EUR/USD

Higher Time Frames

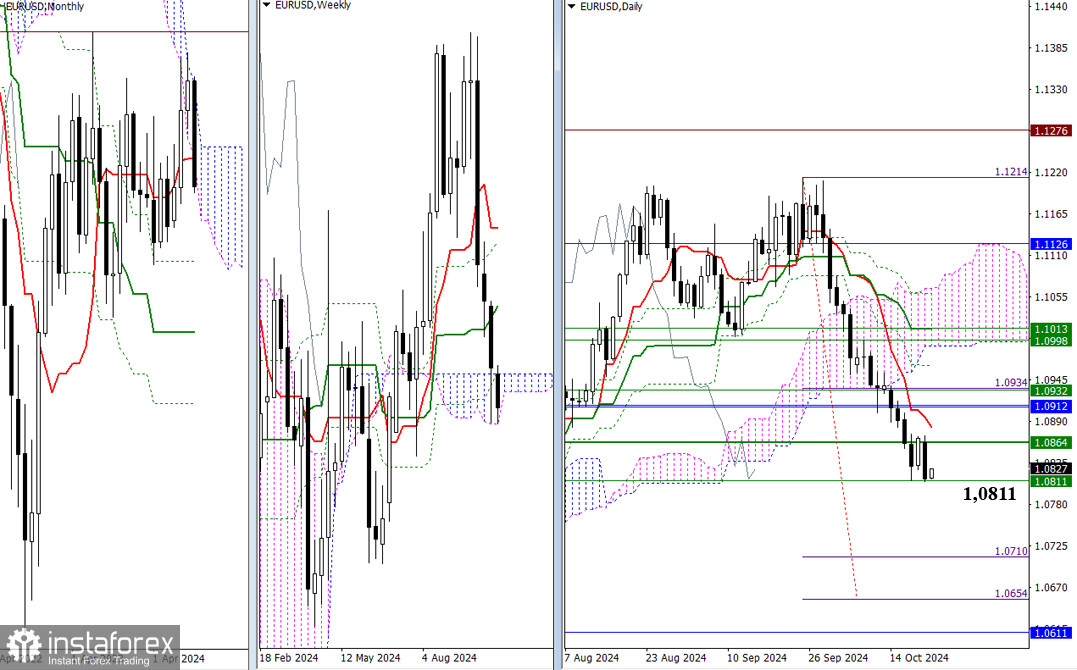

The bulls failed to maintain Friday's momentum and yielded the initiative to their opponents. The bears took advantage of the situation and aimed for the lower boundary of the weekly Ichimoku cloud (1.0811). As a result, the primary objective of breaking through the Ichimoku cloud remains the main agenda for further bearish sentiment. Additional downward targets in this area include breaking through the daily Ichimoku cloud (1.0710 – 1.0654) and monthly support (1.0611). If the weekly cloud withstands the bearish pressure and avoids a breakout, the bulls, after regaining the bullish zone relative to the weekly cloud (1.0864), will need to overcome several strong resistance levels: 1.0883 (daily short-term trend), 1.0912 (lower boundary of the monthly cloud + monthly short-term trend), and 1.0932 (weekly mid-term trend).

H4 – H1

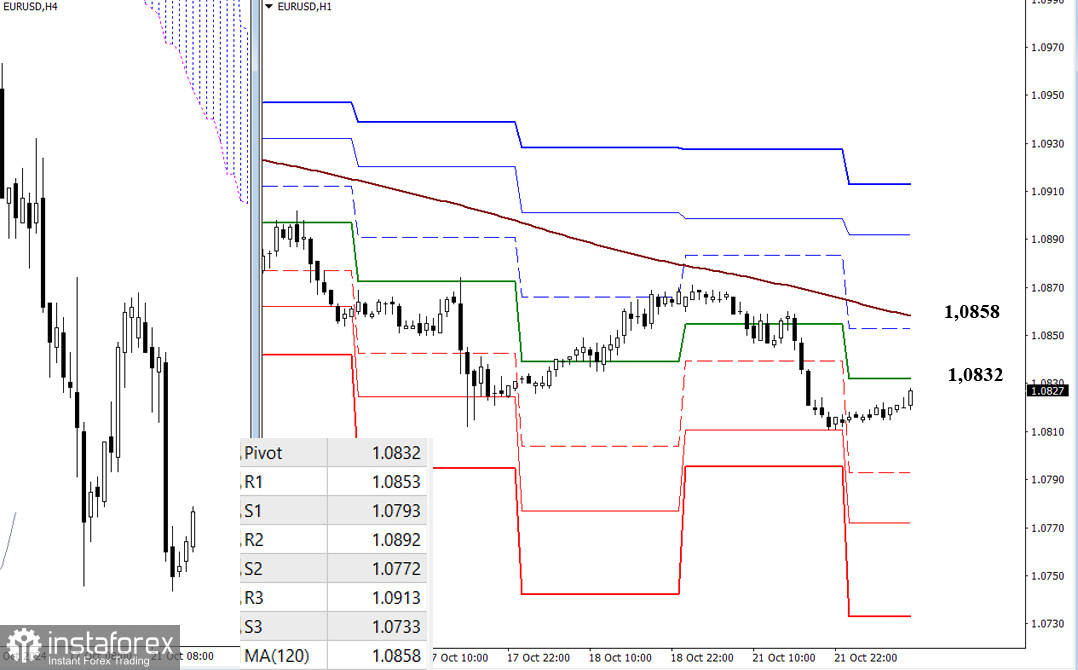

Yesterday, the bears updated the previous week's low (1.0812) but have not yet managed to exit the corrective zone and continue the downward trend. Despite the correction, the main advantage of the lower time frames remains with the bears. If the downward trend resumes, bearish attention will focus on breaking through the classic Pivot support levels (1.0793 – 1.0772 – 1.0733) during the day. If the bulls continue their corrective rise, the pair will soon face key lower timeframe levels, currently at 1.0832 (central Pivot level of the day) and 1.0858 (weekly long-term trend). A breakout and trend reversal could shift the balance of power, with the following targets for strengthening bullish sentiment during the day being the classic Pivot resistance levels R2 (1.0892) and R3 (1.0913).

GBP/USD

Higher Time Frames

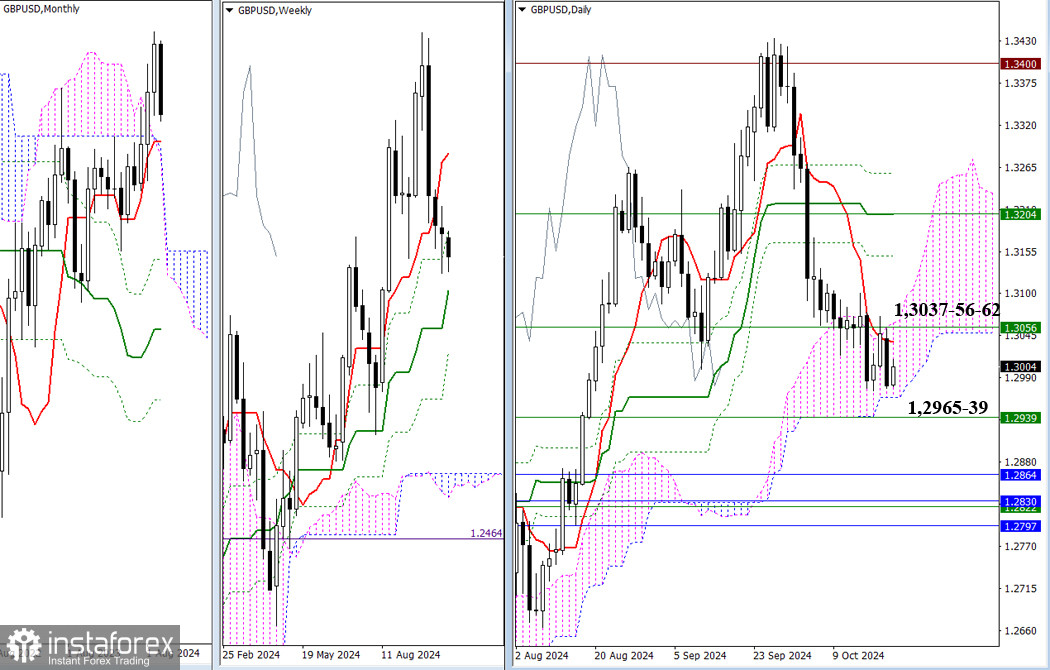

The resistance area of the daily short-term trend (1.3037) and the upper boundary of the daily Ichimoku cloud (1.3062), reinforced by the weekly level (1.3056) from the start of trading yesterday, managed to uphold the bearish sentiment. The bears returned to last week's low (1.2973) but did not reach the lower boundary of the daily cloud (1.2965). Therefore, breaking through the daily cloud, strengthened by the weekly mid-term trend (1.2939), remains the primary goal for the bears.

H4 – H1

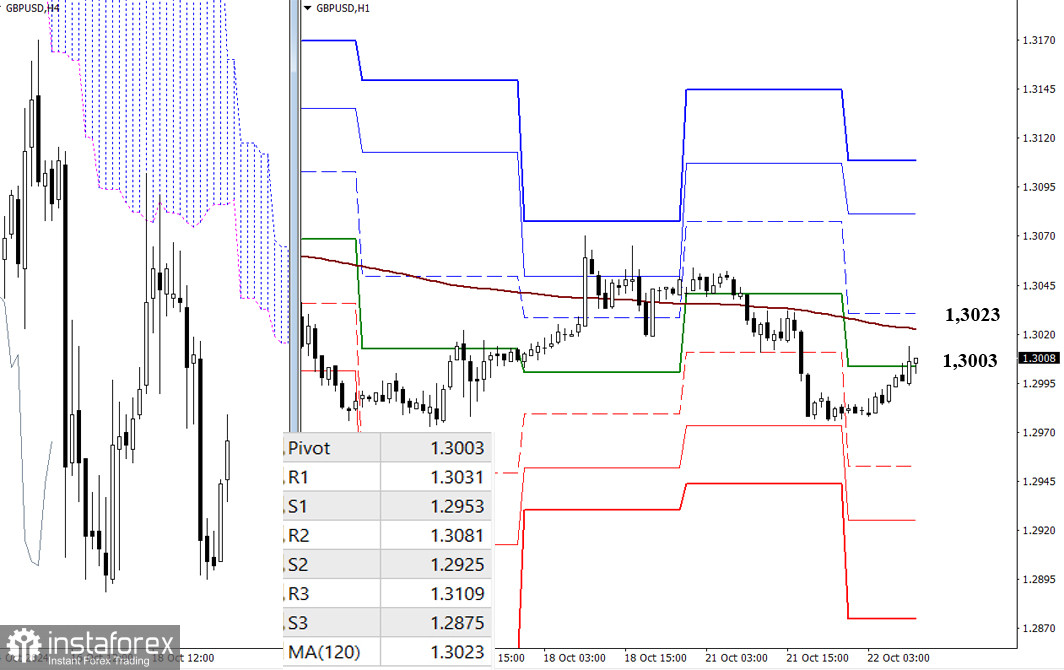

In the lower time frames, the pair currently trades below key levels, giving the bears the main advantage. Exiting the corrective zone and resuming the downward trend will refocus on the classic Pivot support levels (1.2953 – 1.2925 – 1.2875). Breaking through the key levels at 1.3003 (central Pivot level of the day) and 1.3023 (weekly long-term trend) and a firm consolidation above will further strengthen the bullish sentiment. During the day, market attention will shift to the classic Pivot resistance levels (1.3031 – 1.3081 – 1.3109).

Technical Analysis Tools Used:

Higher time frames: Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels;

Lower time frames: H1 – Pivot Points (classic) + 120-period Moving Average (weekly long-term trend).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română