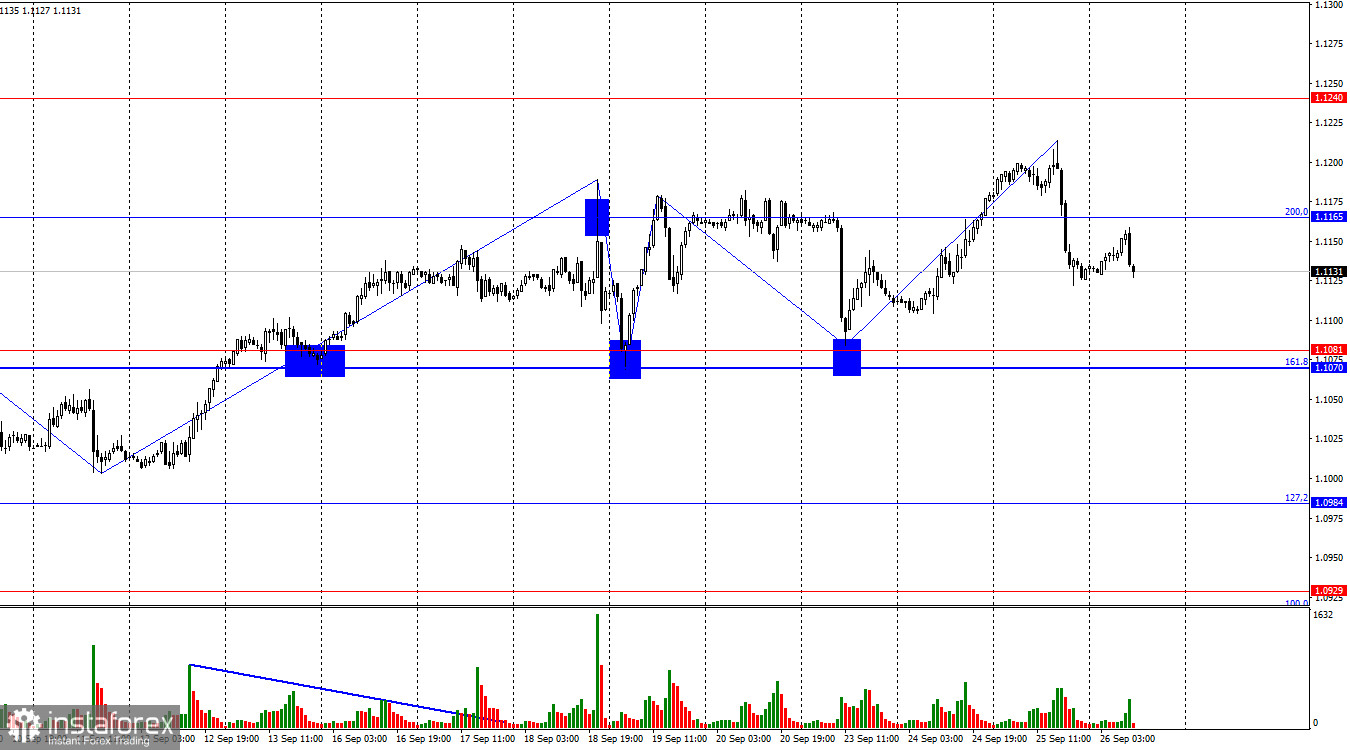

On Wednesday, the EUR/USD pair shifted in favor of the U.S. dollar, consolidating below the 200.0% corrective level at 1.1165. This indicates that the decline may extend towards the nearest support zone between 1.1070 and 1.1081. A rebound from this zone would support the euro and could initiate a resurgence towards the 1.1165 level and possibly higher. The bullish trend remains intact.

The wave dynamics have grown somewhat more complex but overall, they remain unproblematic. The last completed downward wave (September 19–23) did not breach the low of the previous wave, while the new upward wave exceeded the peaks of the prior two waves. Consequently, the pair may either be transitioning into a complex sideways pattern or beginning to establish a new bullish trend. A consolidation below the support zone of 1.1070–1.1081 would negate the emerging bullish trend.

Despite the lack of significant news on Wednesday, traders will find no shortage of important information today. I particularly note the pair's decline yesterday, which occurred without any newsworthy catalysts, reinforcing the hypothesis of a transition to a sideways movement. The inception of a bearish trend could be identified by a close below the 1.1070–1.1081 zone. Today's speech by Jerome Powell and the GDP report are poised to significantly impact trader sentiment. Given Powell's recent dovish statements, I do not anticipate any dollar strengthening post-speech. However, if the pair is indeed in a sideways trend, the decline could persist, independent of the information backdrop. The same holds true for the GDP report, which has recently tended to exceed expectations but has not significantly bolstered the dollar, as the market continues to anticipate aggressive FOMC monetary easing through the end of 2024.

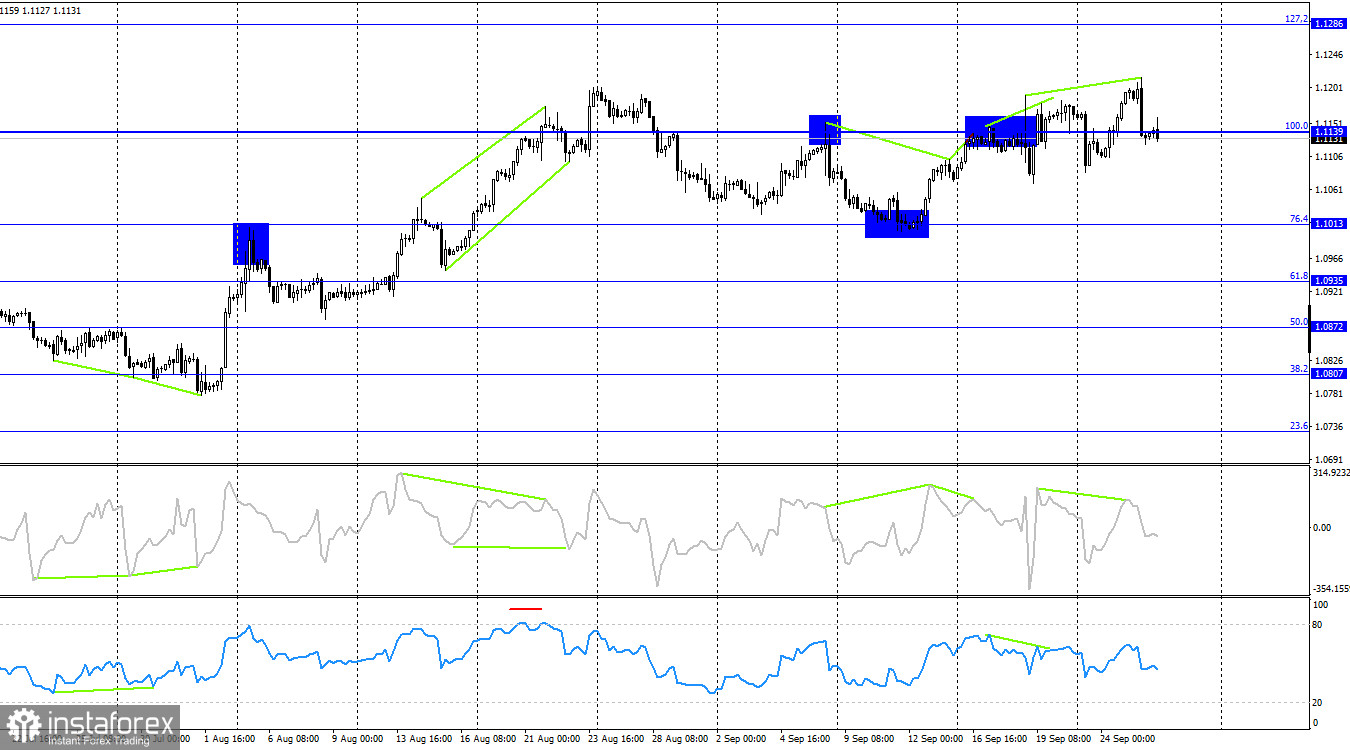

On the 4-hour chart, the pair shifted in favor of the U.S. dollar following a series of bearish divergences on the RSI and CCI indicators, yet a significant decline did not ensue. The RSI entered overbought territory a few weeks ago, and a new bearish divergence has now appeared on the CCI indicator. Considering the bulls' strength and persistence, a significant drop in the euro seems unlikely. However, a move below the 1.1139 level might lead towards the 1.1013 level, although bears have not yet managed to breach even the nearest support zone on the hourly chart.

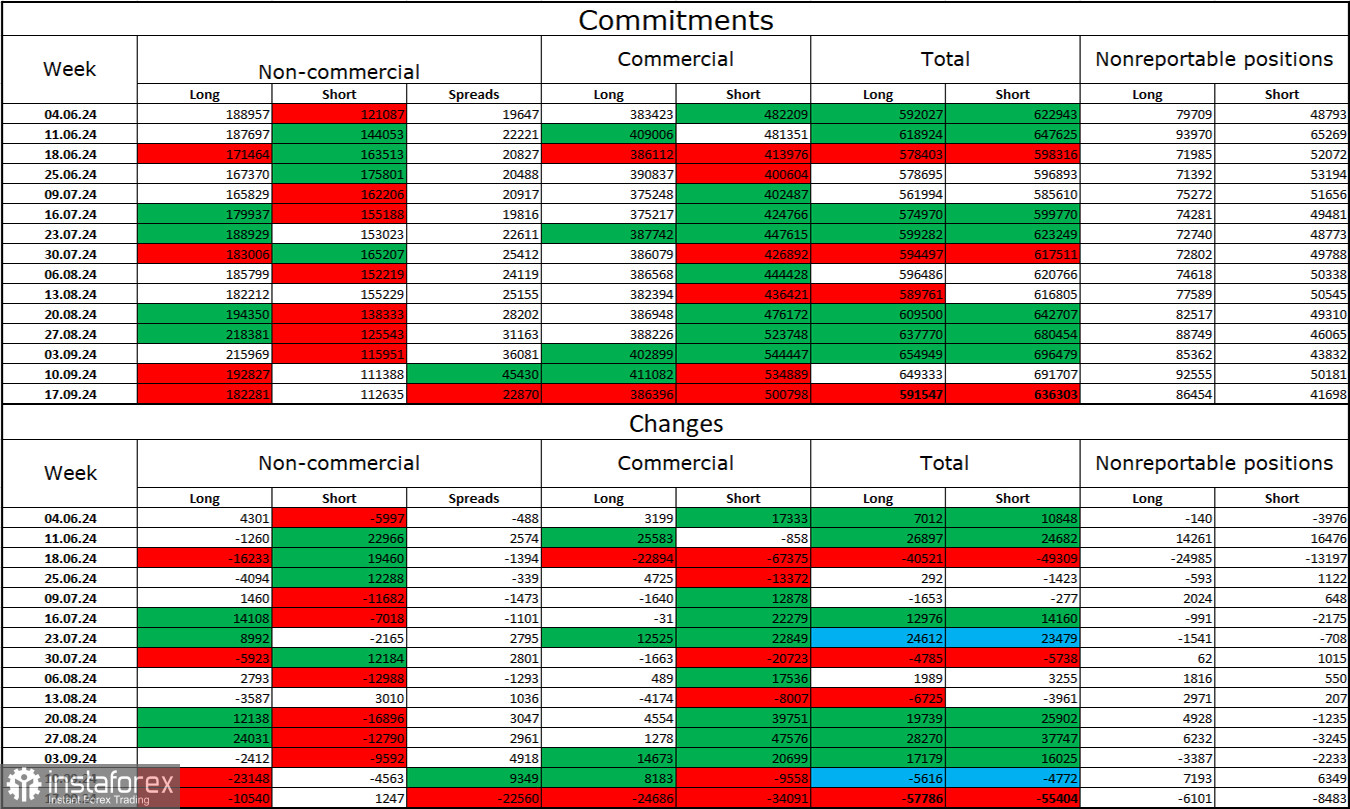

Commitments of Traders (COT) Report:

In the latest report, speculators decreased their long positions by 10,540 positions and increased their short positions by 1,247 contracts. The non-commercial group's sentiment turned bearish several months ago, but currently, bulls are regaining dominance. The total long positions now stand at 182,000, while shorts are at just 112,000.

For the second consecutive week, major players have been offloading the euro. This could presage a new bearish trend or at least a correction. The primary factor behind the dollar's recent decline—expectations for FOMC policy easing—has been fully absorbed, leaving fewer reasons for further weakening of the dollar. While new factors may emerge, current indicators suggest that the growth of the U.S. dollar is more probable. Active selling of the euro has not yet commenced, but should it begin, the likelihood of a bearish trend will rise.

Economic News Calendar for the US and the Eurozone:

- US: Change in Durable Goods Orders (12:30 UTC)

- US: GDP Change for Q2 (12:30 UTC)

- US: Initial Jobless Claims (12:30 UTC)

- US: Speech by Federal Reserve Chair Jerome Powell (13:20 UTC)

- Eurozone: Speech by ECB President Christine Lagarde (13:30 UTC)

The economic calendar for September 26 includes numerous significant events. The day's information background is expected to strongly influence market sentiment.

EUR/USD Forecast and Trading Tips: Selling the pair was feasible upon closing below the 1.1165 level on the hourly chart, with targets at 1.1081 and 1.1070. Purchases of the pair should be considered upon a rebound from the support zone of 1.1070–1.1081 on the hourly chart, aiming for 1.1139 and 1.1165.

The Fibonacci levels are established based on 1.0917–1.0668 on the hourly chart and 1.1139–1.0603 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română