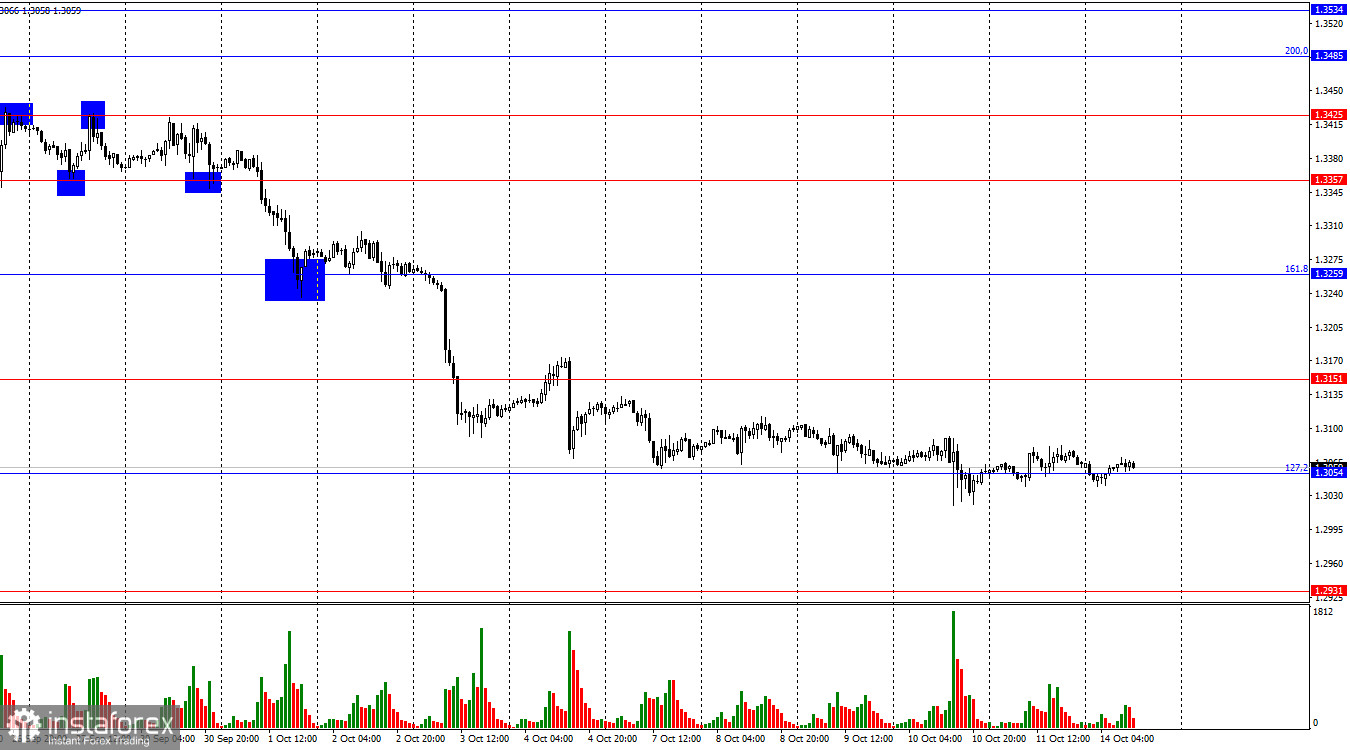

On the hourly chart, the GBP/USD pair continued trading horizontally around the 127.2% corrective level at 1.3054 on Friday. There was no rebound or consolidation below this level, so there were no signals on Friday. Moreover, we shouldn't expect any signals today either, as the 1.3054 level has already been breached by 10–15 points in both directions about five times. This indicates that this level cannot be considered a reliable source of signals.

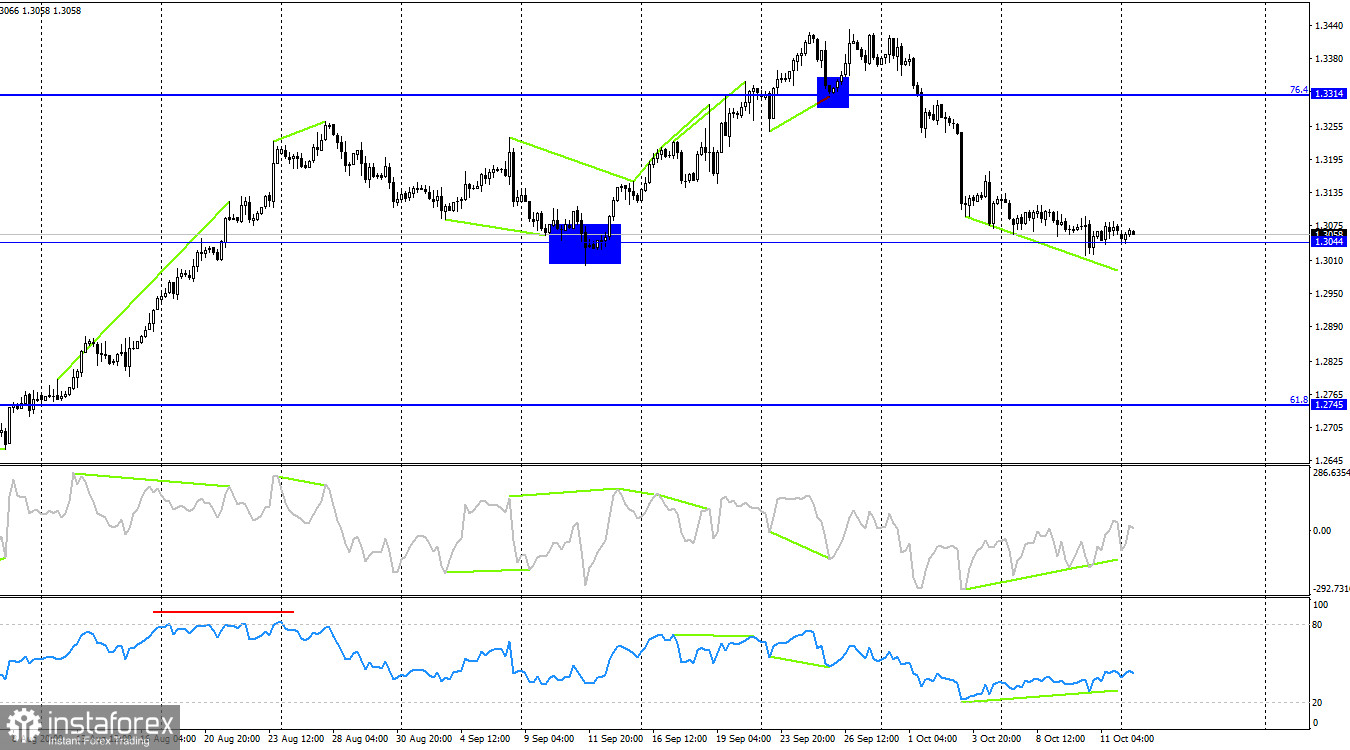

There are no concerns regarding the current wave pattern. The last completed wave upward (on September 26) did not break the previous wave's peak, and the wave forming over the past 13 days easily broke the low of the previous wave, which was located at the 1.3311 level. Therefore, the "bullish" trend is now considered over, and a "bearish" trend is forming. We can expect a corrective wave upward from the 1.3054 level, but there are no signals indicating its start yet.

On Friday morning, economic data from the UK was released, which I cannot consider positive. GDP in August grew by 0.2% m/m, as expected by traders, but overall, the British economy is growing very weakly, and it grew by only 0.5% in the second quarter, which is below forecasts. Industrial production volumes grew by 0.5% m/m, with a forecast of +0.2% m/m, but the annual figure has been declining for 11 consecutive months. Overall, the British data can hardly be called positive. I believe the recent market optimism towards the pound was excessive. For a long time, the pound has ignored the weak state of the UK economy, the prospects of lowering inflation, and the potential easing of the Bank of England's monetary policy. Now, all of these factors may come crashing down at once. It is clear to me that the Bank of England will cut rates in 2024, in 2025, and possibly even in 2026. The pace may be slower than in the Eurozone or the U.S., but inflation in the UK reached higher levels, which is why the Bank of England is forced to battle it longer. The pound is too expensive relative to the current information background.

On the 4-hour chart, the pair fell to the 1.3044 level. A "bullish" divergence has been forming for more than a week on both indicators, warning of a possible rebound from the 1.3044 level. A rebound from this level could lead to some growth, but I don't expect a significant rise in the pound. A consolidation below 1.3044 would signal further declines towards the 61.8% Fibonacci level at 1.2745, even though bullish divergences are present. Bears, with this move, will show they are ready to keep attacking.

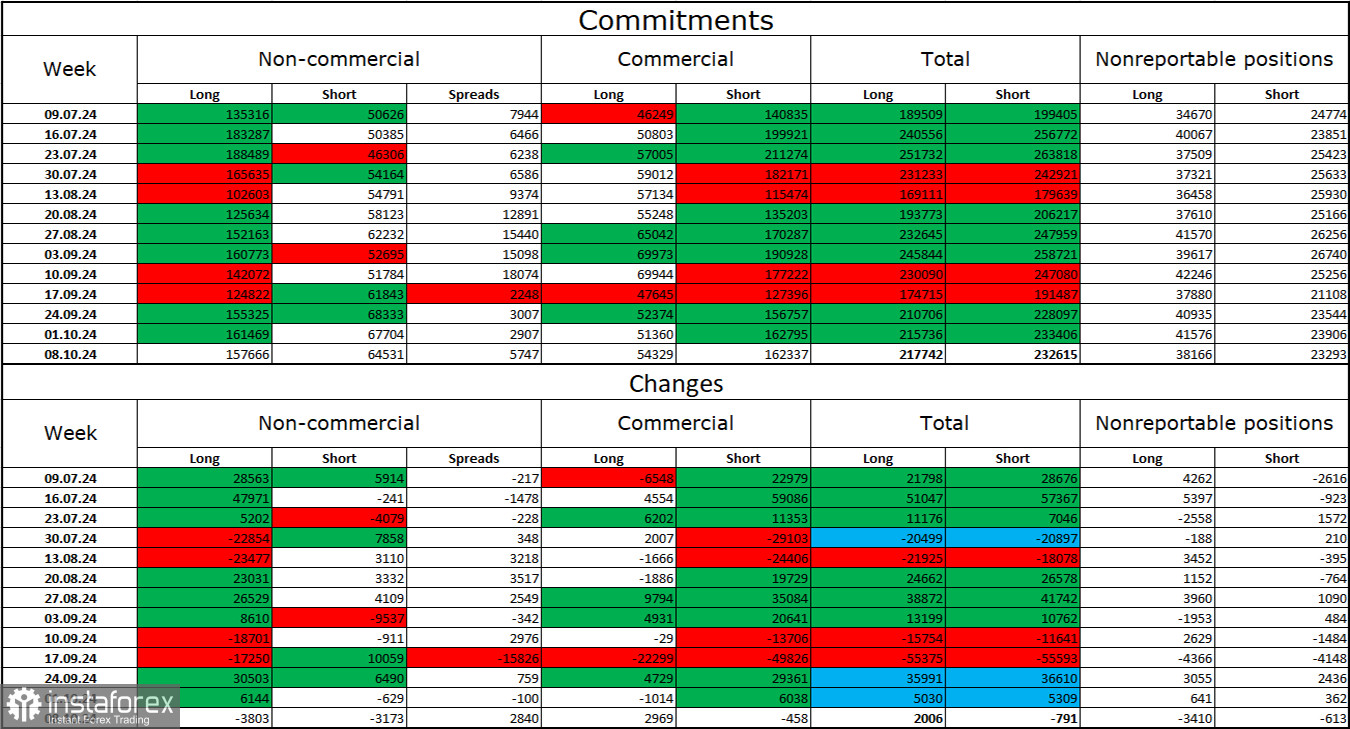

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders was unchanged last week and remains "bullish." The number of long positions held by speculators decreased by 3,803, and short positions by 3,173. Thus, for two weeks, professional players reduced their long positions and increased their short ones, but now they have returned to buying the pound. The bulls still hold a solid advantage. The gap between the number of long and short positions is 93,000: 158,000 versus 65,000.

In my opinion, the pound still has room to fall, but the COT reports are currently showing the opposite. Over the past three months, the number of long positions has increased from 135,000 to 158,000, while the number of short positions has risen from 50,000 to 65,000. I believe that over time, professional traders will start to reduce their long positions or increase their short positions, as all possible factors supporting the pound have already been priced in. Technical analysis suggests that this process may start in the near future.

News Calendar for the U.S. and the UK:

On Monday, the economic events calendar contains no significant entries. The influence of the information background on market sentiment will be absent today.

Forecast for GBP/USD and Advice for Traders:

Sales of the pair were possible after a bounce on the hourly chart from the 1.3425 level with targets at 1.3357, 1.3259, 1.3151, and 1.3054. All targets have been reached. I believe that these sales can be closed. New short positions can be opened if the pair consolidates below 1.3044 on the 4-hour chart with a target of 1.2931, but preferably after a correction. I do not see any potential signals for buying at the moment.

The Fibonacci levels are built based on 1.2892–1.2298 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română