The US dollar is still holding the upper hand in the Forex market. EUR/USD has been declining for 13 out of the last 16 trading days. Asset managers and hedge funds have taken their $13 billion bearish position on the US currency to neutral over the past three weeks. The talk of parity in the major currency pair has resurfaced. Who's to blame for this? Jerome Powell or Donald Trump?

It almost feels like the Republican is envious of the Federal Reserve Chairman. His latest critique touches on the question of what is the easiest job in the world: "Show up at the office once a month, flip a coin to decide the fate of interest rates, and the whole world thinks you're a god." In this sense, what's happening in the markets in October is a balm for Trump's wounds. The rising probability of his victory in the presidential election is pushing up US Treasury yields. The growing appeal of US assets is great news for the dollar.

Dynamics of Donald Trump's popularity and US Treasury yields

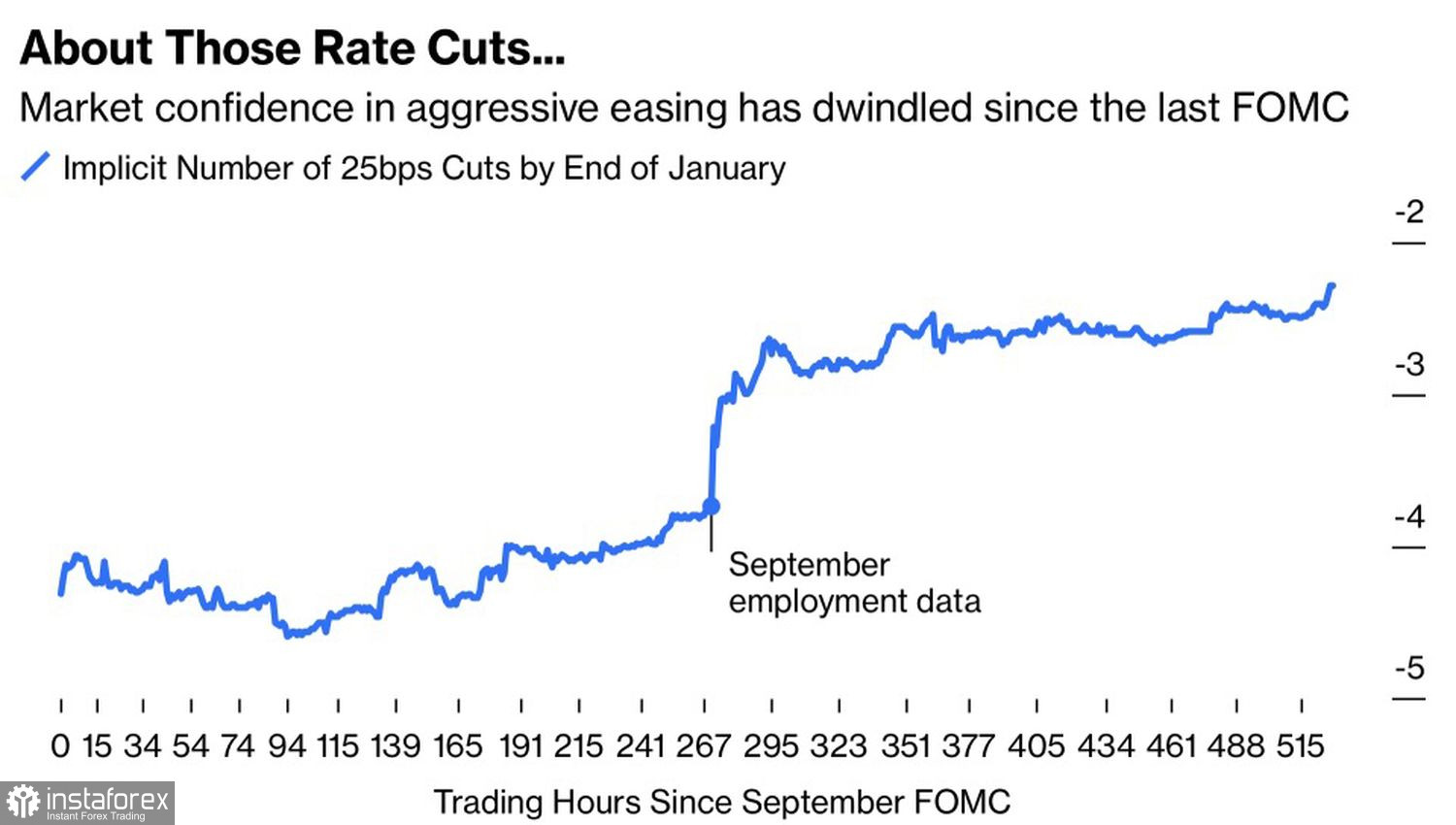

But it's not just Trump-driven trading that determines market sentiment. Jerome Powell has also played a part in the EUR/USD slump. When the Federal Reserve began its monetary policy easing cycle—and did so quite swiftly—derivatives markets assumed that the federal funds rate would drop by 100 basis points over the next three FOMC meetings in November, December, and January. This suggested at least one more significant move.

However, the US nonfarm payrolls for September turned everything upside down. Now the futures market expects borrowing costs to decrease by only 50 basis points between November and January, meaning the Fed will likely pause at one of its meetings.

Market expectations for US funds rate

This shift in market outlook wasn't driven entirely by macroeconomic data. Recently, FOMC officials have been unanimously underscoring the need for a cautious approach to monetary easing. The brisk pace of rate cuts is now a thing of the past, and it's no surprise—the US economy remains robust. In a strong economy, the risk of accelerating inflation is high. The Federal Reserve doesn't want a repeat of the 1970s when a prematurely declared victory over inflation led to renewed monetary tightening and a double-dip recession.

History from half a century ago could repeat itself, especially if Donald Trump returns to power in the US. His protectionist policies threaten to disrupt supply chains and drive higher inflation. A combination of a strong economy and trade wars is a potent mix, highly beneficial for the US dollar. While the 45th US president and the Federal Reserve Chair pull the blanket in different directions, the USD index continues its confident rise.

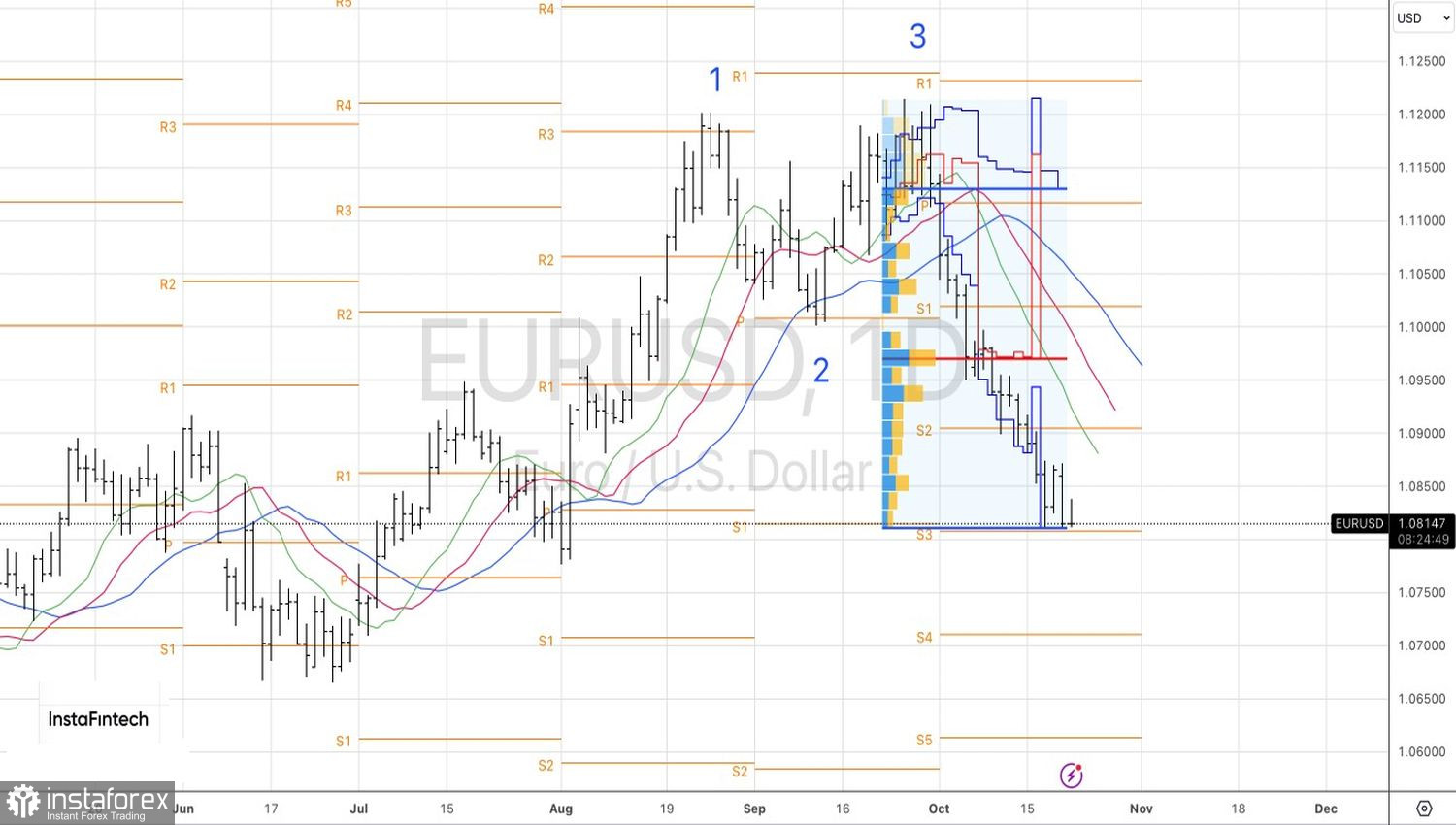

Technical outlook for EUR/USD

Technically, on the daily chart, EUR/USD is now within arm's reach of the lower border of a fair range between 1.0805 and 1.1135. A decisive break through this level will open the path downward for the instrument, toward 1.0710 and 1.0600. Isn't this a perfect reason to add more short positions?

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română