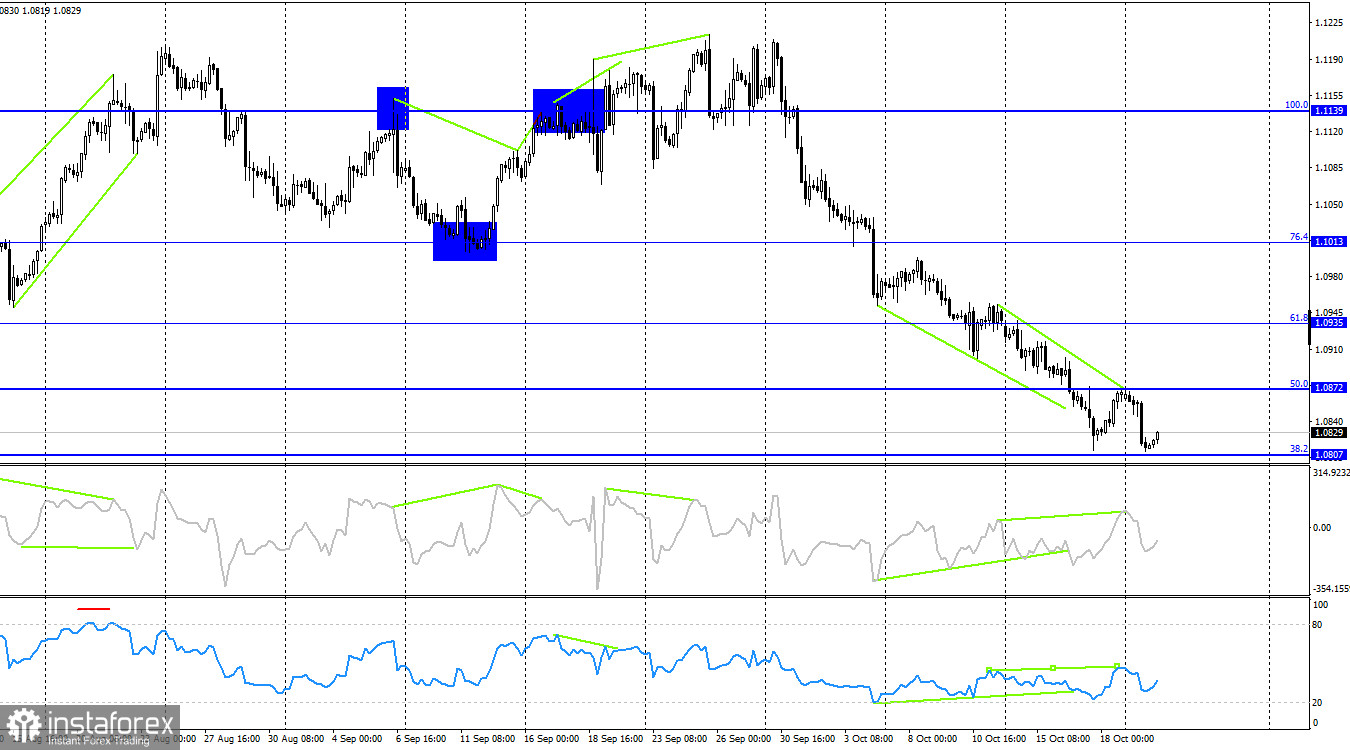

The wave situation is clear. The last completed upward wave (September 25–30) did not break the peak of the previous wave, while the new downward wave, which is still forming, has broken the lows of the previous three waves. This indicates that a new "bearish" trend has begun. In the near term, we might see a corrective wave, but the bulls have already lost their momentum. Regaining it would require significant effort, which is unlikely to happen soon.

There was no significant news on Monday, but today there will be two speeches by ECB President Christine Lagarde. These speeches are particularly important for the euro, as the market anticipates potential interest rate cuts at every subsequent meeting after inflation falls below the 2% target until reaching the "neutral zone." It should be noted that the ECB is concerned about weak economic growth, and its actions to ease monetary policy are aimed at stimulating the economy. If Christine Lagarde mentions today or tomorrow that the regulator is not in a hurry to cut rates due to the risks of a new rise in inflation (or for other reasons), it could provide temporary support for the euro. Beyond that, the euro has limited supportive factors today.

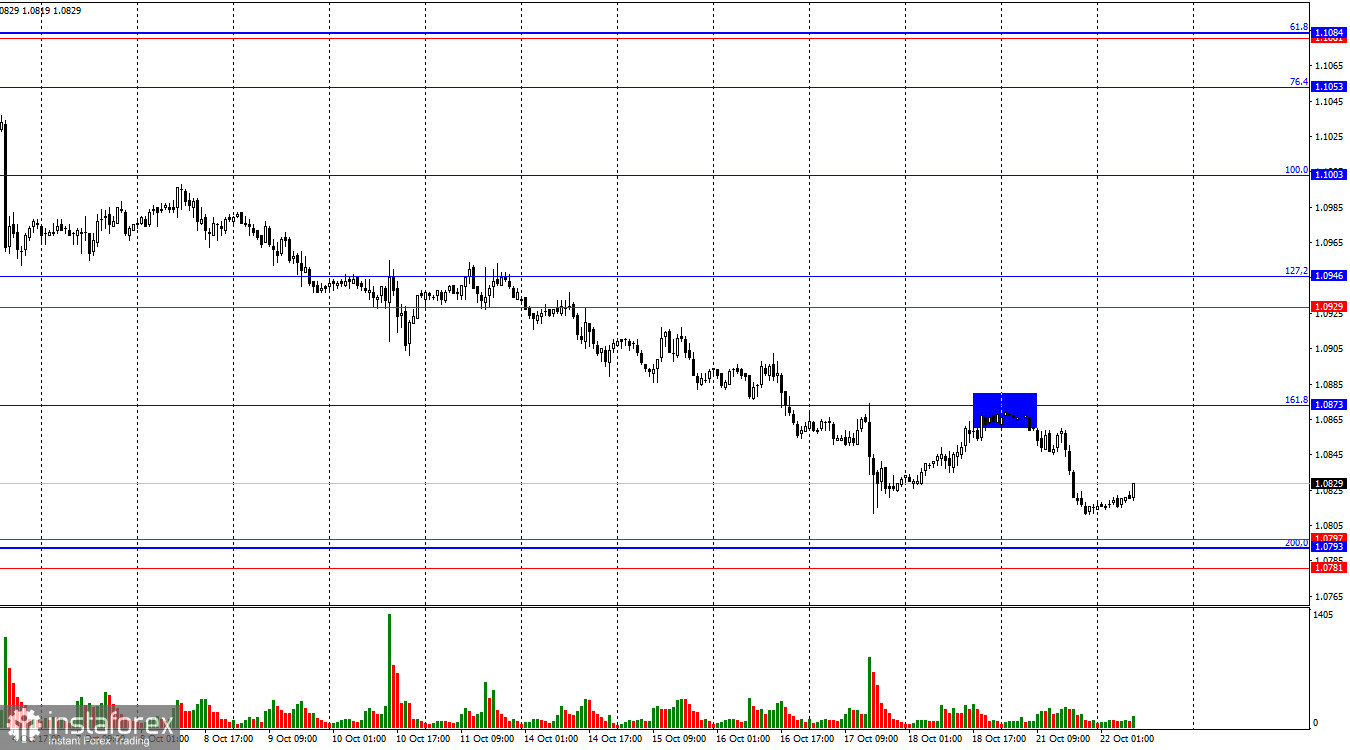

On the 4-hour chart, the pair approached the 38.2% corrective level at 1.0807 for the second time. "Bullish" divergences have been forming on both indicators for over a week, but they only suggest a possible start of a correction, as the trend has shifted to "bearish." For now, traders are ignoring these signals. Meanwhile, "bearish" divergences have also formed, which have more weight in a "bearish" trend, but they have already played out. A rebound from the 1.0807 level could support a rise in the euro towards 1.0872 and 1.0935.

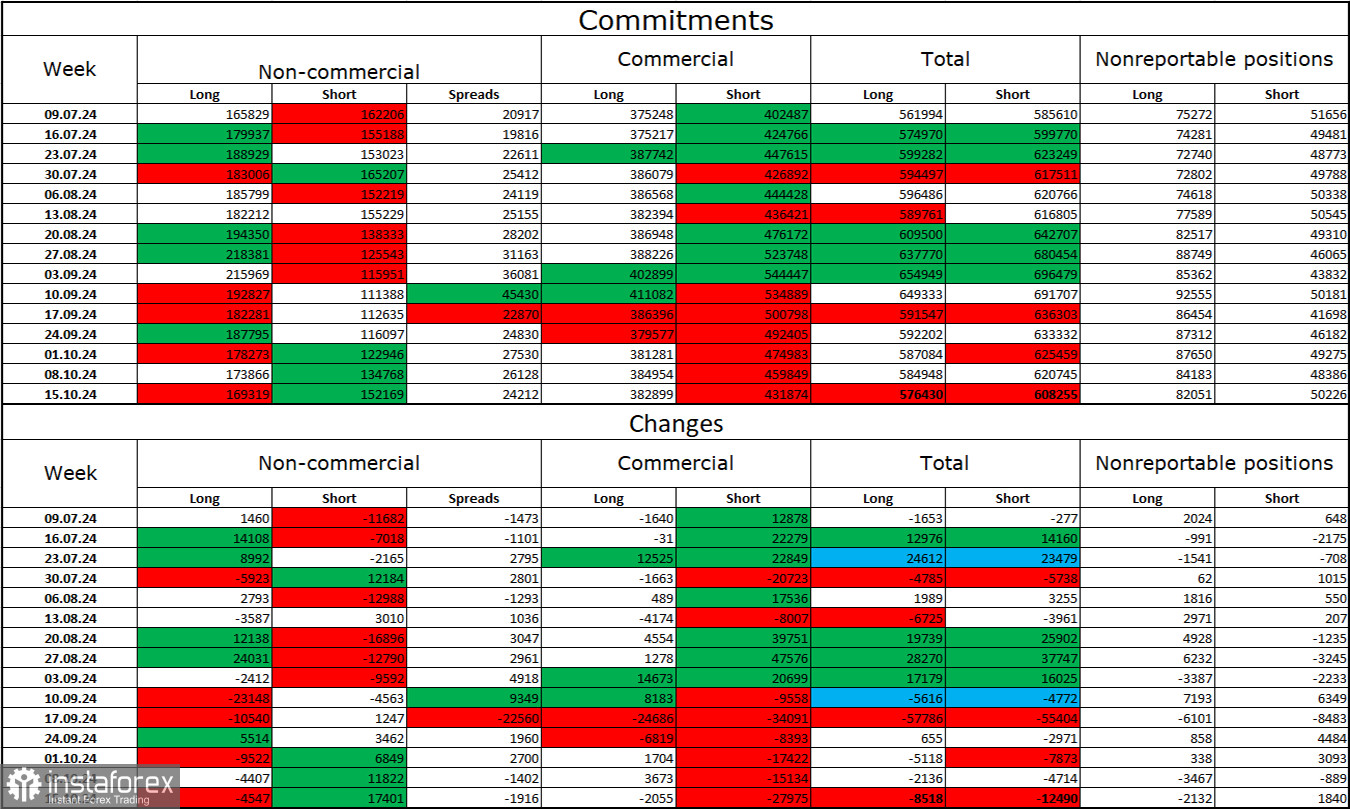

Commitments of Traders (COT) Report.

In the last reporting week, speculators closed 4,547 long positions and opened 17,401 short positions. The sentiment of the "Non-commercial" group turned "bearish" a few months ago, but now the bulls are dominating again. However, their momentum is weakening each week. The total number of long positions held by speculators now stands at 169,000, while short positions amount to 152,000.

For the sixth consecutive week, large traders have been reducing their positions in the euro. In my view, this could signal the beginning of a new "bearish" trend or at least a significant correction. The key factor behind the dollar's decline—expectations of easing FOMC monetary policy—has been priced in, and the market has no further reasons to massively sell off the dollar. Such reasons may arise over time, but currently, a stronger U.S. dollar seems more likely. Graphical analysis also suggests the start of a "bearish" trend. Thus, I anticipate a prolonged decline in the EUR/USD pair.

News Calendar for the US and Eurozone:

Eurozone – ECB President Christine Lagarde's speech (14:00 UTC).

Eurozone – ECB President Christine Lagarde's speech (19:15 UTC).

On October 23, the economic events calendar includes two significant entries. The impact of the information background on market sentiment that day may be moderate if Lagarde makes statements regarding monetary policy.

EUR/USD Forecast and Trader Tips:

Sales of the pair were possible after a close below 1.1139 on the 4-hour chart with targets at 1.1081, 1.1070, 1.1013, and 1.0984. All targets were met. It was also possible to sell the euro following consolidation below 1.0873 (or after a rebound from this level) with a target of 1.0797. I would only consider buying the pair after a rebound from the 1.0797 level.

Fibonacci levels are drawn between 1.1003–1.1214 on the hourly chart and between 1.1139–1.0603 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română