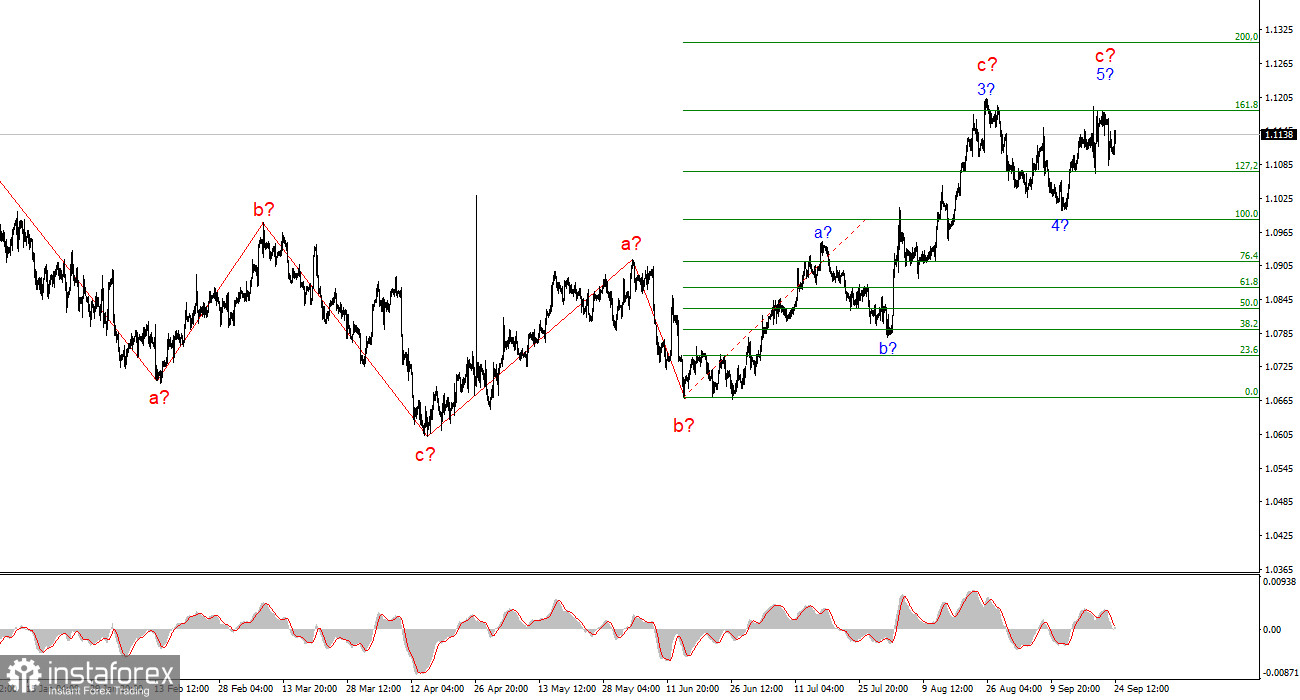

The wave structure for the EUR/USD pair on the 4-hour chart is becoming increasingly complex. Since January 2024, only two three-wave patterns (a-b-c) with a turning point on April 16 can be identified. Once the current wave c completes, a new three-wave structure downward might begin, but the current wave c could also extend into a five-wave pattern. If this assumption is correct, a successful break above the 161.8% Fibonacci level will indicate the formation of another upward wave, thus forming a five-wave structure for wave c.

The entire trend from April 16 could also take on a five-wave form. As we can see, there is still room for the euro to rise if market demand continues to increase.

It's worth noting that any wave structure can become more extended and complicated multiple times. This is the downside of wave analysis. However, as with any other form of analysis, no one can guarantee the accuracy of a forecast. There are only expectations and points where reversals or wave completions/initiations are most likely. Based on the current news environment, I don't anticipate a prolonged rise in the pair. However, all indications suggest that wave c may take on a five-wave form.

The EUR/USD pair rose by 25 points on Tuesday. The amplitude of price changes today was minimal due to the lack of significant news. Only a few reports were released in Germany this morning, which had little impact. The Business Expectations Index was 86.3 points, the Current Assessment Index was 84.4 points, and the Business Climate Index was 85.4 points. Two out of three reports came in below market expectations, so a decrease in demand for the euro would have been logical in the first half of the day. However, no such decrease occurred, as the market remains very reluctant to sell the pair.

Given the above, I wouldn't consider the current stagnation as the beginning of a new downward trend or even a corrective wave set. It seems likely that the market will remain in place for a week or two before resuming an upward trend. The next rise might be short-lived since the euro has been appreciating for quite some time. However, at the beginning of next month (next Friday), the U.S. will release the Nonfarm Payrolls and unemployment rate reports. In 2024, these reports have typically supported further dollar declines. Therefore, it's possible that the market is simply waiting for these reports to resume selling the U.S. dollar.

General Conclusions

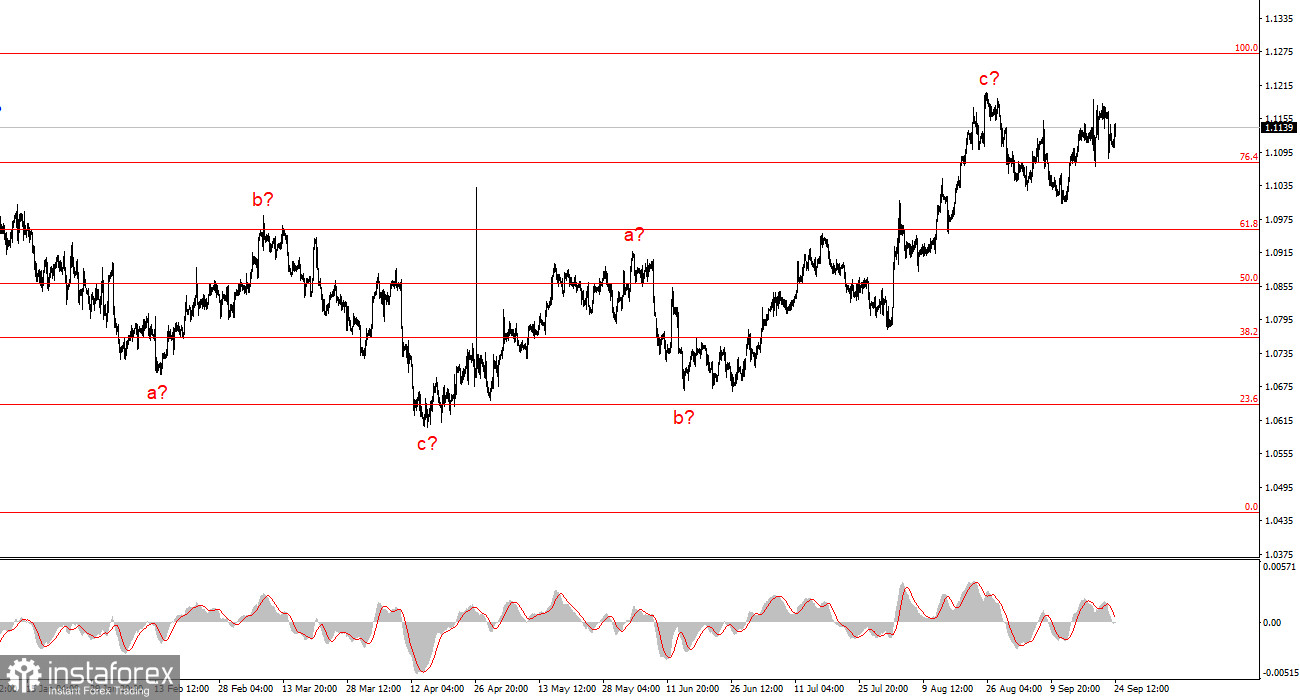

Based on the EUR/USD analysis, I conclude that the pair continues to build a series of corrective structures. The price increase may continue within a five-wave corrective structure with targets around the 1.1300 level. The proposed wave d may already be complete (having taken on a three-wave form), so I can't be certain of a decline resuming right now. At the same time, I'm not confident in further price increases either—the attempt to break through the 1.1181 mark, corresponding to the 161.8% Fibonacci level, was unsuccessful.

On a higher wave scale, the wave structure is also evolving into a more complex form. It's likely that an upward wave sequence is ahead, but its length and structure are currently difficult to predict.

Key Principles of My Analysis:

- Wave structures should be straightforward and easily understandable. Complex structures are challenging to analyze and frequently undergo changes.

- If you're uncertain about the market, it's better to stay out.

- There is never absolute certainty in the direction of movement. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română