The EUR/USD currency pair traded in both directions on Thursday, but the downward bias persisted after three weeks of declines. It's been so long since the euro has fallen for three consecutive weeks that we can hardly remember the last time this happened. However, we've repeatedly highlighted the euro's overvaluation and unjustified high price, so the decline was expected.

Now, a correction seems in order—not because of any strong fundamental or macroeconomic reasons, but rather because it would fit a textbook scenario. However, the market often deviates from textbook patterns, and it wouldn't surprise us if, this time, there is no correction either. On what grounds should it happen—just because it would look nice?

Yesterday, the European Central Bank (ECB) lowered all three key interest rates by 0.25%. This decision was anticipated, as members of the ECB's monetary committee had hinted at an October rate cut for the past two weeks. What remained uncertain was whether the ECB planned another cut in December. In our view, it will. It doesn't matter much what Christine Lagarde's current stance is. There's still a month and a half until the December meeting. New reports on GDP, inflation, wages, and business activity will be released during this time. These reports could influence the ECB's current plans, which may change accordingly. Just two weeks ago, no one expected a rate cut in October. The ECB has set a certain pace for easing its monetary policy—once every two meetings. Thus, the cut in October can be seen as "ahead of schedule."

We would even argue that the inflation report for the Eurozone in September released a few hours before the ECB's announcement, was more significant. Although it was the second estimate of the figure, it differed from the first, which is quite rare. The Consumer Price Index slowed to 1.7% instead of the previously expected 1.8%. Core inflation came in at 2.7%, close to the target level. Meanwhile, the deposit rate (considered the primary rate in the EU) was reduced to 3.25%. Given that the neutral rate is 2.00-2.50%, the ECB still has some work to do.

Work is needed because the pace of economic growth has been disappointing for the past two years. If inflation is steadily decreasing, why continue to restrain an economy that is already on the brink of recession? We believe that the ECB will cut rates again in December. The euro is likely to continue its decline since the market has been pricing in the Fed's monetary policy easing "in advance" for the past two years.

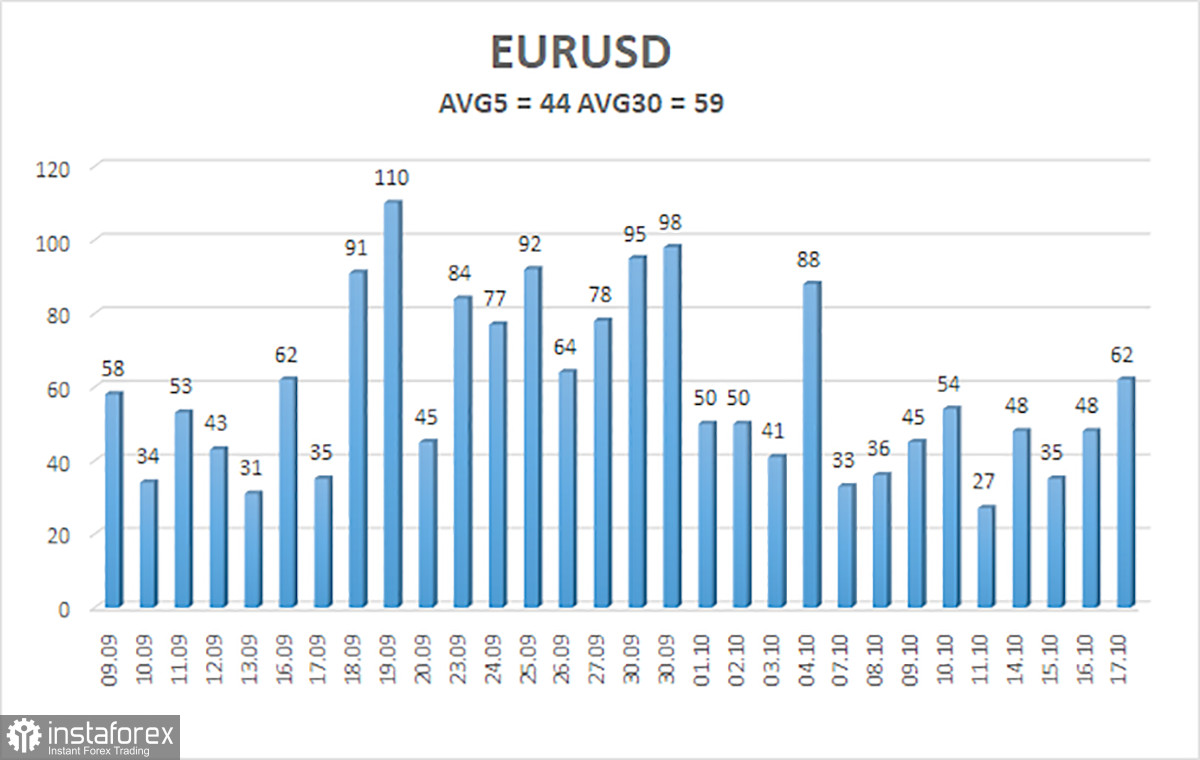

The average volatility of the EUR/USD currency pair over the last five trading days as of October 18 is 44 pips, characterized as "low." We expect the pair to move between the levels of 1.0781 and 1.0869 on Friday. The higher linear regression channel is directed upward, but the overall downward trend remains. After several visits to the overbought area, the CCI indicator entered the oversold area and formed two bullish divergences, indicating that a potential correction was brewing.

Nearest support levels:

- S1 – 1.0803

- S2 – 1.0742

- S3 – 1.0681

Nearest resistance levels:

- R1 – 1.0864

- R2 – 1.0925

- R3 – 1.0986

Trading Recommendations:

The EUR/USD pair continues its downward movement. In recent weeks, we have indicated that we expect only a decline in the euro in the medium term, so we fully support the current downward direction. The market may have priced in all or nearly all future Fed rate cuts. If that's the case, the dollar has no further reasons to fall, though there were a few reasons. Short positions can still be considered with targets at 1.0803 and 1.0781. If you trade using "pure" technical analysis, long positions will be relevant when the price is above the moving average line. However, such a position would only signify a correction in the near future.

Explanations for Illustrations:

Linear Regression Channels: Help determine the current trend. If both are pointing in the same direction, it means the trend is strong.

Moving Average Line (20,0, smoothed): Defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: Target levels for movements and corrections.

Volatility Levels (red lines): The likely price range in which the pair will trade over the next 24 hours, based on current volatility readings.

CCI Indicator: Entry into the oversold area (below -250) or overbought area (above +250) indicates an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română