EUR/USD

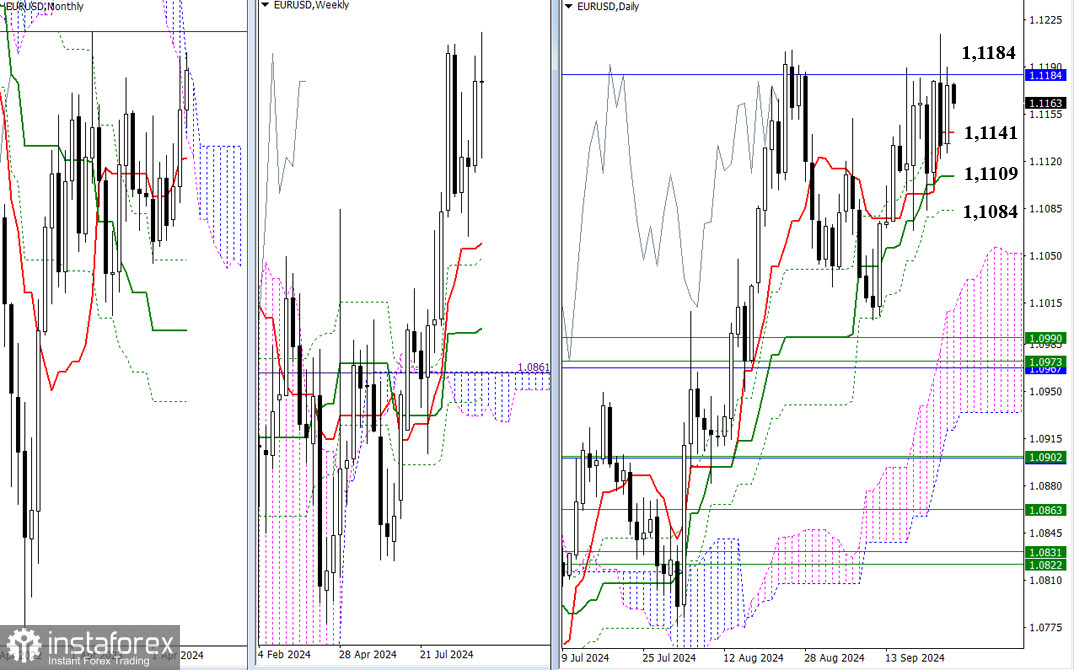

Larger timeframes

This week, the EUR/USD pair has been consolidating below the upper border of the one-month cloud (1.1184). Bearish traders have managed a few times to destroy all of their opponents' gains, bringing the price back to the short-term daily trend channel. As a result, the consolidation range and the current uncertainty can now be defined by the one-month resistance at 1.1184 and the support levels of the daily Ichimoku cross (1.1141 – 1.1133 – 1.1109 – 1.1084). If the instrument breaks out beyond these levels and firmly settles outside these borders, this will open up new prospects for EUR/USD.

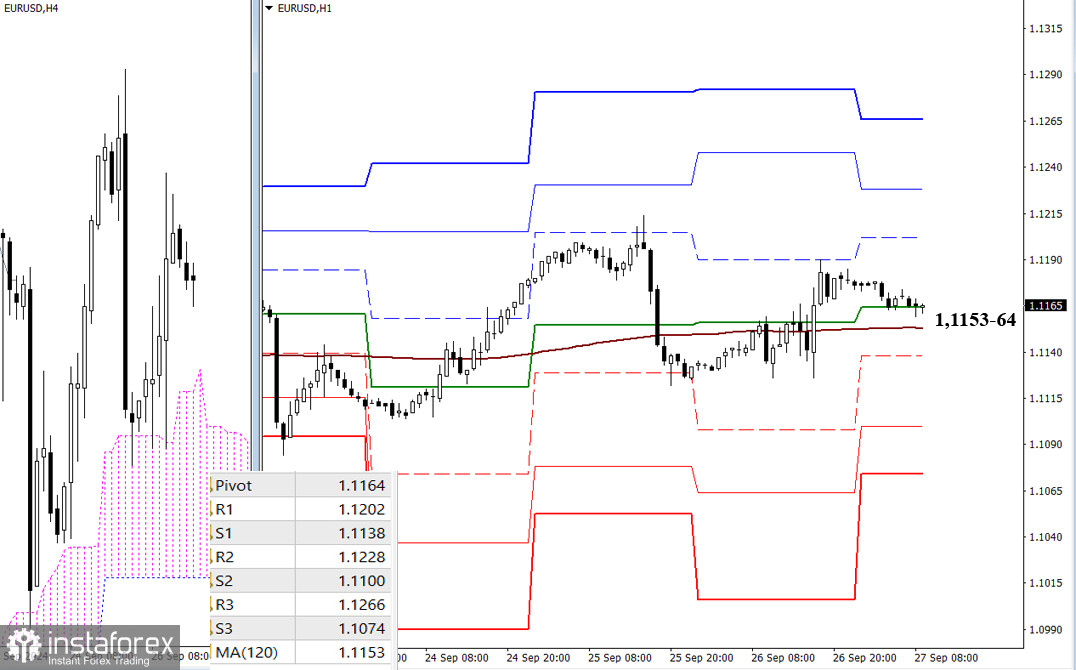

H4 – H1 timeframes

On the lower timeframes, key levels of 1.1153 – 1.1164 (the central pivot level of the day + the weekly long-term trend) remain horizontal, maintaining uncertainty. The instrument is fluctuating above and below these levels, winding around the trend line. If a directional movement develops, attention will shift to other reference points on the lower timeframes. In the case of an upward move, the resistances of the classic Pivot levels (1.1202 – 1.1228 – 1.1266) will be of interest to bulls. If the EUR/USD pair declines, the classic Pivot level supports (1.1138 – 1.1100 – 1.1074) may come into play.

***

GBP/USD

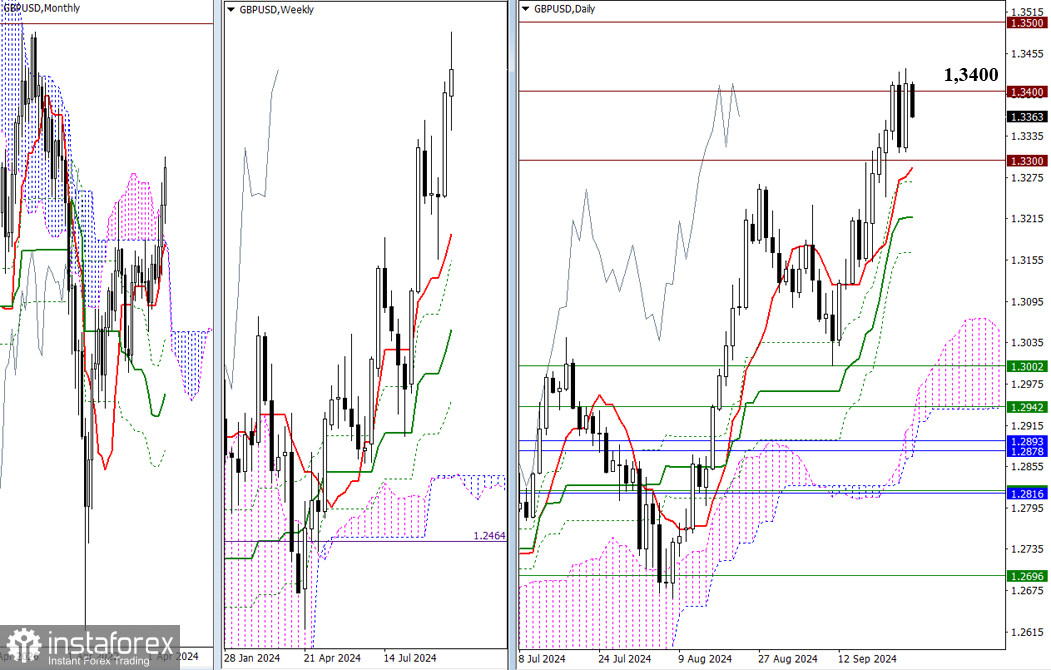

Larger timeframes

As the week is coming to an end, the market is still struggling to decide on the 1.3400 level. A breakout of this level will pave the way for new bullish prospects, potentially driving the price toward the next psychological resistance at 1.3500. A rejection will bring the price back to the previous level of 1.3300, followed by testing the supports of the daily Ichimoku cross (1.3289 – 1.3217 – 1.3166). Let's wait for the week's close to see which trading force secures the advantage, though uncertainty may prevail at this stage.

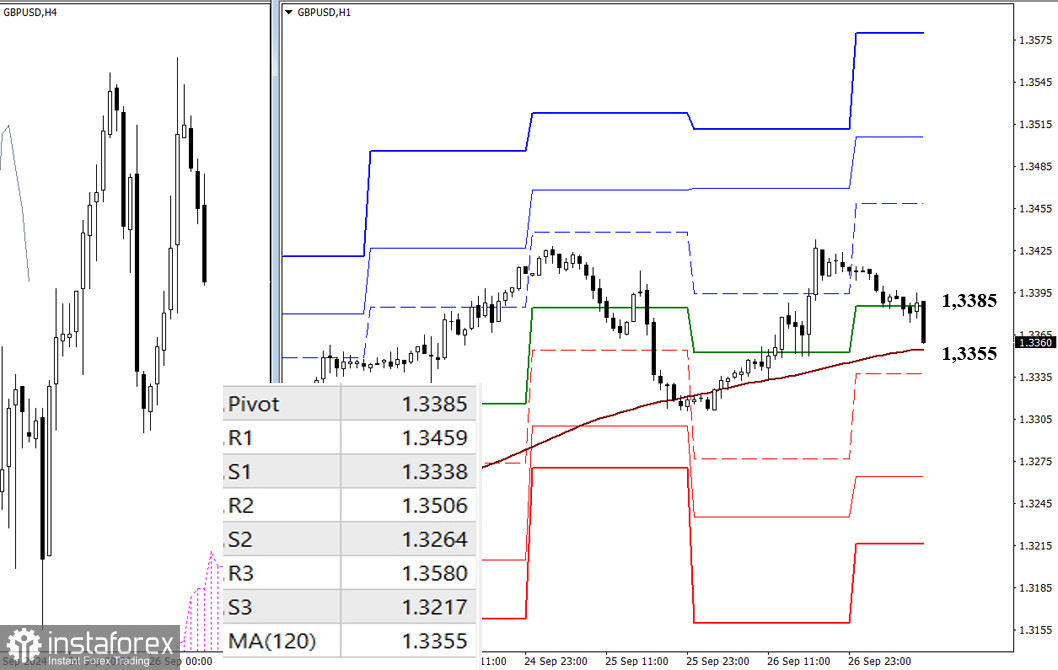

H4 – H1 timeframes

On the lower timeframes, the market is descending toward key support levels, located today at 1.3385 – 1.3355 (central Pivot level + weekly long-term trend). Control of the trend provides the primary advantage. Additional intraday reference points are the classic Pivot levels, meaning an upward move would pass through resistances (1.3459 – 1.3506 – 1.3580), while a downward move would go through supports (1.3338 – 1.3264 – 1.3217).

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot points + 120-period Moving Avarage (weekly long-term trendline)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română