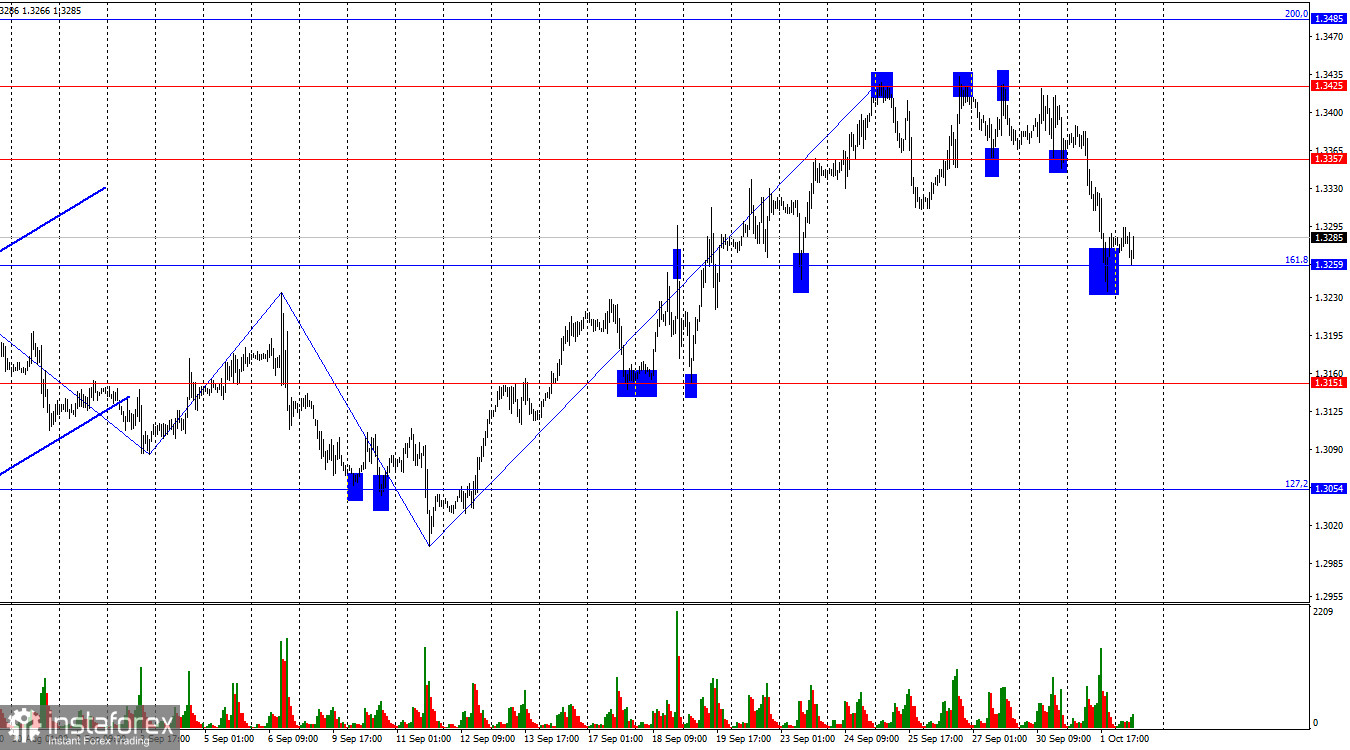

On the hourly chart, the GBP/USD pair broke out of its range on Tuesday. It then consolidated below the 1.3357 level and fell towards the 161.8% retracement level at 1.3259. A rebound from this level could favor the British pound and lead to some growth towards 1.3357. A close below 1.3259 will suggest further decline for the pound. It is still too early to talk about a full shift to a bearish trend.

The wave structure is clear. The last completed wave down (September 6-11) broke the low of the previous wave, and the upward wave forming over the last few weeks has broken the peak of the previous wave, located at 1.3234. Thus, the bearish trend ended before it really began. Currently, there are no signs of a new bearish trend starting. To break the current bullish trend, we would need a fall of 280-300 points or the formation of a new upward wave that does not break the last peak.

On Tuesday, traders eagerly awaited the first reports from the U.S. On Monday, Jerome Powell mentioned two more interest rate cuts of 0.25% by the end of the year. Traders had expected a larger rate cut, so Powell's comments can be considered "hawkish," which supported the dollar. Yesterday, the ISM Manufacturing Index did not impress, but another report—JOLTS—showed a higher-than-expected result. In August, there were 8.04 million job openings in the U.S. labor market, compared to the forecast of 7.655 million. Thus, the first report in the labor market and unemployment "package" was positive for the dollar. However, today we await the ADP report, and on Friday, the Nonfarm Payrolls and unemployment rate will be released. Traders should wait until Friday afternoon before reacting, as a weak Nonfarm Payrolls report could cause bears to retreat from the market.

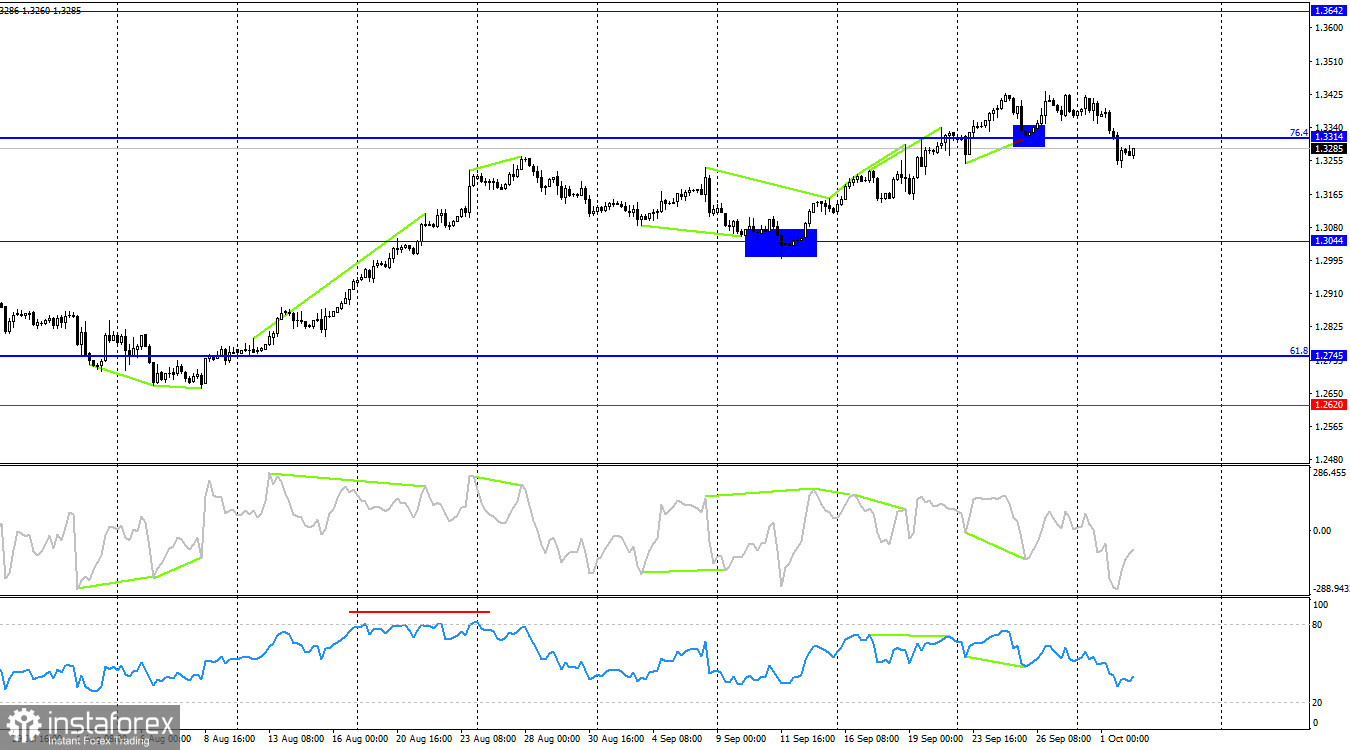

On the 4-hour chart, the pair reversed in favor of the dollar and consolidated below the 76.4% retracement level at 1.3314. This suggests the decline could continue towards the next level at 1.3044. No new divergences are forming today, but in recent weeks, several bearish signals have appeared. A consolidation above 1.3314 could signal a resumption of the bullish trend.

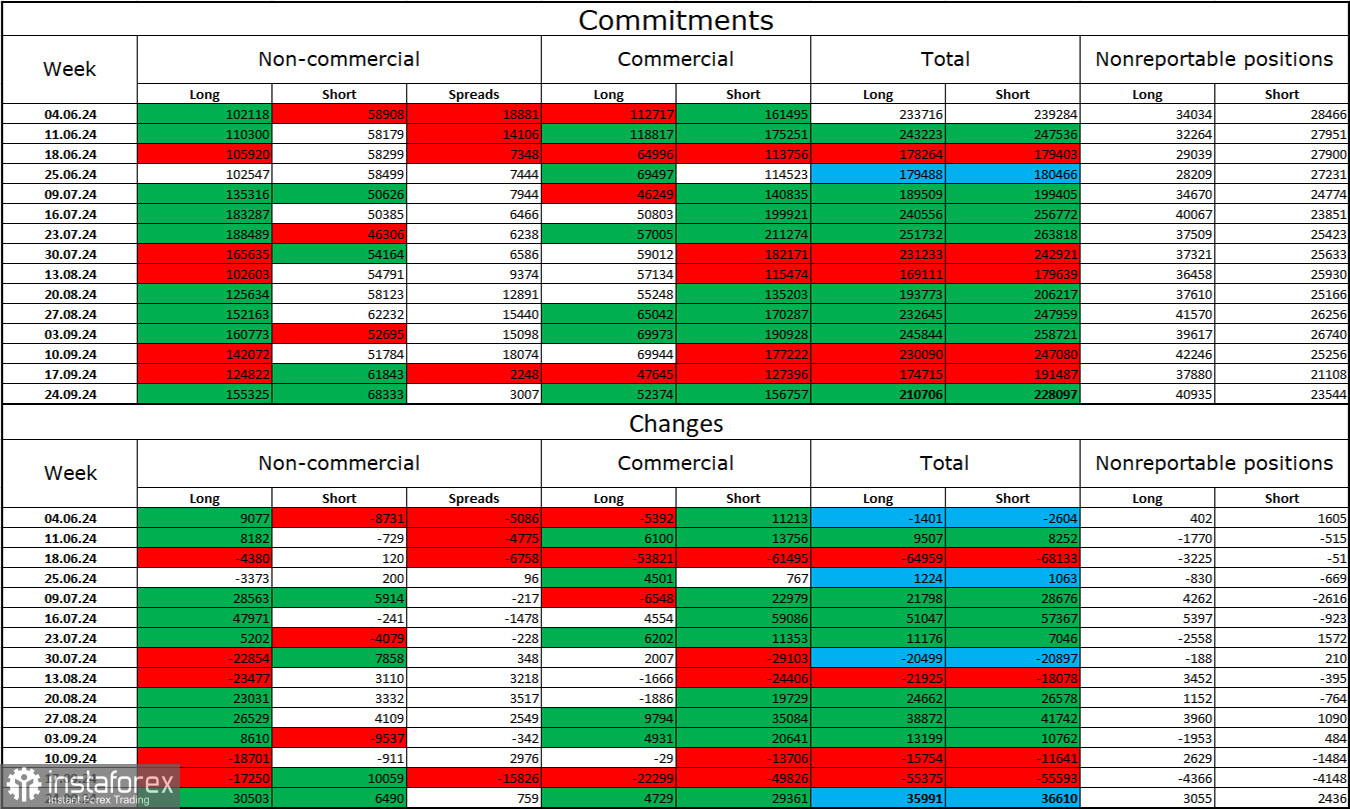

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became much more bullish during the last reporting week. The number of long positions held by speculators increased by 30,503, while the number of short positions grew by 6,490. For two weeks, professional players reduced their longs and increased their shorts, but now they are back to their old habits. Bulls still hold a solid advantage. The gap between the number of long and short positions is 87,000: 155,000 vs. 68,000.

In my view, the pound still retains prospects for decline, but the COT reports suggest otherwise for now. Over the past three months, the number of long positions has risen from 102,000 to 155,000, while short positions have increased from 58,000 to 68,000. I believe that over time, professional players will begin to unwind their long positions or build up short positions, as all potential bullish factors for the pound have already played out. However, graphical analysis still points to a bullish trend.

News Calendar for the U.S. and the U.K.:

U.S. – ADP Nonfarm Employment Change (12:15 UTC)

On Wednesday, the economic calendar features only one significant event. The news may have a limited impact on the market for the remainder of the day.

Forecast for GBP/USD and trading tips:

Selling the pair was possible after a rebound from 1.3425 on the hourly chart, with targets at 1.3357 and 1.3259. Both targets have been met. Small buy opportunities are possible from a rebound from 1.3259 on the hourly chart, but I would expect further declines in the pound with a target of 1.3151.

Fibonacci grids are drawn from 1.2892–1.2298 on the hourly chart and from 1.4248–1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română