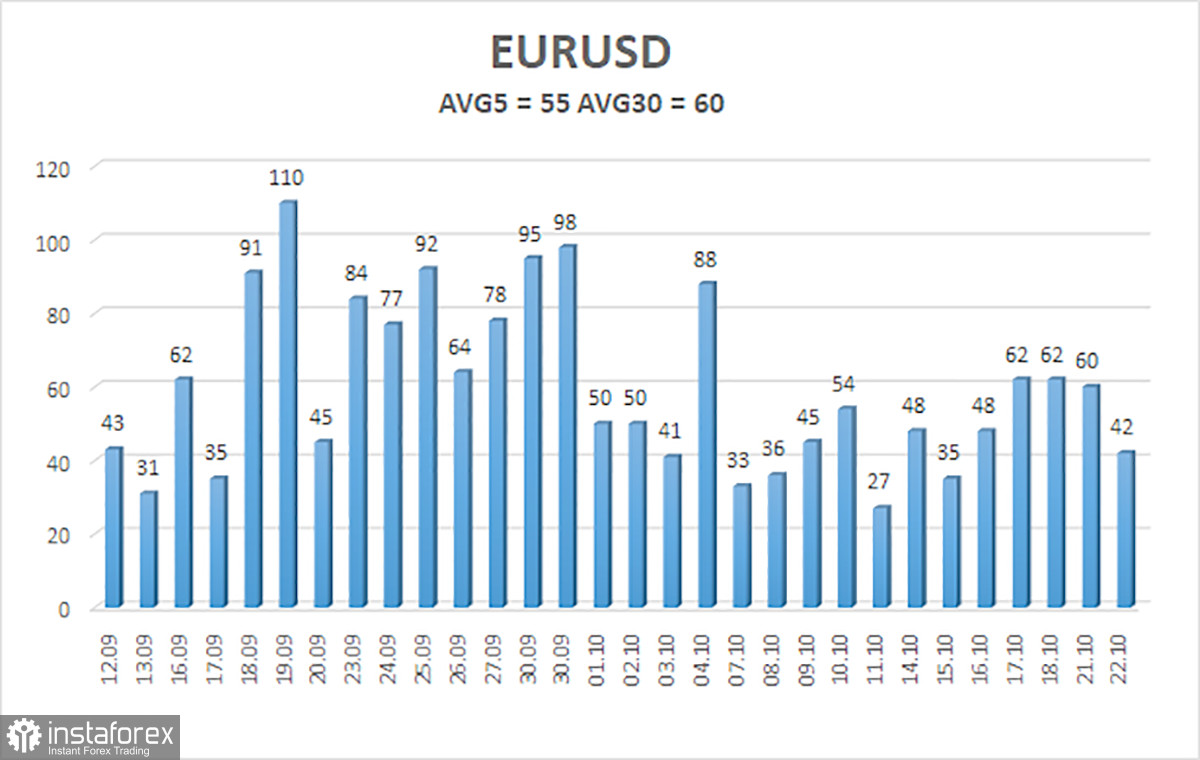

The average volatility of the EUR/USD currency pair over the last five trading days as of October 23 is 55 pips, characterized as "low." We expect the pair to move between the levels of 1.0748 and 1.0858 on Wednesday. The higher linear regression channel is directed upward, but the overall downward trend remains. After a series of visits to the overbought area, the CCI indicator has now entered the oversold zone and formed two bullish divergences—a correction is brewing. However, it might start later.

Nearest Support Levels:

- S1 – 1.0803

- S2 – 1.0742

- S3 – 1.0681

Nearest Resistance Levels:

- R1 – 1.0864

- R2 – 1.0925

- R3 – 1.0986

Trading Recommendations:

The EUR/USD pair continues its downward movement. In recent weeks, we expect only a decline from the euro in the medium term, so we fully support the downward direction of the trend. Likely, the market has already priced in all or almost all of the future Fed rate cuts. If so, there are no more reasons for the dollar to fall, although there weren't many. Short positions can still be considered with targets of 1.0748 and 1.0742 if the price is below the moving average. If you trade using "pure" technical analysis, then long positions will be relevant when the price is above the moving average line. However, such a move would only signify a correction soon.

Illustration Notes:Linear Regression Channels: help determine the current trend. If both are directed the same way, the trend is strong.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the likely price range the pair will trade in the next 24 hours, based on current volatility readings.

CCI Indicator: entering the oversold area (below -250) or the overbought area (above +250) signals that a trend reversal in the opposite direction is near.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română