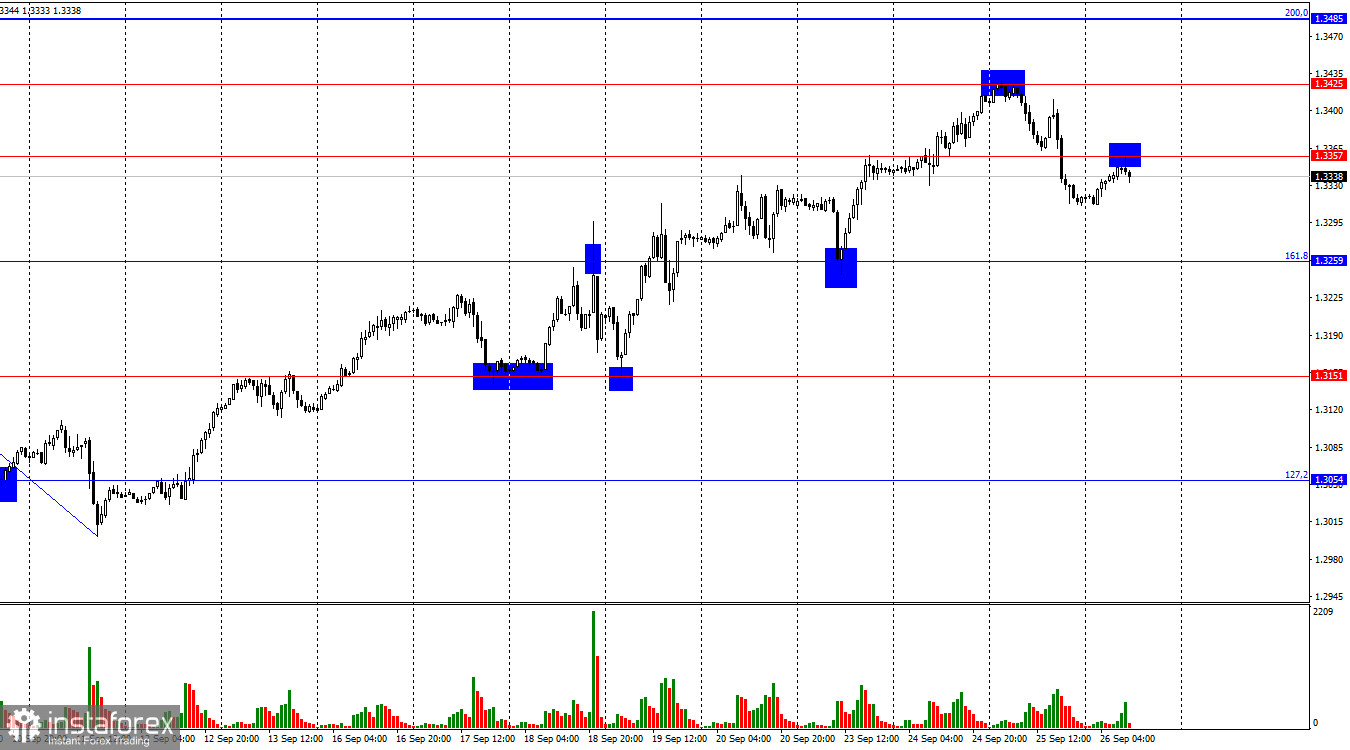

On the hourly chart, the GBP/USD pair rebounded from the 1.3425 level on Wednesday, subsequently reversing in favor of the U.S. dollar. The anticipated decline ensued, with the pair closing below the 1.3357 level. Today, we might see a rebound from this level, which would increase the likelihood of continued declines toward the next correction target of 161.8% at 1.3259. Should the pair consolidate above the 1.3357 mark, we could anticipate a new upward move toward 1.3425 and 1.3485.

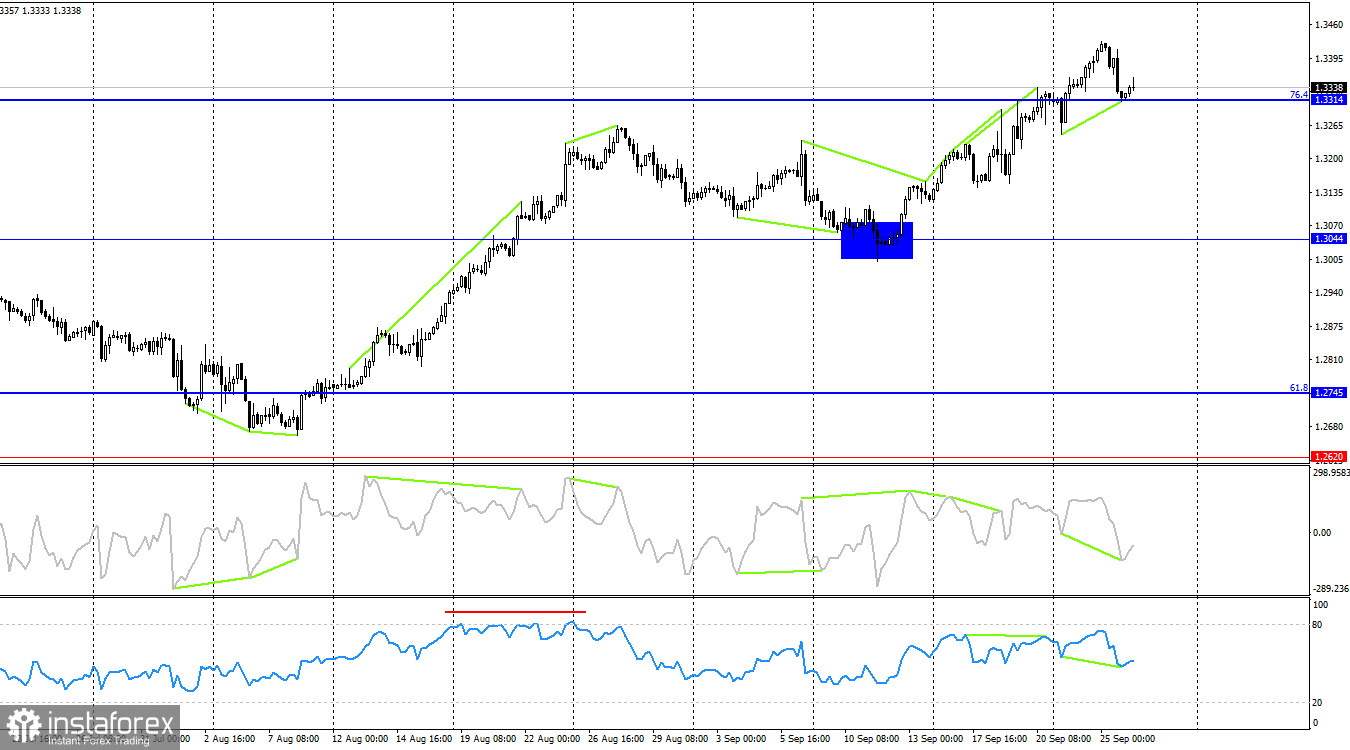

The current wave analysis raises no questions. The most recent downward wave (September 6–11) breached the low of its predecessor, whereas the wave currently forming has surpassed the previous peak at 1.3234. Consequently, the bearish trend has ended almost before it began. At present, there are no indications of even a sideways trend that could provide relief for the U.S. dollar. A drop of 340–360 points is necessary to disrupt the prevailing bullish trend.

Thursday's information could once again undermine the U.S. dollar. While yesterday's market showed initial signs of a potential bearish turn, these may be swiftly countered today. It is plausible that the bulls have strategically retreated to mount a significant offensive today. Current expectations for "hawkish" statements from Jerome Powell are low, which the dollar desperately needs. A GDP report surpassing 3% for the second quarter will offer only marginal aid to bearish traders. Additionally, forecasts suggest a 2.6% decrease in durable goods orders from the previous month. Consequently, the dollar's prospects today hinge on an unforeseen development or the bulls' potential exhaustion from their prolonged buying activities.

On the 4-hour chart, the pair revisited the 76.4% corrective level at 1.3314. A rebound from this point could signal a pivot in favor of the pound and a potential resurgence towards the 1.3642 level. "Bullish" divergences observed in the RSI and CCI indicators further support the likelihood of a rebound from 1.3314. However, a stable move below this level could herald the start of a new bearish trend.

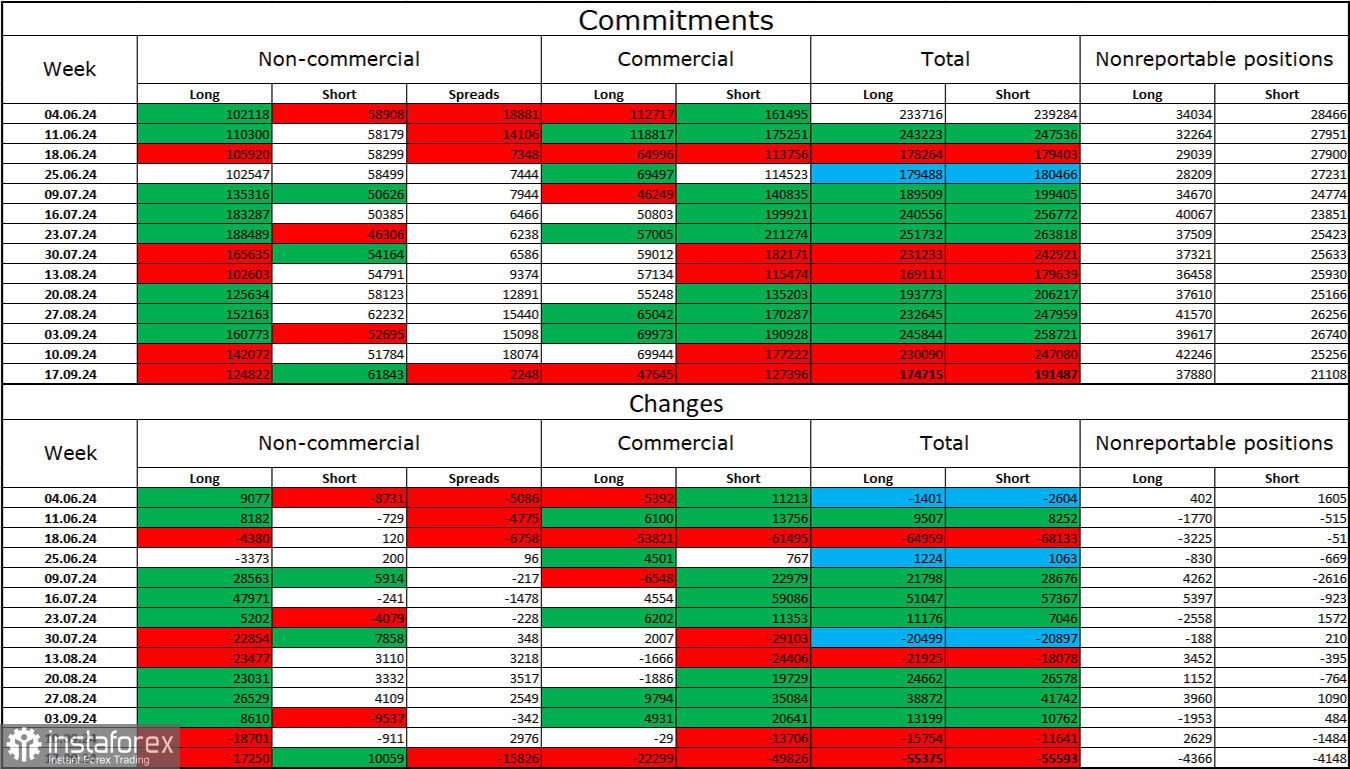

Commitments of Traders (COT) Report:

In the latest report, the "Non-commercial" traders' sentiment has shifted notably less bullish. Long positions decreased by 17,250, whereas shorts increased by 10,059. This marks the second consecutive week that professional traders have reduced their long positions while augmenting their shorts. Despite these shifts, the pound has remained relatively stable, indicating that a decline remains likely. Nevertheless, bulls maintain a substantial lead, with long positions outnumbering shorts by 63,000: 125,000 to 62,000.

From my perspective, while the pound still has potential for a decline, the current COT reports indicate otherwise. Over the past three months, long positions have risen from 102,000 to 125,000, and short positions have increased from 58,000 to 62,000. I anticipate that professional players will gradually reduce their long positions or increase their shorts, as all potential bullish factors for the pound have already been factored in. However, technical analysis still points to a bullish trend.

Economic News Calendar for the US and the UK:

- US – Change in Durable Goods Orders (12:30 UTC)

- US – Change in GDP for the Second Quarter (12:30 UTC)

- US – Initial Jobless Claims (12:30 UTC)

- US – Speech by Federal Reserve Chair Jerome Powell (13:20 UTC)

Thursday's economic calendar includes at least three significant entries. The day's information context is expected to strongly influence market sentiment.

GBP/USD Forecast and Trading Tips:

Trading on the hourly chart initially allowed selling at the rebound from the 1.3425 level, targeting 1.3357 and 1.3259. These positions can remain open. New buying opportunities may arise if the pair closes above the 1.3357 level on the hourly chart, targeting 1.3425 and 1.3485, or in response to a rebound from the 1.3259 level.

Fibonacci levels are established based on 1.2892–1.2298 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română