For the fourth consecutive day, gold has been gaining upward momentum, continuing its bullish trend and rising above the $2700 round level, setting a new record.

Major central banks are cutting interest rates, which further eases their monetary policies. Additionally, ongoing geopolitical risks, including conflicts in the Middle East and uncertainty around the U.S. presidential elections, are key factors. These factors are driving flows toward the precious metal. Furthermore, a modest pullback in the U.S. dollar relative to its August high is providing additional support for gold.

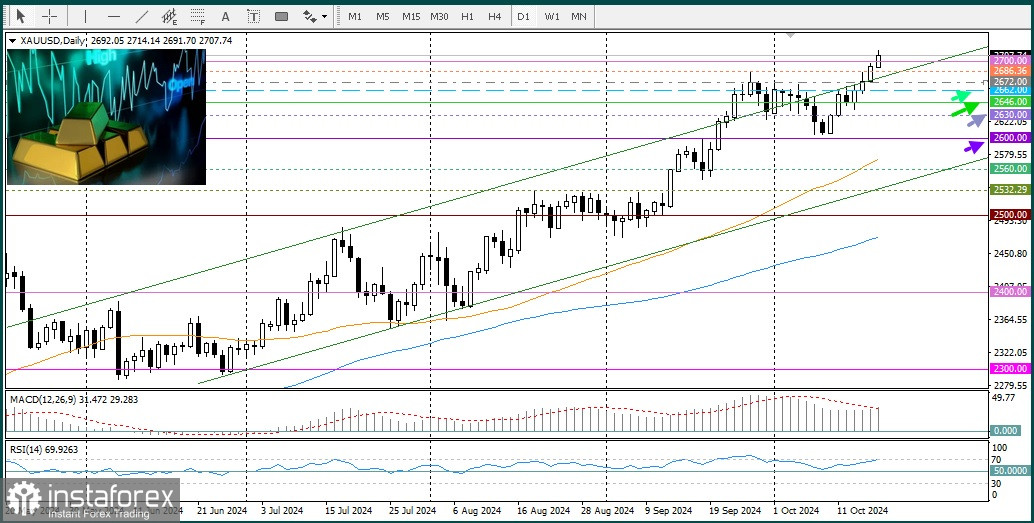

Moreover, traders are no longer expecting another aggressive interest rate cut by the Federal Reserve at the November meeting—previously a major factor in the recent rise in U.S. Treasury yields. As a result, this helps limit significant corrective declines in the U.S. dollar, dissuading traders from taking new bullish positions on gold. From a technical perspective, the sustained move beyond the $2700 round level follows this week's breakout above the supply zone at $2672, which may signal a new buying opportunity. Additionally, oscillators on the daily chart remain in positive territory and have not yet entered the overbought zone. This suggests that the path of least resistance for gold prices is upwards. However, if the RSI (Relative Strength Index) enters the overbought zone, profit-taking could occur, especially before the weekend, triggering a slight decline. Therefore, traders should avoid opening new long positions currently.

On the other hand, any corrective pullback will find solid support near the horizontal zone of $2662, before the $2646 level. A convincing break below $2646 could trigger technical selling, pushing the price toward the intermediate support at $2630 on its way to the $2600 round level, which now serves as a strong base for the XAU/USD pair and a key support point for short-term traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română