Analysis of Trades and Trading Tips for the British Pound

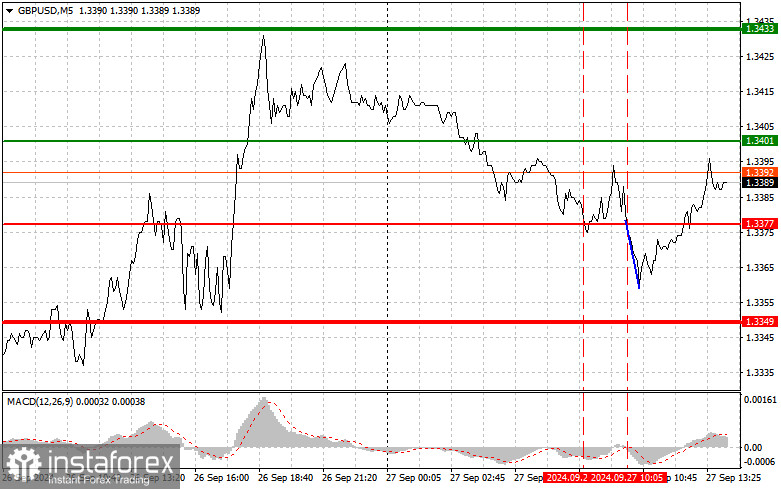

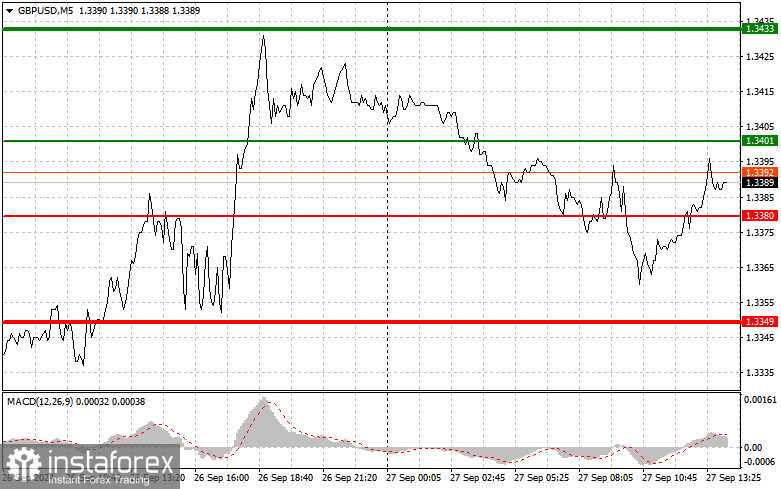

The retest of the 1.3377 price level occurred when the MACD indicator was just beginning to move down from the zero mark, which confirmed the appropriate entry point for selling the pound. As a result, the pair dropped by 20 points but didn't quite reach the target level of 1.3349. Important U.S. statistics lie ahead. Data on the U.S. core Personal Consumption Expenditures (PCE) index could indicate rising inflation, which will likely lead to a decline in the pound. Reports on the growth of U.S. household spending and income levels will cause GBP/USD to drop further. If statistics are weak, the pound might reach a new monthly high. For my intraday strategy, I plan to act based on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound at the entry point around 1.3401 (green line on the chart) with a target of rising to 1.3433 (thicker green line on the chart). At around 1.3433, I'll exit my purchases and open short positions in the opposite direction, expecting a retracement of 30-35 points. You can expect the pound to rise today if U.S. statistics are weak. It is important that before buying, you ensure the MACD indicator is above the zero mark and is just beginning its upward movement.

Scenario #2: I also plan to buy the pound today in case of two consecutive touches of the 1.3380 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal of the market upwards. You can expect a rise to the opposite levels of 1.3401 and 1.3433.

Sell Signal

Scenario #1: I plan to sell the pound today once it reaches the 1.3380 level (red line on the chart). This is expected to lead to a sharp decline in the pair. The key target for sellers will be the 1.3349 level, where I will exit my sales and immediately open long positions in the opposite direction, expecting a retracement of 20-25 points. Sellers are likely to be more active if U.S. statistics are strong. It is important that before selling, you ensure the MACD indicator is below the zero mark and just starting its downward movement.

Scenario #2: I also plan to sell the pound today in case of two consecutive touches of the 1.3401 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. You can expect a decline to the opposite levels of 1.3380 and 1.3349.

What is on the Chart:

- Thin green line – the entry price at which you can buy the trading instrument.

- Thick green line – the anticipated price where you can set Take Profit or manually secure profits, as further growth above this level is unlikely.

- Thin red line – the entry price at which you can sell the trading instrument.

- Thick red line – the anticipated price where you can set Take Profit or manually secure profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it's important to pay attention to overbought and oversold zones.

Important: Beginner forex traders should be very cautious when making market entry decisions. Before the release of key fundamental reports, it's best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

It is essential to remember that, for successful trading, having a clear trading plan, such as the one presented above, is crucial. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română