Analysis of Thursday's Trades:

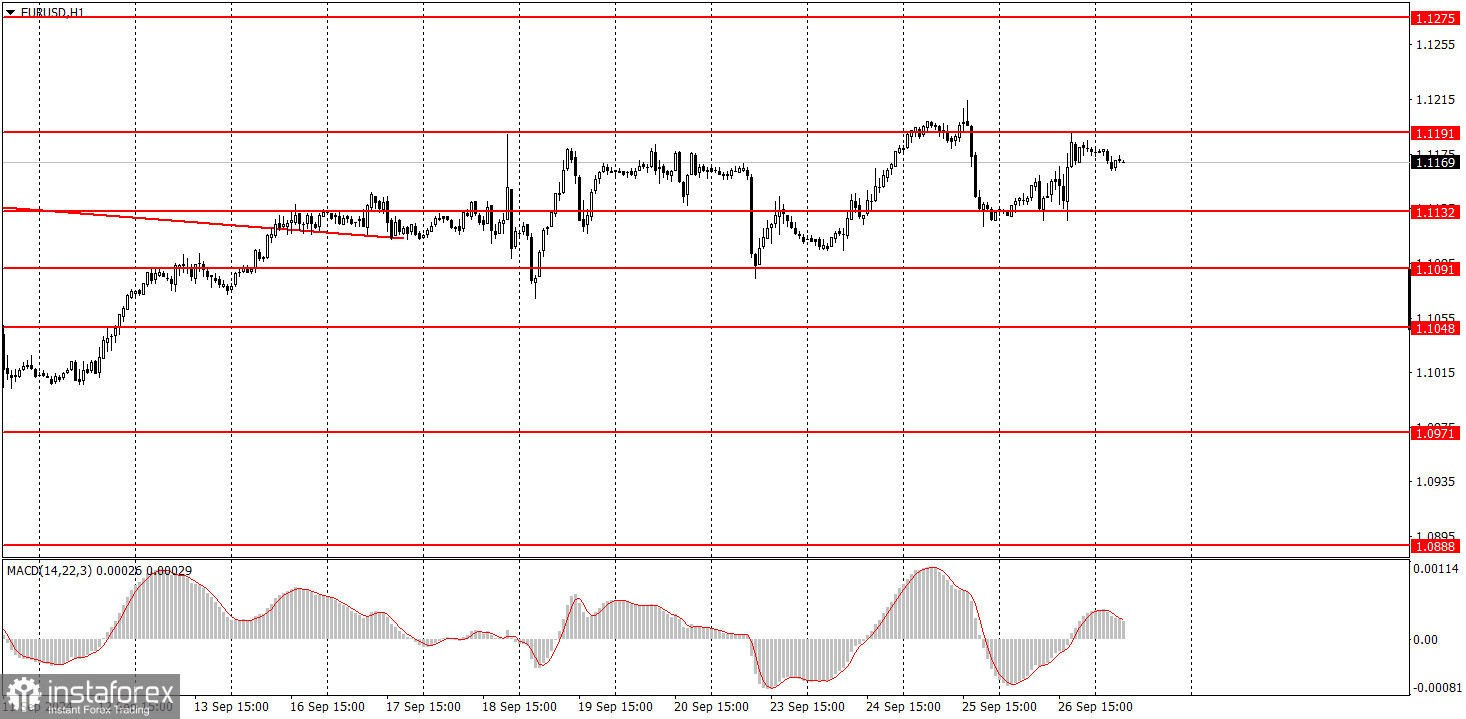

EUR/USD on 1H Chart

The EUR/USD pair traded higher again on Thursday. The first thing to pay attention to is the macroeconomic data in the US. The GDP report for the second quarter matched experts' forecasts, but the figure for the first quarter was revised upward to +1.6%. A positive report? Yes, it was. Next, the durable goods orders report was published. Its August value exceeded expectations, reaching 0.0% against the expected -2.6%. The number of jobless claims also turned out better than the market expected. So, three out of three reports showed better values than traders anticipated. How much did the dollar rise? By 35 pips. And then it lost 65. Yes, Federal Reserve Chair Jerome Powell's speech followed these reports, and surely the market found something dovish in it, but even if we ignore Powell's speech, the dollar only gained 35 pips from two important and strong US reports.

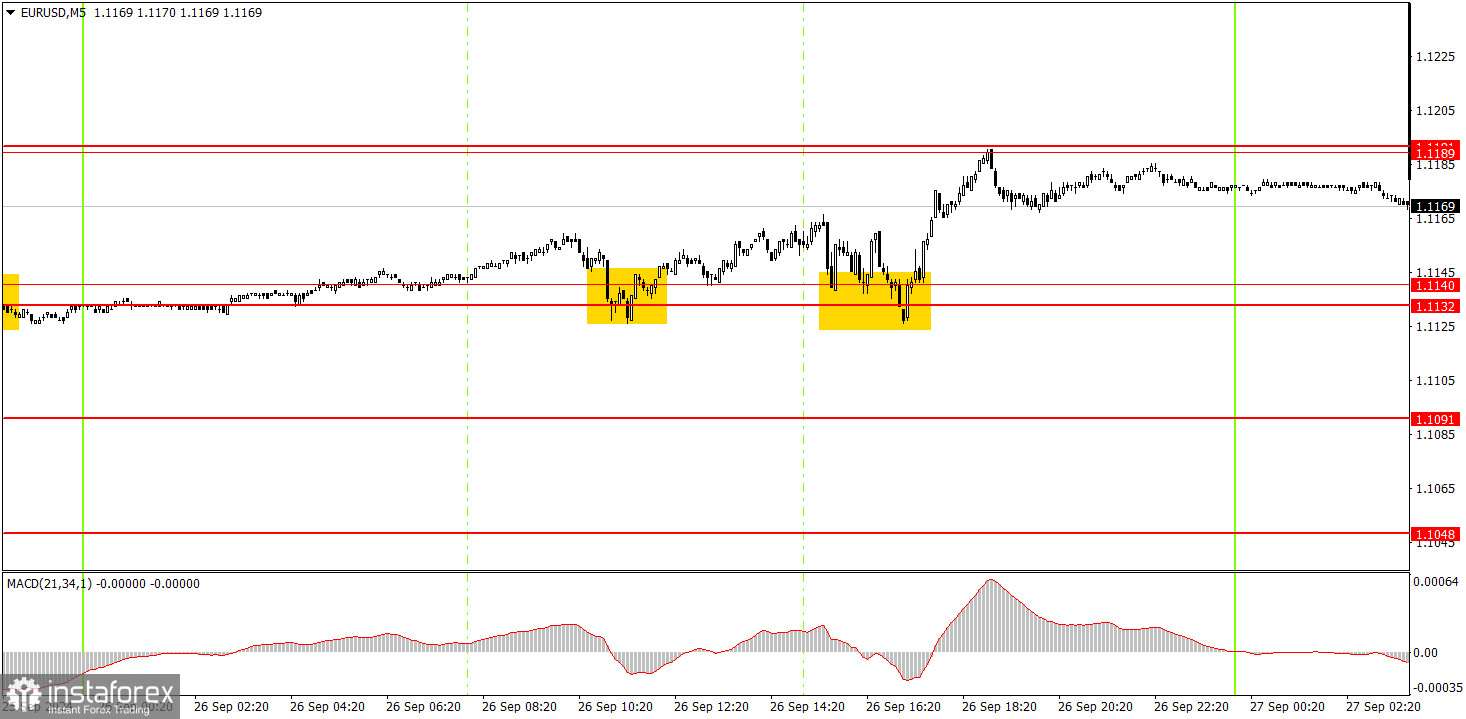

EUR/USD on 5M Chart

Two buy signals were formed in the 5-minute time frame on Thursday. The price bounced off the 1.1132-1.1140 area twice, so novice traders could open two long positions. In the first case, the price rose by only 15 pips, enough to set the Stop Loss at breakeven, where the trade was eventually closed. The upward movement was stronger the second time, and the price managed to reach the nearest target of 1.1189-1.1191. This trade allowed for a profit of about 30-35 pips.

How to Trade on Friday:

In the hourly time frame, the EUR/USD pair still has chances to form a downward trend, but these chances gradually diminish. Unfortunately, the illogical selling of the dollar could easily continue in the medium term since no one knows how long the market will keep pricing in the Fed's monetary policy easing and ignoring all factors favoring the dollar. Over the past couple of weeks, it's become apparent that market participants are finding it difficult to push the pair further upward. Perhaps we are close to the end of the uptrend, but next week brings important data in the US.

On Friday, the pair might start a new downward correction if it bounces off the 1.1189-1.1191 area. If this area is surpassed, the upward movement will continue, and intraday-long positions will be relevant.

In the 5-minute time frame, the following levels should be considered: 1.0726-1.0733, 1.0797-1.0804, 1.0838-1.0856, 1.0888-1.0896, 1.0940, 1.0971, 1.1011, 1.1048, 1.1091, 1.1132-1.1140, 1.1189-1.1191, 1.1275-1.1292. No significant events are scheduled in the Eurozone on Friday, so a flat movement may be observed during the European session. The relatively important PCE index and the Consumer Sentiment Index from the University of Michigan will be released in the US.

Basic Rules of the Trading System:

1) Signal Strength: The strength of a signal is determined by the time it takes to form (bounce or break through a level). The less time it takes, the stronger the signal.

2) False Signals: If two or more trades are opened near a certain level based on false signals, all subsequent signals from that level should be ignored.

3) Flat Market: In a flat market, any pair can generate numerous false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trading Timeframe: Trades should be opened between the start of the European session and the middle of the American session, after which they should be closed manually.

5) MACD Indicator Signals: In the hourly time frame, it is preferable to trade based on MACD signals only when there is good volatility and a trend confirmed by a trendline or trend channel.

6) Close Levels: If two levels are located too close to each other (between 5 and 20 pips), they should be considered as a single support or resistance area.

7) Stop Loss: Once the price moves 15 pips in the intended direction, a Stop Loss should be set at the breakeven point.

What's on the Charts:

Support and Resistance Price Levels: These levels serve as targets when opening buy or sell positions. They can also be used as points to set Take Profit levels.

Red Lines: These represent channels or trend lines that display the current trend and indicate the preferred trading direction.

MACD Indicator (14,22,3): The histogram and signal line serve as an auxiliary indicator that can also be used as a source of trading signals.

Important Speeches and Reports (always found in the news calendar) can significantly impact the movement of a currency pair. Therefore, trading should be done with maximum caution during their release, or you may choose to exit the market to avoid a sharp price reversal against the preceding movement.

For Beginners Trading on the Forex Market: It's essential to remember that not every trade will be profitable. Developing a clear strategy and practicing money management is key to achieving long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română