Trade Analysis and Tips for Trading the Japanese Yen

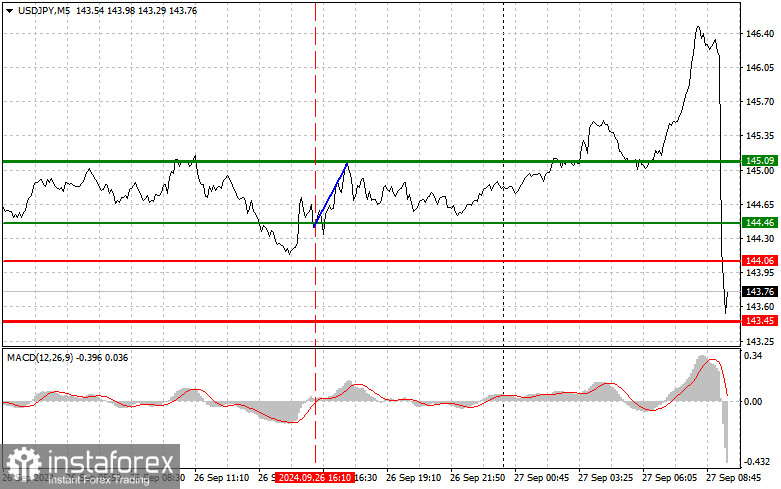

The test of the 144.46 price level occurred when the MACD indicator was just starting to move up from the zero mark, confirming the correct entry point for buying the dollar. As a result, the pair rose by 50 pips. Today's Tokyo Consumer Price Index and Japan's Leading Economic Indicators Index data supported the dollar, prompting pair buying. However, political news that Japan's ruling party chose Shigeru Ishiba as its next leader, appointing a proponent of an Asian NATO as prime minister—which could lead to increased tensions with China—caused a strong sell-off of the trading instrument and strengthening of the Japanese yen. Regarding the intraday strategy, I will mostly rely on the implementation of scenarios #1 and #2.

Buy Signal

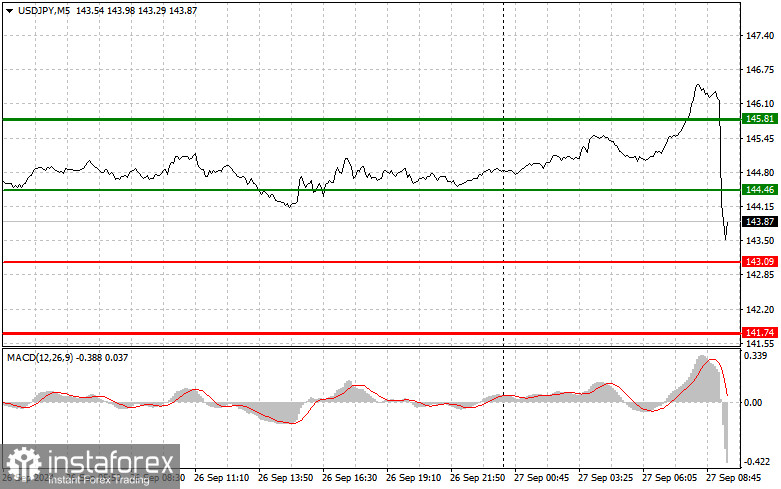

Scenario #1: Today, I plan to buy USD/JPY when the entry point reaches the 144.46 area (green line on the chart) with a target of rising to the 145.81 level (thicker green line on the chart). Around the 145.81 level, I intend to exit the buy positions and open sell positions in the opposite direction (expecting a movement of 30-35 pips in the opposite direction from the level). It is unlikely that we can expect the pair to rise today. Important! Before buying, ensure the MACD indicator is above the zero mark and is just beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if the price of 143.09 is tested twice consecutively when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth to the opposite levels of 144.46 and 145.81 can be expected.

Sell Signal

Scenario #1: Today, I plan to sell USD/JPY only after the 143.09 level is tested (red line on the chart), which will lead to a rapid decline of the pair. The key target for sellers will be the 141.74 level, where I intend to exit the sell positions and immediately open buy positions in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair will persist within the framework of the bearish market trend for the dollar. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if the price of 144.46 is tested twice consecutively when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline to the opposite levels of 143.09 and 141.74 can be expected.

What's on the Chart:

Thin green line: The entry price at which you can buy the trading instrument.

Thick green line: The estimated price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely.

Thin red line: The entry price at which you can sell the trading instrument.

Thick red line: The estimated price at which you can set Take Profit or manually lock in profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it's important to be guided by overbought and oversold zones.

Important: Beginner forex traders must make market entry decisions cautiously. It's best to stay out of the market before the release of significant fundamental reports to avoid sharp fluctuations in exchange rates. If you choose to trade during news releases, always set stop orders to minimize losses. Without using stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, to trade successfully, you need a clear trading plan, similar to the example I've presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română