Analysis of Trades and Tips for Trading the Euro

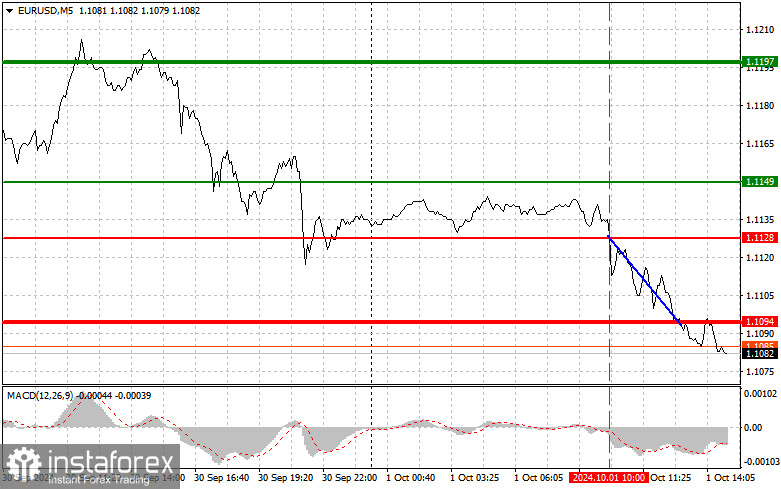

The retest of the 1.1128 price level occurred when the MACD indicator had just started moving down from the zero mark, confirming a correct entry point into the market. As a result, the pair moved down by 30 points, reaching the target level of 1.1094. I did not buy at that level on the rebound according to Scenario #2, as the weak manufacturing data from the Eurozone and Powell's comments yesterday left little chance for the euro to rise, even from current levels. Upcoming events include the U.S. ISM Manufacturing Index figures and the job openings and labor turnover data from the U.S. Bureau of Labor Statistics for September. Additionally, speeches by FOMC members Raphael Bostic and Lisa D. Cook are expected. Given the outcome of Powell's speech yesterday, I'm currently not optimistic about the euro's potential to rise. It's better to anticipate a continuation of the downward trend for the pair. Regarding my intraday strategy, I plan to act based on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro when the price reaches the area around 1.1102 (green line on the chart), aiming for a rise to the 1.1143 level. At 1.1143, I will exit the market and sell the euro in the opposite direction, aiming for a 30-35 point movement from the entry point. A strong upward movement of the euro today can only be expected if the Fed maintains a dovish stance and weak ISM data is released. Important: Ensure that the MACD indicator is above the zero mark and just beginning to rise before buying.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1075 price level when the MACD indicator enters the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. You can expect a rise toward the resistance levels of 1.1102 and 1.1143.

Sell Signal

Scenario #1: I will sell the euro after reaching the 1.1075 level (red line on the chart). The target will be 1.1041, where I plan to exit the market and immediately buy the euro in the opposite direction (aiming for a 20-25 point movement from that level). Pressure on the pair will likely return if strong U.S. statistics are released. Important: Ensure that the MACD indicator is below the zero mark and just starting its downward movement before selling.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1102 price level when the MACD indicator enters the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. You can expect a decline to the opposite levels of 1.1075 and 1.1041.

What's on the Chart:

- Thin green line – the entry price at which you can buy the trading instrument.

- Thick green line – the estimated price where you can set Take Profit or lock in profits yourself, as further growth above this level is unlikely.

- Thin red line – the entry price at which you can sell the trading instrument.

- Thick red line – the estimated price where you can set Take Profit or lock in profits yourself, as further decline below this level is unlikely.

- MACD Indicator: It's essential to consider overbought and oversold zones when entering the market.

Important: Beginner forex traders should exercise extreme caution when making market entry decisions. It's best to stay out of the market before the release of crucial fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, to trade successfully, you need a clear trading plan, like the one presented above. Making impulsive trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română