Analysis of Trades and Trading Tips for the Japanese Yen

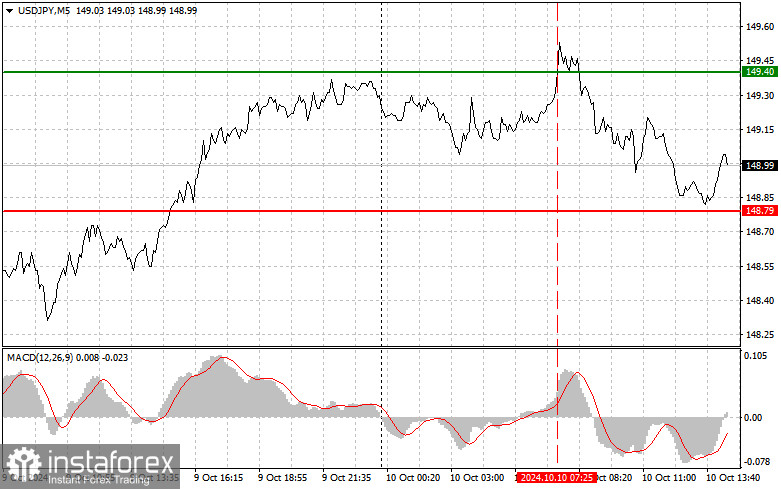

The first test of the 149.40 price level occurred when the MACD indicator had moved significantly above the zero mark, limiting the pair's further upward potential. For this reason, I decided not to buy the dollar at that time. During the U.S. session, attention will focus on the U.S. Consumer Price Index for September and the core prices excluding food and energy. Additionally, there will be speeches from Federal Reserve members Lisa D. Cook and John Williams. An increase in U.S. inflation would justify continued buying of dollars and selling yen. However, if inflation declines more than economists expect, the dollar could face significant weakening. Regarding the intraday strategy, I plan to follow Scenario #1 while taking the MACD indicator's readings into account, as I anticipate a significant directional movement.

Buy Signal

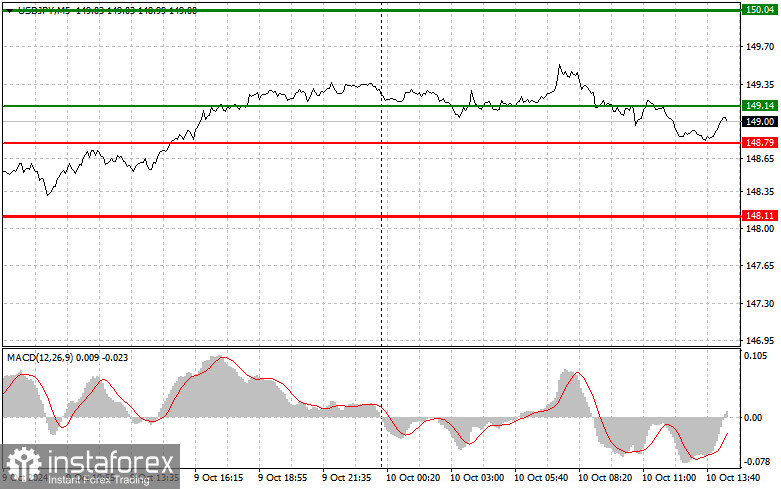

Scenario #1: Today, I plan to buy USD/JPY at the entry point around 149.14 (green line on the chart), with a target of rising to the 150.04 level (thicker green line on the chart). At 150.04, I will close buy trades and initiate sell trades in the opposite direction, expecting a corrective movement of 30-35 points. An increase in the pair is likely only if U.S. inflation rises. It is important to ensure that the MACD indicator is above the zero mark and has just begun its upward movement before buying.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive retests of the 148.79 level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to an upward market reversal. Growth toward the resistance levels of 149.14 and 150.04 is anticipated.

Sell Signal

Scenario #1: Today, I plan to sell USD/JPY upon a break below the 148.79 level (red line on the chart), which is likely to lead to a quick decline in the pair. The primary target for sellers will be the 148.11 level, where I will exit the sell trades and immediately open buy trades in the opposite direction, expecting a corrective movement of 20-25 points. Pressure on the pair will return if the inflation data comes in below expectations. It is important to ensure that the MACD indicator is below the zero mark and has just begun its downward movement before selling.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive retests of the 149.14 level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a downward market reversal. A decline toward the support levels of 148.79 and 148.11 is expected.

Chart Analysis Overview:

- Thin green line: The entry price for buying the trading instrument.

- Thick green line: The projected price where you can set Take Profit or manually secure profits, as further growth beyond this level is unlikely.

- Thin red line: The entry price for selling the trading instrument.

- Thick red line: The projected price where you can set Take Profit or manually secure profits, as further declines beyond this level are unlikely.

- MACD Indicator: When entering the market, it's crucial to consider overbought and oversold areas.

Note: Beginner traders in the forex market should exercise extreme caution when making decisions to enter the market. Before the release of significant fundamental reports, it is best to stay out of the market to avoid sharp price movements. If you choose to trade during news releases, always set stop-loss orders to minimize potential losses and manage risk effectively. Without using stop-loss orders, you can quickly lose your entire deposit. This risk increases if you do not use proper money management and trade in large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is generally considered a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română