Troubles never come alone. Israel's military operation against Hezbollah has increased demand for the U.S. dollar as a safe-haven asset, while the standoff between the new French government and parliament is raising political risk in Europe and putting pressure on the euro. When we add the drop in eurozone inflation below the 2% target, which pushes the ECB towards a rate cut in October, the collapse of the EUR/USD begins to make sense.

In a region where power is the primary language, Israel's ground operation against Hezbollah leaves a mixed impression. On one hand, Jerusalem's superiority is beyond doubt. On the other hand, the Israeli army risks becoming entangled in Lebanon, and Iran could be drawn into the conflict. If the conflict escalates, we can expect rising oil prices and increased demand for safe-haven assets. What is happening now with the EUR/USD is just the beginning.

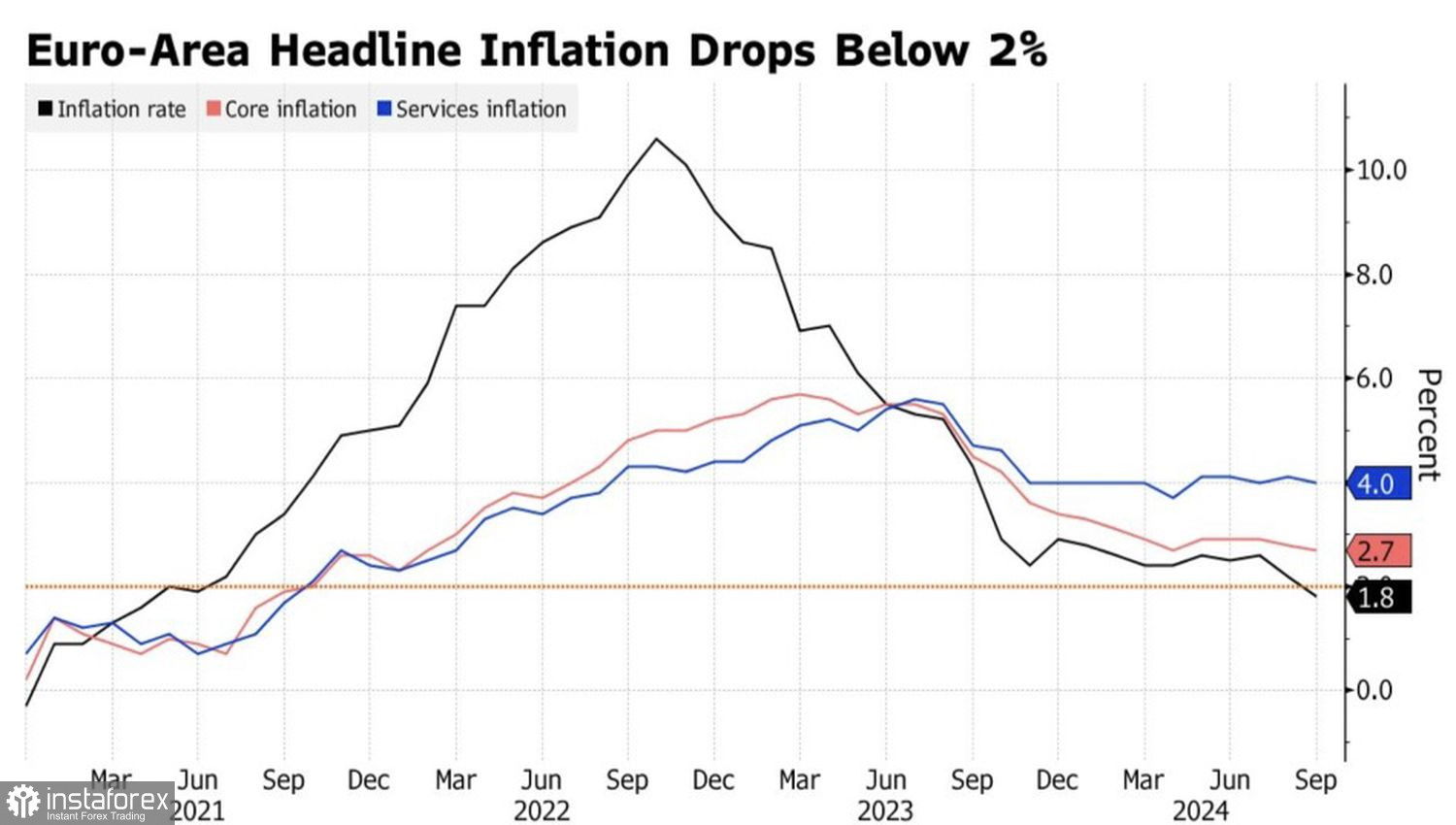

The slowdown in European inflation from 2.2% to 1.8% was widely anticipated after consumer price growth rates fell in the leading economies of the eurozone. The ECB forecasts that CPI indices will rise by the end of the year. But what if they do not? If deflation returns to the eurozone, the deposit rate may need to be cut sharply, perhaps even to zero. Under such circumstances, the EUR/USD could experience a significant decline.

European Inflation Trend

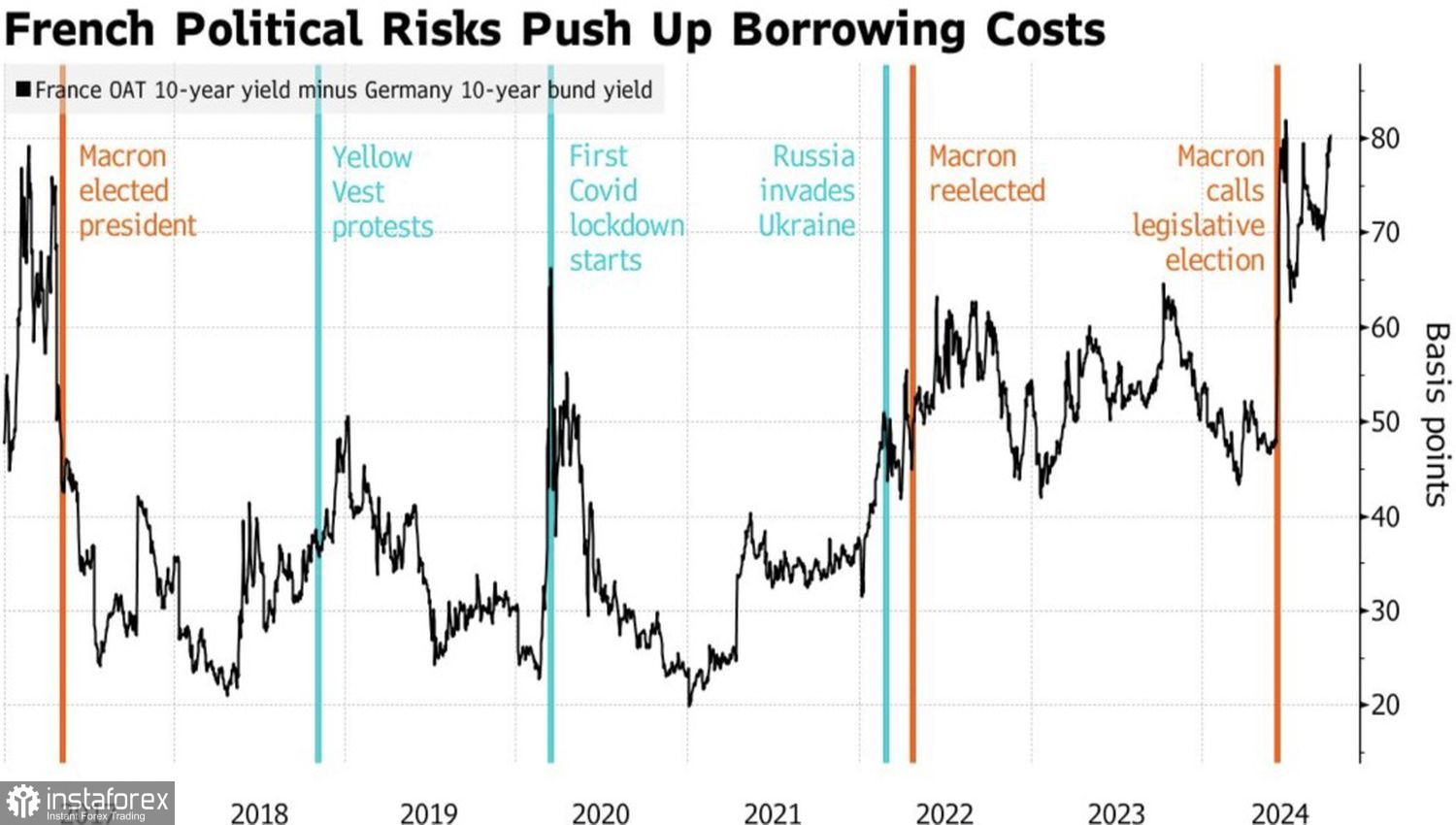

Meanwhile, foreign investors are actively selling French stocks and bonds, leading to a sharp rise in the yield spread between French and German bonds. This indicates an increase in political risk, especially in light of the first clash between the new French Prime Minister and parliament. The Prime Minister, faced with a minority government, risks facing a vote of no confidence from lawmakers at any moment.

There are plenty of reasons for this. Despite announcing an increase in the budget deficit from 4.4% to 6% of GDP, the new Prime Minister intends to reduce this figure to the 3% required by the European Union. Achieving this goal would require raising taxes, a highly unpopular measure that could provoke the anger of both right-wing and left-wing parties controlling the National Assembly.

Yield Spread Dynamics Between French and German Bonds

Contributing to the EUR/USD decline is the reduced probability of a 50 basis point rate cut by the Federal Reserve in November, which fell from 50% to 37% following Jerome Powell's speech. The Fed Chairman stated that the central bank does not feel a sense of urgency and that its policy will depend on data.

Thus, the rise in geopolitical risks in the Middle East, combined with political risks in Europe, the increasing likelihood of continued monetary expansion by the ECB, and the Fed's cautious stance, are pushing the main currency pair downward.

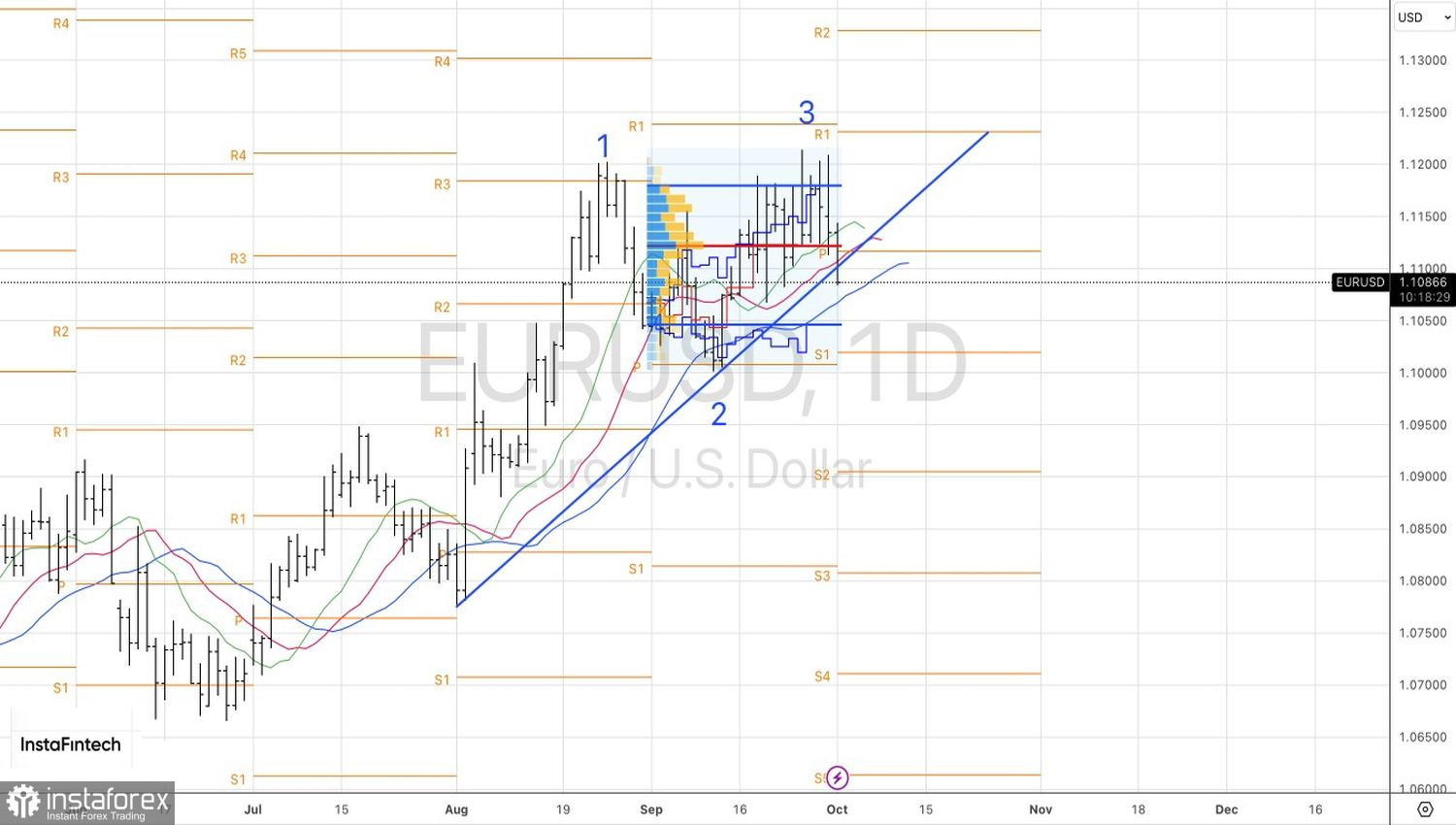

Technically, on the daily EUR/USD chart, the inability of the bulls to stay above the upper boundary of the fair value range of 1.1045-1.118 indicates their weakness. Control has shifted to the bears. However, a rebound from the support levels at 1.1065 and 1.1045 should be seen as an opportunity for buying.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română