To open long positions on EUR/USD:

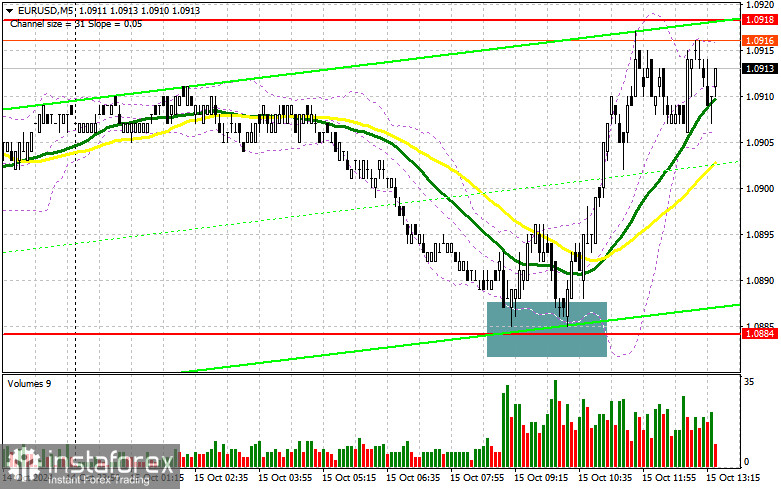

Given that everything is already working well, there was no need to revise the technical picture. Apart from the Empire Manufacturing index, there is nothing notable in the second half of the day, so all attention will again shift to the speeches by Federal Reserve representatives Mary Daly and Adriana D. Kugler. Most likely, their statements will have little impact following last week's speeches by several Fed members, so I expect trading to remain within a sideways channel. If the pair declines, a failed breakout at the 1.0884 support level, similar to earlier, would create a good opportunity to increase long positions, opening the way to 1.0918. Breaking through and testing this range from above will confirm the right entry point for a buy with the aim of updating 1.0952 and 1.0979. The furthest target will be the 1.1011 high, where I plan to take profits. If EUR/USD continues to decline and there is no activity around 1.0884 in the second half of the day, pressure on the euro will persist. In that case, I will only enter after a failed breakout near the next support at 1.0855. I plan to buy on a rebound from 1.0830, aiming for a 30-35 point correction within the day.

To open short positions on EUR/USD:

The sellers haven't gone anywhere, but their failure to hold below the weekly low raises questions. However, a new low was established so the trend remains in their favor. In the event of soft statements from the Fed representatives, we could see a small rise in the euro, and a failed breakout at 1.0918 would provide a good entry point for opening new short positions with the prospect of another decline to support at 1.0884. A break and consolidation below this range, followed by a bottom-up retest, will offer another opportunity to sell, targeting the 1.0855 level, further strengthening the bearish market. Only here do I expect to see more active bulls. The furthest target will be 1.0830, where I will take profits. If EUR/USD moves upward in the second half of the day and bears fail to defend 1.0918 (where the moving averages are also supporting sellers), the buyers could gain a chance for a small pair strengthening. In this case, I will postpone selling until the next resistance level is tested at 1.0952. I will also sell from there, but only after a failed consolidation. I plan to open short positions on a rebound from 1.0979 with the target of a 30-35 point downward correction.

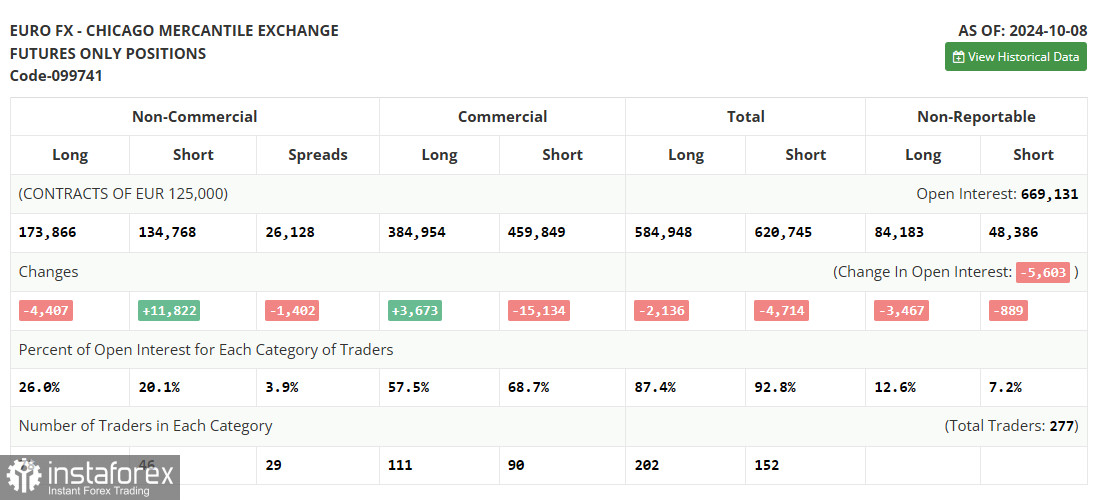

The Commitments of Traders (COT) report for October 8 showed a sharp increase in short positions and a reduction in long ones. The report reflects the latest U.S. labor market data but has yet to account for inflation data, which likely caused a further increase in short positions on the euro. Everything still favors the U.S. dollar, and only strong European statistics—which we will see enough of in the near future—could stop the bearish market for this trading instrument. However, this does not cancel the medium-term upward trend for the pair, and the lower the pair goes, the more attractive it becomes for buying. The COT report showed that long non-commercial positions decreased by 4,407 to 173,866, while short non-commercial positions increased by 11,822 to 134,768. As a result, the gap between long and short positions decreased by 1,402.

Indicator signals:

Moving Averages:

Trading is occurring around the 30- and 50-day moving averages, signaling market uncertainty.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator near 1.0884 will act as support.

Description of indicators:

- Moving average: Defines the current trend by smoothing volatility and noise. Period 50, marked in yellow on the chart.

- Moving average: Defines the current trend by smoothing volatility and noise. Period 30, marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence): Fast EMA period 12, slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions: Represents the total long open position of non-commercial traders.

- Short non-commercial positions: Represents the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română