EUR/USD

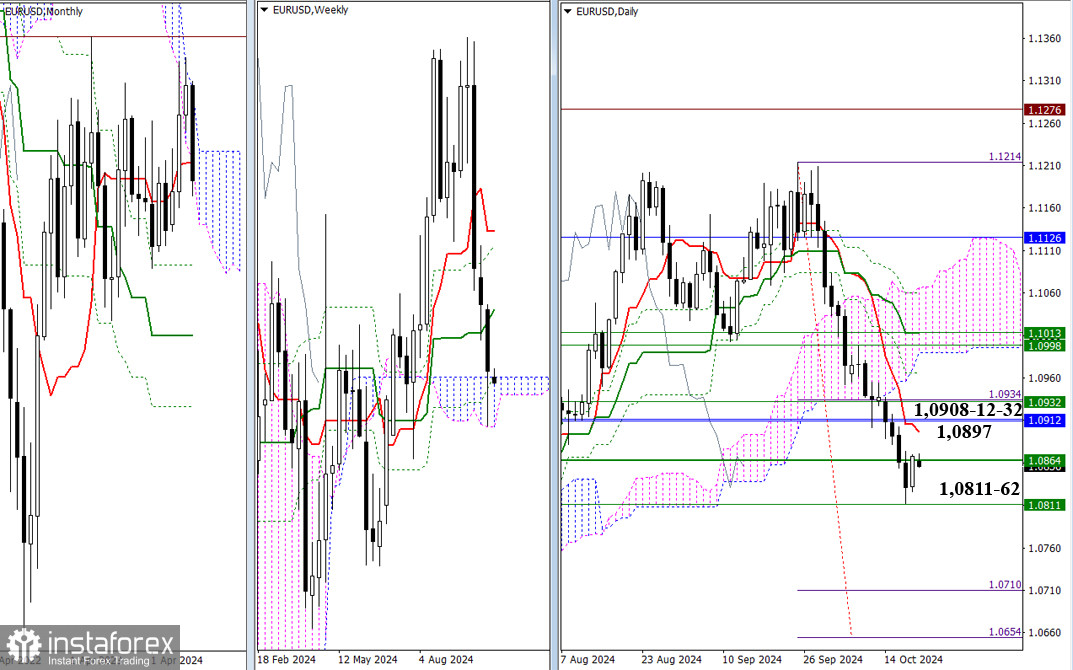

Higher Time Frames

Last week, the bears tested the weekly cloud (1.0862 – 1.0811), but the week ended with only a long lower shadow. The market closed the week above the weekly cloud, so testing these levels will continue. The bears' immediate plans still include breaking through the cloud (1.0862 – 1.0811) and forming a weekly downward target.

Meanwhile, the bulls will be aided by the momentum that led to the emergence of an upward correction at the end of last week. This correction's immediate target is the daily short-term trend (1.0897). The next focus will be on the monthly time frame resistances at 1.0912-08 (monthly short-term trend and lower boundary of the monthly cloud) and 1.0932 (weekly medium-term trend).

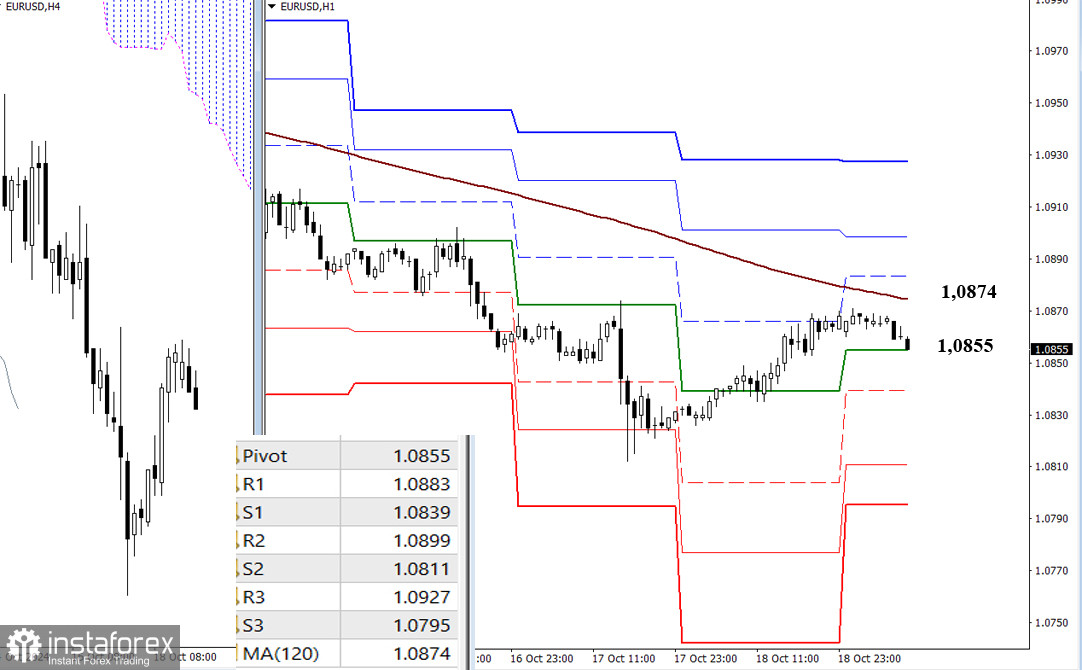

H4 – H1

The bears still maintain their advantage in the lower time frames, but the pair has risen to the key levels at 1.0855 (central Pivot point of the day) – 1.0874 (weekly long-term trend). Consolidation above this trend and its reversal could shift the balance of power in favor of the bulls. The following targets for upward movement during the day would be the resistances of the classic Pivot points (1.0883 – 1.0899 – 1.0927). If bearish activity resumes and the decline continues, the market's focus will shift to breaking through the supports of the classic Pivot points (1.0839 – 1.0811 – 1.0795).

GBP/USD

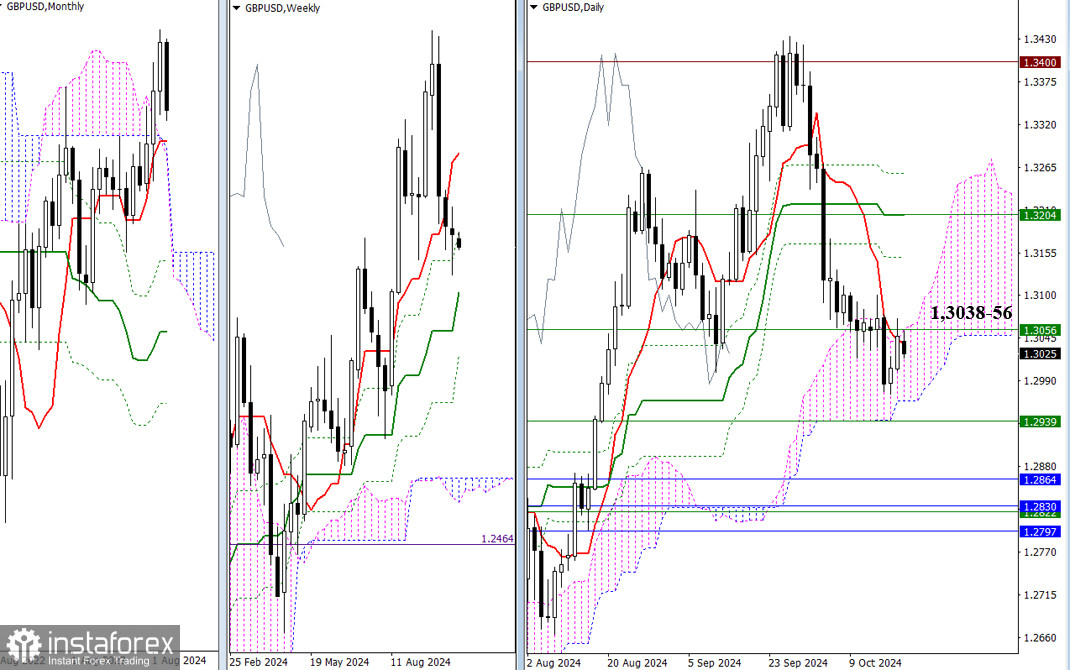

Higher Time Frames

The weekly level, which blocked the bears last week, has now changed its value and location (1.3056), strengthening the resistance area formed by the daily short-term trend (1.3038) and the upper boundary of the daily cloud (1.3056). The bears might use this chance to resume the decline, with targets now at the lower boundary of the daily cloud (1.2965) and the weekly medium-term trend (1.2939). If the bulls secure a reliable hold above the current resistances (1.3038 – 1.3056), a new stage of upward movement could gain a solid foundation for further development. The targets in this scenario will be the resistances of the daily Ichimoku cross (1.3149 – 1.3203 – 1.3257), strengthened by the weekly short-term trend (1.3204).

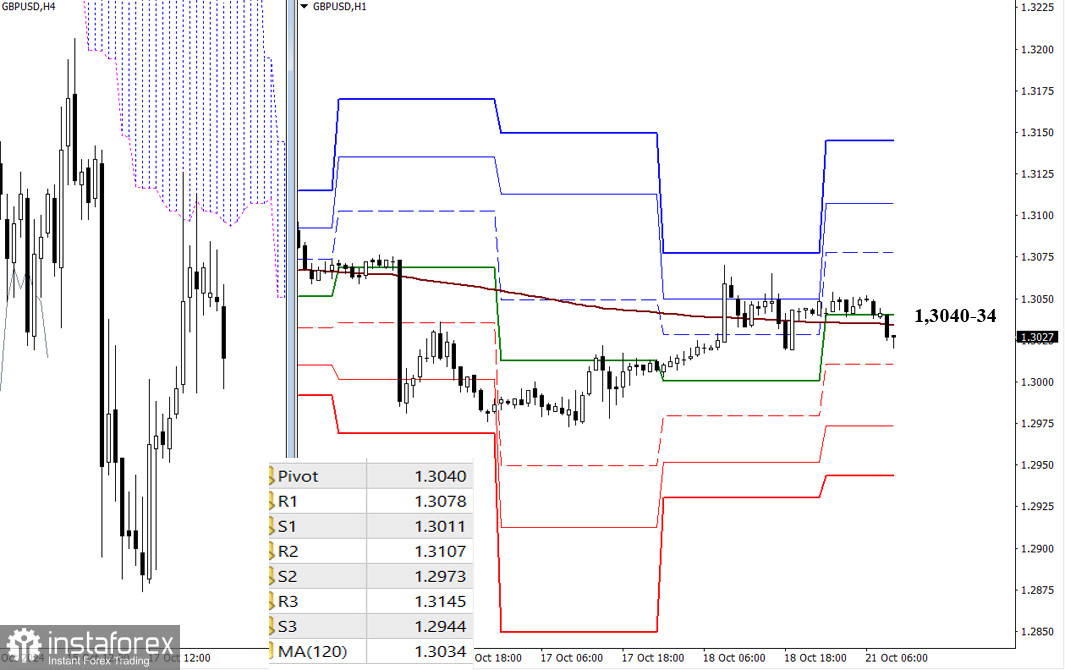

H4 – H1

On the lower time frames, uncertainty currently dominates. The market has been in the area of attraction and influence of key levels for a long time, which today converge around 1.3040 (central Pivot point of the day) – 1.3034 (weekly long-term trend). To overcome this uncertainty, a directional movement is needed. For bullish movements, the intraday targets are the classic Pivot point resistances (1.3078 – 1.3107 – 1.3145), while for bearish developments, the focus will be on the supports (1.3011 – 1.2973 – 1.2944).

Technical Analysis Tools Used:

Higher time frames: Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels;

Lower time frames: H1 – Pivot Points (classic) + 120-period Moving Average (weekly long-term trend).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română