Trade Analysis for Wednesday:

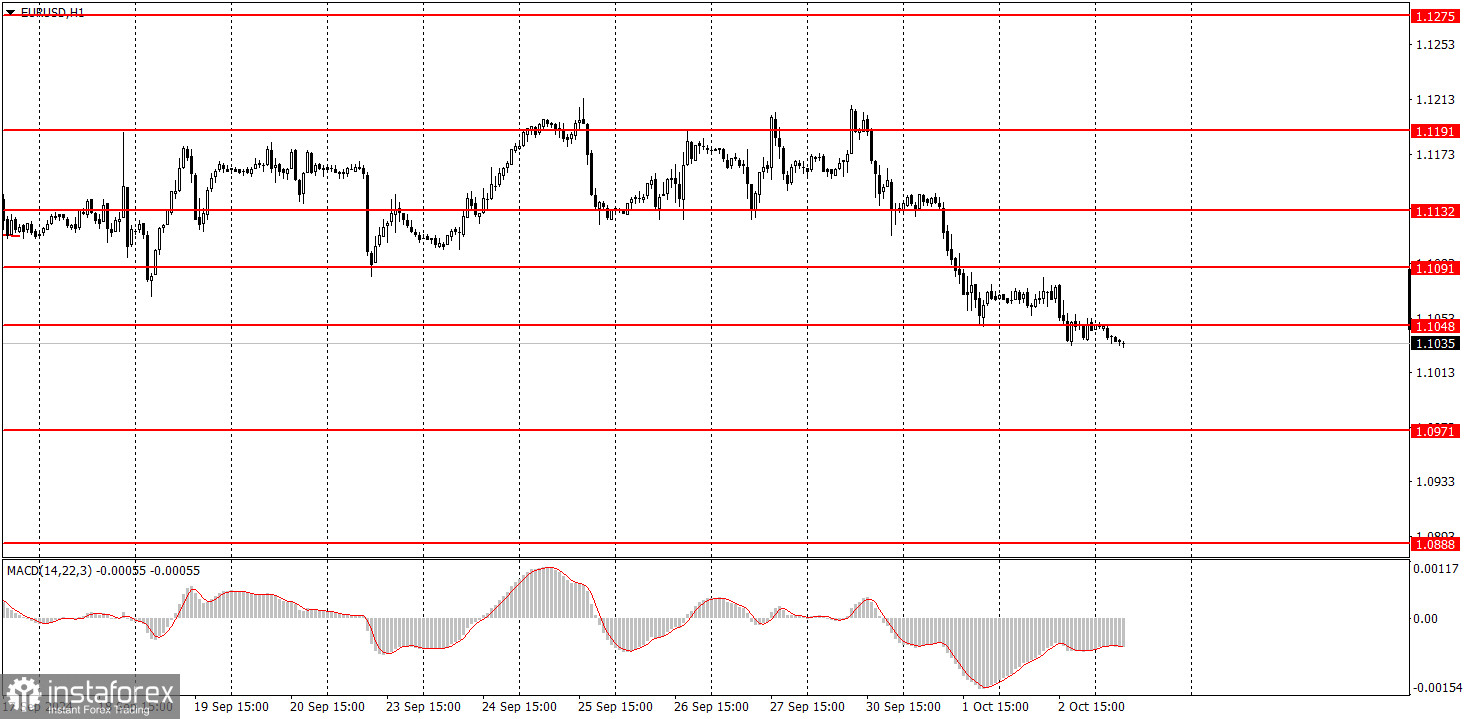

1H Chart of the EUR/USD Pair

On Wednesday, the EUR/USD currency pair continued sluggish downward movement. Yesterday, the only notable macroeconomic event was the ADP report on the number of new jobs in the private sector, which was stronger than experts' forecasts. This marks the third important indicator out of four this week in the US that has supported the US currency. Thus, given its general oversold state and unjustified cheapness, the new strengthening of the dollar does not surprise us at all. Of course, there may be an upward correction today or tomorrow, but overall, we expect further declines in the EUR/USD pair.

5M Chart of the EUR/USD Pair

In the 5-minute time frame on Wednesday, movements were very weak—essentially flat. Several weak trading signals were formed around the 1.1048 level, but it was not possible to profit from them since they appeared late in the day and the market lacked momentum. Market participants are now waiting for Friday's data from the US to make a final assessment of the labor market conditions in September. If a positive trend is observed, the likelihood of a 0.5% rate cut by the Federal Reserve in November will drop to zero, and the dollar will receive support in the coming weeks.

How to Trade on Thursday:

In the hourly time frame, the EUR/USD pair still has the potential to form a downtrend; this week, it has taken its first step in that direction. Unfortunately, irrational dollar selling can quickly resume in the medium term, as no one knows how long the market will continue to price in the Fed's monetary policy easing while ignoring all the factors favoring the dollar. However, in the last couple of weeks, it has become clear that market participants are finding it difficult to push the pair further upward. We might be nearing the end of the upward trend, but important US data is coming this week.

On Thursday, trading can be based on the 1.1048 level. The price has left the flat range, so the decline may continue. However, keep in mind that several important reports from the US this week could turn out to be weak and trigger another dollar drop.

In the 5-minute time frame, consider the levels 1.0726-1.0733, 1.0797-1.0804, 1.0838-1.0856, 1.0888-1.0896, 1.0940, 1.0971, 1.1011, 1.1048, 1.1091, 1.1132-1.1140, 1.1189-1.1191, 1.1275-1.1292. On Thursday, services sector PMI indices for September will be released in both the Eurozone and the US. However, the most significant release will be the US ISM services index.

Basic Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form (bounce or break through a level). The less time it takes, the stronger the signal.

- If two or more trades were opened near a particular level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate a lot of false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trades should be opened during the period between the start of the European session and the middle of the US session, after which all trades should be manually closed.

- In the hourly time frame, it's preferable to trade based on MACD signals only when there is good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are very close to each other (between 5 and 20 pips), they should be treated as a support or resistance zone.

- After a trade has moved 15 pips in the intended direction, set the Stop Loss to breakeven.

What's on the Charts:

Support and Resistance Price Levels: These levels serve as targets when opening buy or sell positions. They can also be used as points to set Take Profit levels.

Red Lines: These represent channels or trend lines that display the current trend and indicate the preferred trading direction.

MACD Indicator (14,22,3): The histogram and signal line serve as an auxiliary indicator that can also be used as a source of trading signals.

Important Speeches and Reports (always found in the news calendar) can significantly impact the movement of a currency pair. Therefore, trading should be done with maximum caution during their release, or you may choose to exit the market to avoid a sharp price reversal against the preceding movement.

For Beginners Trading on the Forex Market: It's essential to remember that not every trade will be profitable. Developing a clear strategy and practicing money management is key to achieving long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română