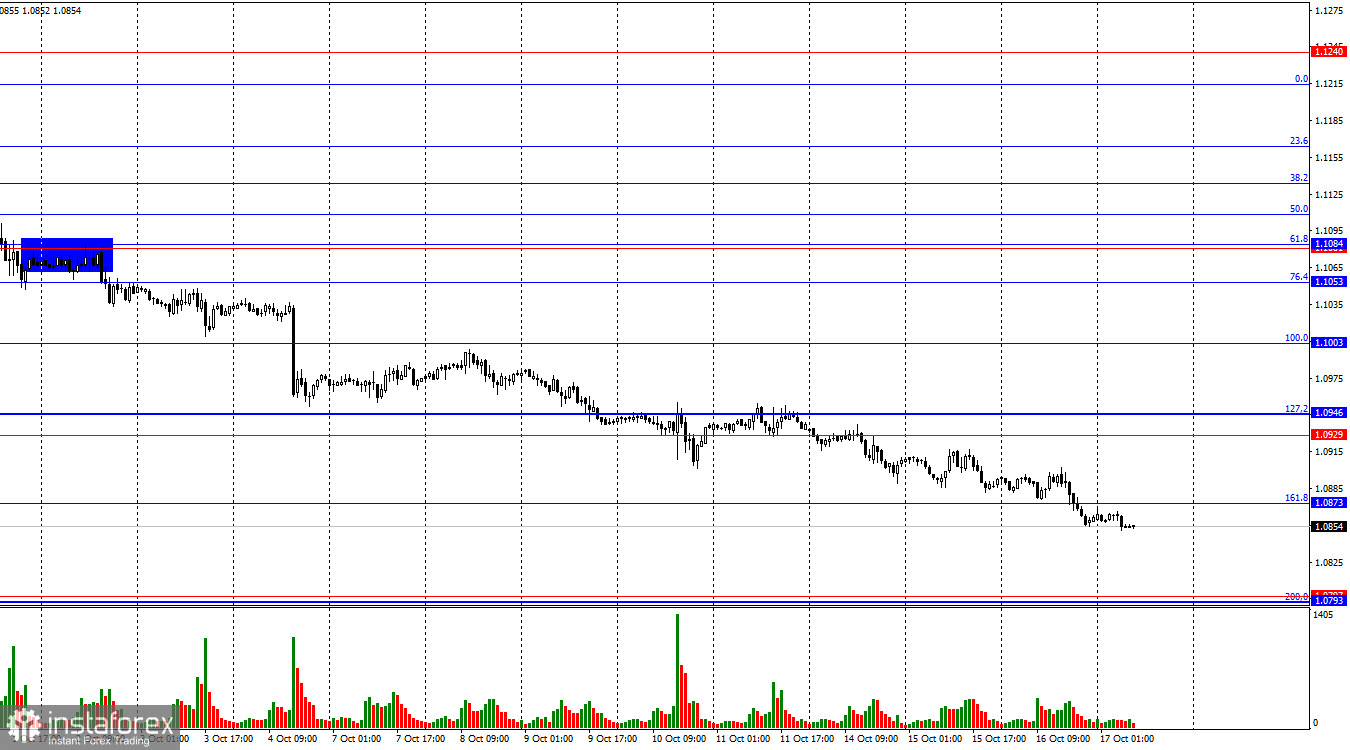

On Wednesday, the EUR/USD pair continued its downward movement and consolidated below the 161.8% corrective level at 1.0873. Thus, the decline may continue toward the next Fibonacci level of 200.0% at 1.0793, which is also located in a support zone. However, in just a few hours, the results of the penultimate ECB meeting of this year will be announced, and trader activity may increase significantly, with the direction of the movement being unpredictable.

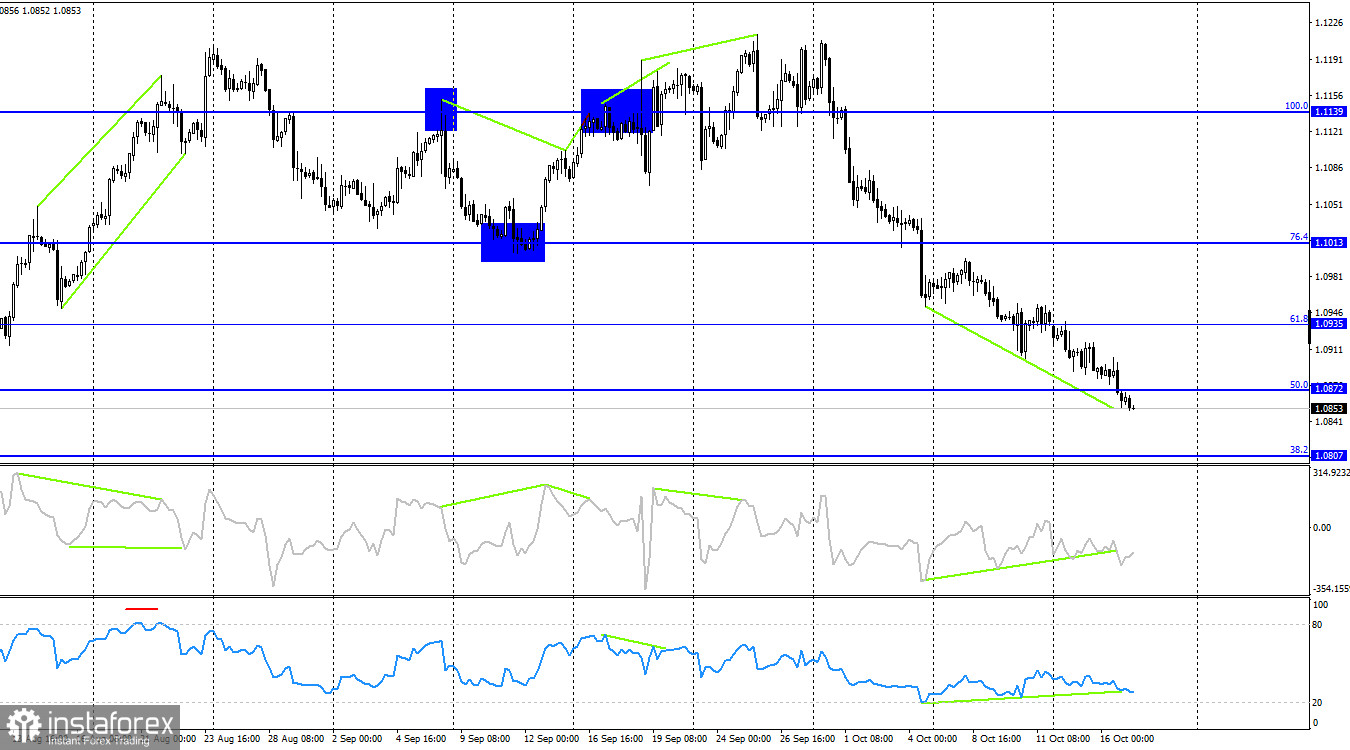

The wave situation raises no concerns. The last completed upward wave (September 25–30) did not break the peak of the previous wave, while the new downward wave (still forming) has broken the low of the previous three waves. Therefore, a new bearish trend is currently forming. A corrective wave may occur soon, but the bulls have already lost their grip on the market. Regaining it will require substantial effort, and it is unlikely they will succeed in the near term.

Wednesday's information was of little value to traders. There were no significant reports from the EU or the US, and no major announcements were expected from ECB President Christine Lagarde's evening speech. The ECB meeting will conclude today, and the post-meeting press conference will reveal all the details about the regulator's monetary policy decisions and outlook. Nevertheless, bearish traders continued their positioning yesterday ahead of the ECB meeting, where an unscheduled rate cut is expected. Previously, traders had anticipated the next rate cut no earlier than December, but the weakness of the European economy and low inflation are prompting the ECB to act sooner. Today, the EU will also release its final inflation report for September, which may confirm that the current level of inflation allows for more aggressive monetary easing.

On the 4-hour chart, the pair continues to decline toward the 38.2% Fibonacci level at 1.0807. Both indicators have been showing positive divergences for over a week, but these only suggest the possibility of a correction, as the trend has shifted to bearish. Currently, traders are ignoring the positive divergences. A rebound from the 1.0807 level would favor the euro and may lead to some growth toward 1.0872 and 1.0935.

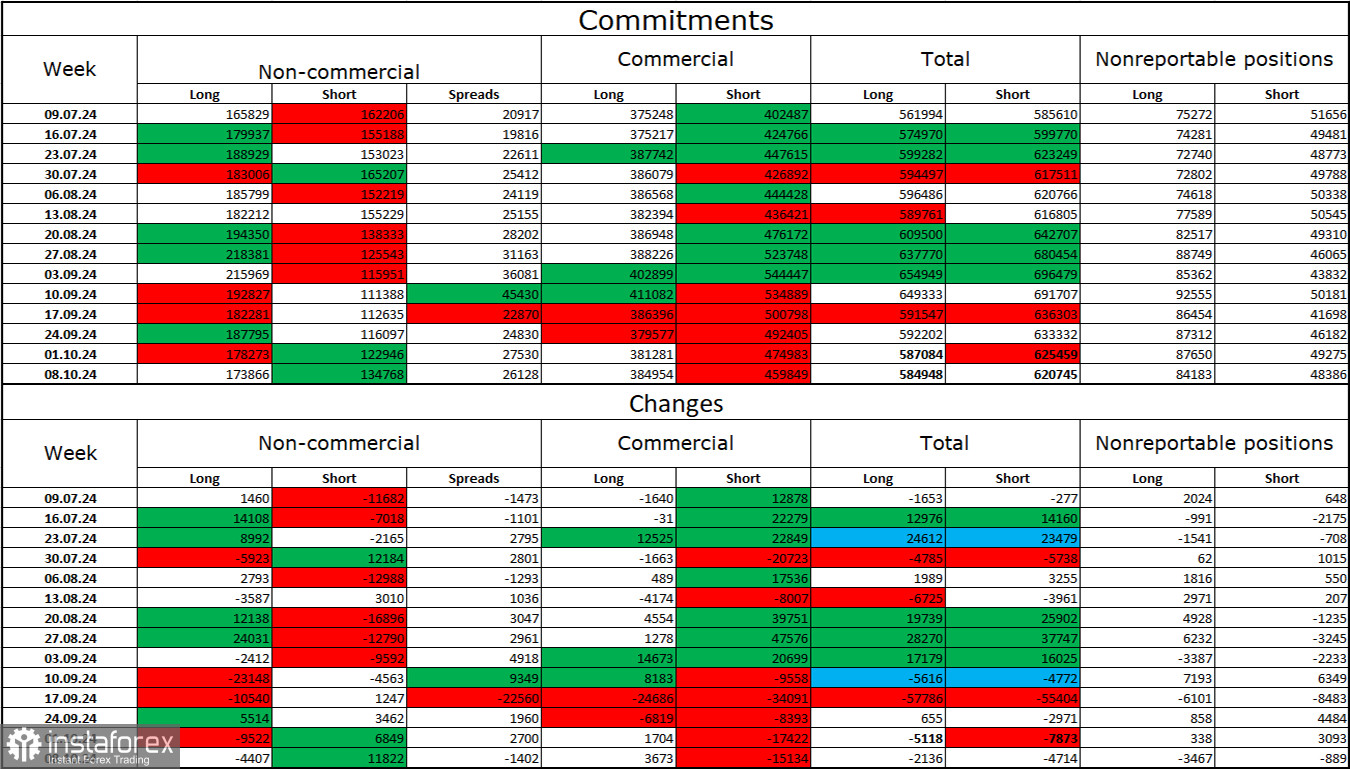

Commitments of Traders (COT) Report:

During the latest reporting week, speculators closed 4,407 long positions and opened 11,822 short positions. The sentiment of the "Non-commercial" group turned bearish several months ago, but bulls are now regaining dominance. The total number of long positions held by speculators is now 174,000, while short positions total 135,000.

However, for the fifth consecutive week, large players have been unloading the euro. In my view, this could be a precursor to a new bearish trend or at least a significant correction. The key factor in the dollar's decline—expectations of monetary easing by the FOMC—has already played out, and there is no longer a reason for the dollar to fall. New reasons may emerge over time, but for now, the growth of the U.S. dollar seems more likely. Technical analysis also indicates the start of a bearish trend. Therefore, I am preparing for an extended decline in the EUR/USD pair.

News Calendar for the U.S. and EU:

- EU – Consumer Price Index (09:00 UTC)

- EU – ECB Interest Rate Decision (12:15 UTC)

- U.S. – Retail Sales (12:30 UTC)

- U.S. – Philadelphia Fed Manufacturing Index (12:30 UTC)

- U.S. – Initial Jobless Claims (12:30 UTC)

- EU – ECB Press Conference (12:45 UTC)

- U.S. – Industrial Production (13:15 UTC)

October 17's economic calendar is filled with important events, with the ECB meeting being the most significant. The impact of the news on market sentiment could be strong.

EUR/USD Forecast and Trader Tips:

Selling the pair was possible when it closed below 1.1139 on the 4-hour chart with targets of 1.1081, 1.1070, 1.1013, and 1.0984—all of which were reached. Yesterday, one could have sold the euro after it consolidated below 1.0873. Today, caution is advised as Christine Lagarde's speech could lead to a temporary retreat of the bears. I would consider buying the pair after a rebound from the 1.0793 level, but remember that the trend has shifted to bearish.

The Fibonacci retracement grids are drawn from 1.1003 to 1.1214 on the hourly chart and from 1.1139 to 1.0603 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română