On Thursday, Bitcoin again surpassed the $60,000 mark and reached $61,200 during today's Asian session. However, little suggests the possibility of further growth in the cryptocurrency market. At the same time, smaller cryptocurrencies have fallen amidst geopolitical instability and the strengthening of the US dollar.

Bitcoin's dominance over the broader market means that BTC's share of the total cryptocurrency market capitalization has exceeded 58%, while the ETH/BTC ratio has fallen to its mid-September low of 0.038. If you recall, economists and experts dubbed this year the "year of Ethereum," but as you can see from the chart, their expectations have not matched reality so far.

Today, the market's direction will depend on U.S. labor market data. Strong reports and a decrease in U.S. unemployment, along with an increase in new jobs, would be a solid reason for the dollar to strengthen and will likely harm the bullish prospects of the cryptocurrency market, as it would extend the period of higher interest rates in the U.S. If the data disappoints, it's likely that the Federal Reserve will lower interest rates by half a percent in November, just as they did last month, which would help the cryptocurrency market recover.

As for the intraday strategy in the cryptocurrency market, I will focus on any major dips in Bitcoin and Ethereum, anticipating the continuation of a mid-term bullish market that is still in play.

For short-term trading, the strategy and conditions are described below.

Bitcoin

Buy Scenario

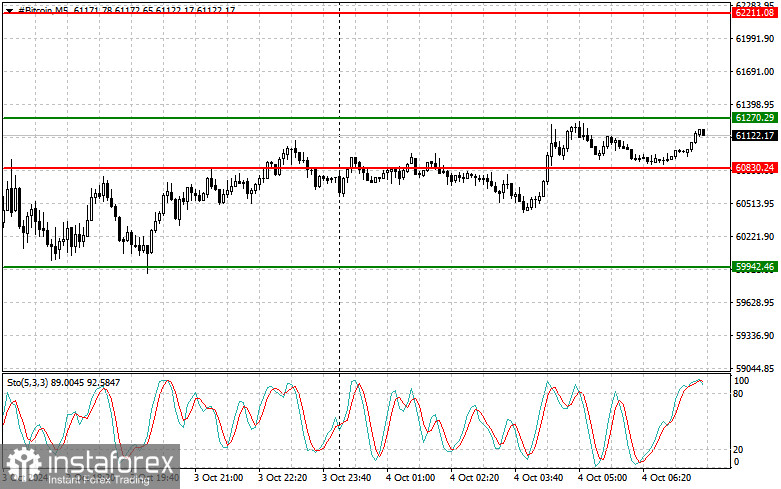

Today, I plan to buy Bitcoin when it reaches the entry point of around $61,270, targeting a rise to $62,211. At $62,211, I will exit the purchase and sell immediately on a rebound. Before buying on a breakout, it's best to ensure that the Stochastic indicator is near the lower boundary, around the 20 level.

Sell Scenario

Today, I plan to sell Bitcoin when it reaches the entry point of around $60,830, targeting a drop to $59,940. At $59,940, I will exit the sale and buy immediately on a rebound. Before selling on a breakout, ensure the Stochastic indicator is near the upper boundary, near the 80 level.

Ethereum

Buy Scenario

Today, I plan to buy Ethereum when it reaches the entry point around $2,383, targeting a rise to $2,430. At $2,430, I will exit the purchase and sell immediately on a rebound. Before buying on a breakout, ensure the Stochastic indicator is near the lower boundary, around the 20 level.

Sell Scenario

Today, I plan to sell Ethereum when it reaches the entry point around $2,365, targeting a drop to $2,325. At $2,325, I will exit the sale and buy immediately on a rebound. Before selling on a breakout, ensure that the Stochastic indicator is near the upper boundary, near the 80 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română