After the US dollar's unclear rise on Wednesday, it started losing ground yesterday without any particular reason. Especially since the macroeconomic data in the United States generally matched expectations. The final GDP data confirmed the preliminary estimates, which the market had already factored in. The changes in jobless claims were symbolic and couldn't influence the situation. So, this is simply a matter of a bounce and an attempt to correct the imbalances.

Today, even such data won't be published, so logically, the market should consolidate around the achieved levels. However, we shouldn't rule out the high volatility accompanying this process. Nevertheless, in the end, the quotes should settle near the levels at which yesterday's trading ended.

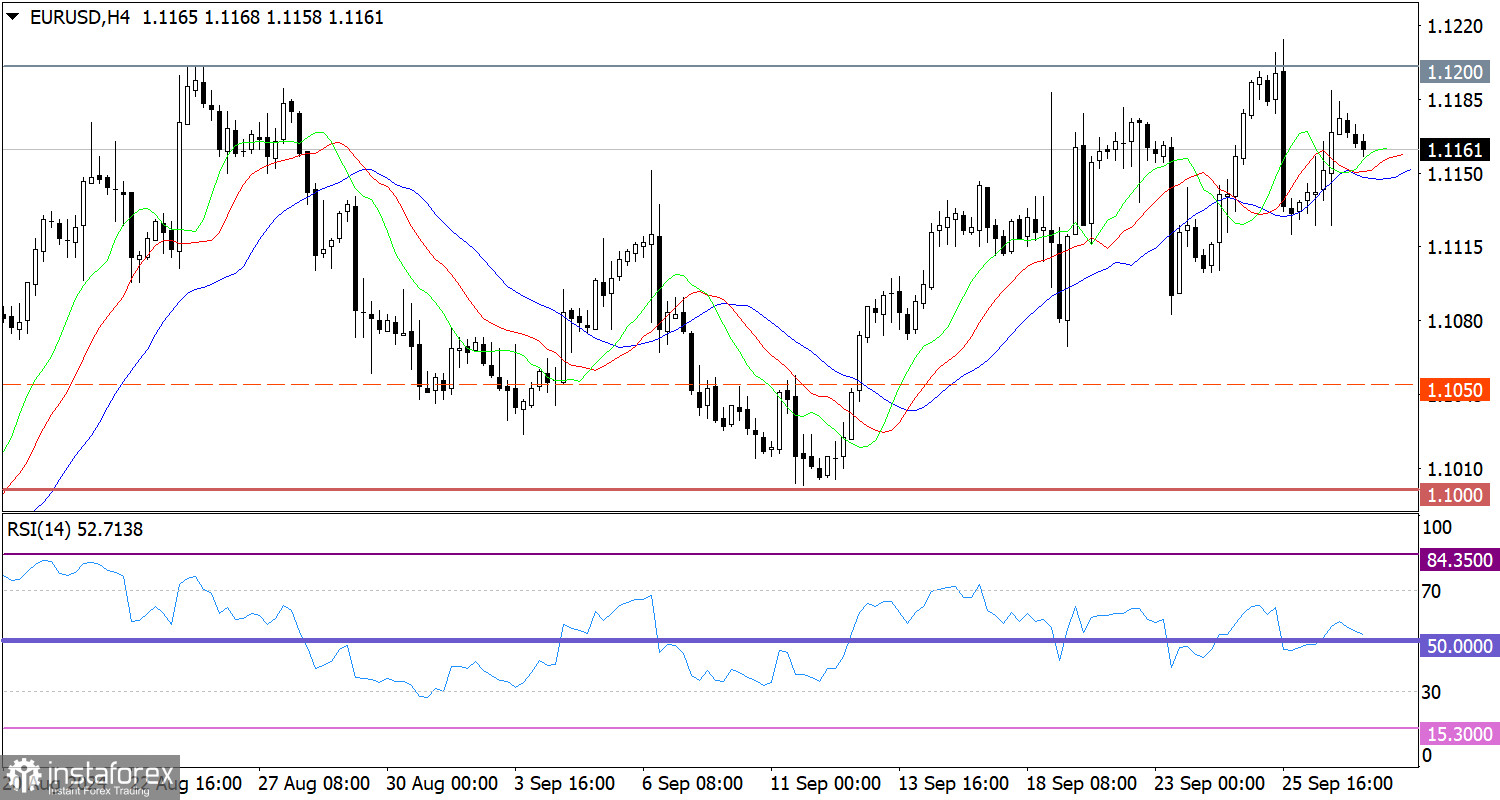

Despite local speculations, the EUR/USD pair is moving within the limits of the peak of the upward cycle, with the 1.1200 level area acting as resistance.

In the four-hour chart, the RSI technical indicator moves in the buyers' area of 50/70, indicating a prevailing bullish sentiment among market participants.

Regarding the Alligator indicator in the same time frame, the moving average (MA) lines are directed upward, corresponding to the main trend direction.

Expectations and Prospects

For the next phase of growth, the quote needs to stabilize above the 1.1200 mark throughout the day. In this scenario, the high set in July 2023, which is the 1.1276 level, is highly probable to be updated. Otherwise, we may experience some choppy fluctuations around the current values.

The complex indicator analysis in short-term and intraday periods indicates a pullback.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română