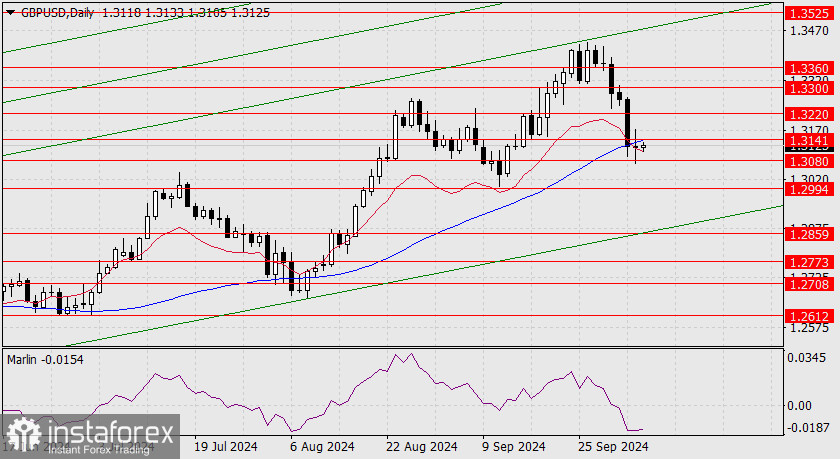

The British pound showed a range of more than 100 pips on the day the US labor data was released. The day closed with a white candle, with the body settling below the MACD line. The price bounced significantly from the support level of 1.3080. Today, the pound begins the day with upward movement. Only a small distance is left before the price breaks through the resistance at the target level of 1.3141 and the MACD line.

If the price consolidates above this level, it will continue to rise towards the next target at 1.3220. The target level of 1.3525 looks like an important goal, as the price aims for the point where it intersects with the price channel line. The signal line of the Marlin oscillator indicates a possible reversal. Additionally, the price remains above the balance indicator line, suggesting that the entire three-figure decline is corrective. A second drop below the 1.3080 level could neutralize the price's upward potential and open the target of 1.2994, the low from September 11.

On the four-hour chart, the price is consolidating between 1.3080 and 1.3141. Marlin is pushing upward to assist the price in securing a move above the 1.3141 level. The success of this move is currently seen as the main scenario.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română