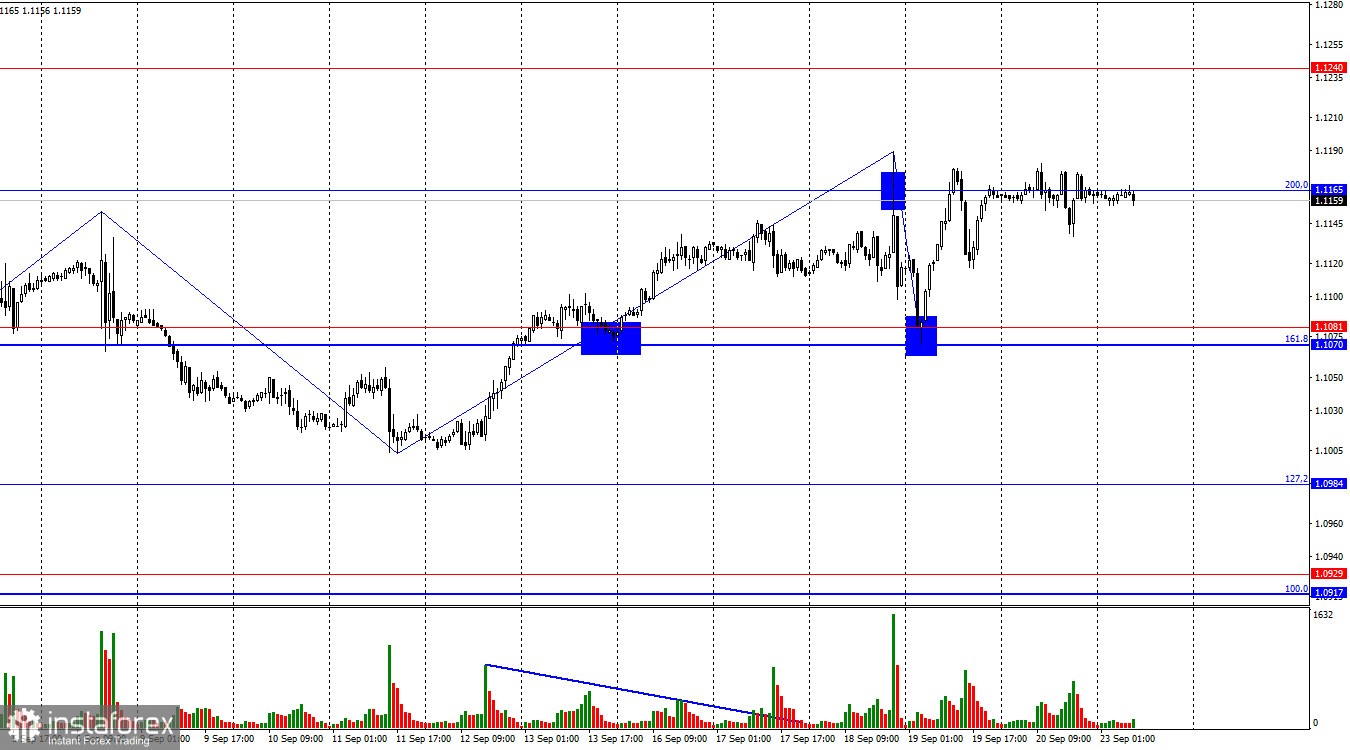

On Friday, the EUR/USD pair traded horizontally along the 200.0% Fibonacci level at 1.1165. Monday began with a slight drop in the price, which could continue toward the support zone of 1.1070–1.1081. I don't think the bullish momentum is over, but it is becoming increasingly challenging for the bulls to push forward. This week, I expect a correction since the news background will be weak for another bullish attack.

The wave structure has become somewhat more complicated but doesn't raise major concerns. The last completed downward wave (September 18-19) didn't break below the low of the previous wave, while the last completed upward wave (September 11-18) broke above the peak of the previous wave. Therefore, the ongoing bearish trend has been invalidated, and the pair is either transitioning into a complex sideways movement or beginning a new bullish trend. A break below the 1.1070–1.1081 support zone would negate the emerging bullish trend.

The news background was quite weak on Friday—in fact, it was nonexistent. Thus, the pair's sideways movement was predictable. At present, the market remains focused on the ECB and FOMC decisions announced over the past two weeks. However, the situation is gradually improving for the dollar. Last week, we saw a sharp rise in the euro, which quickly faded. The bears have a real chance to take the initiative, as they have been in the shadows for a long time. The Federal Reserve has started easing monetary policy, something traders have anticipated for a long time. At this point, it's fair to say that the initial easing has already been priced in by the market, and new solid reasons will be needed for the dollar to decline further. These reasons might emerge next week, but there will be few significant reasons this week. Thus, I believe the next few days present a good opportunity for a correction.

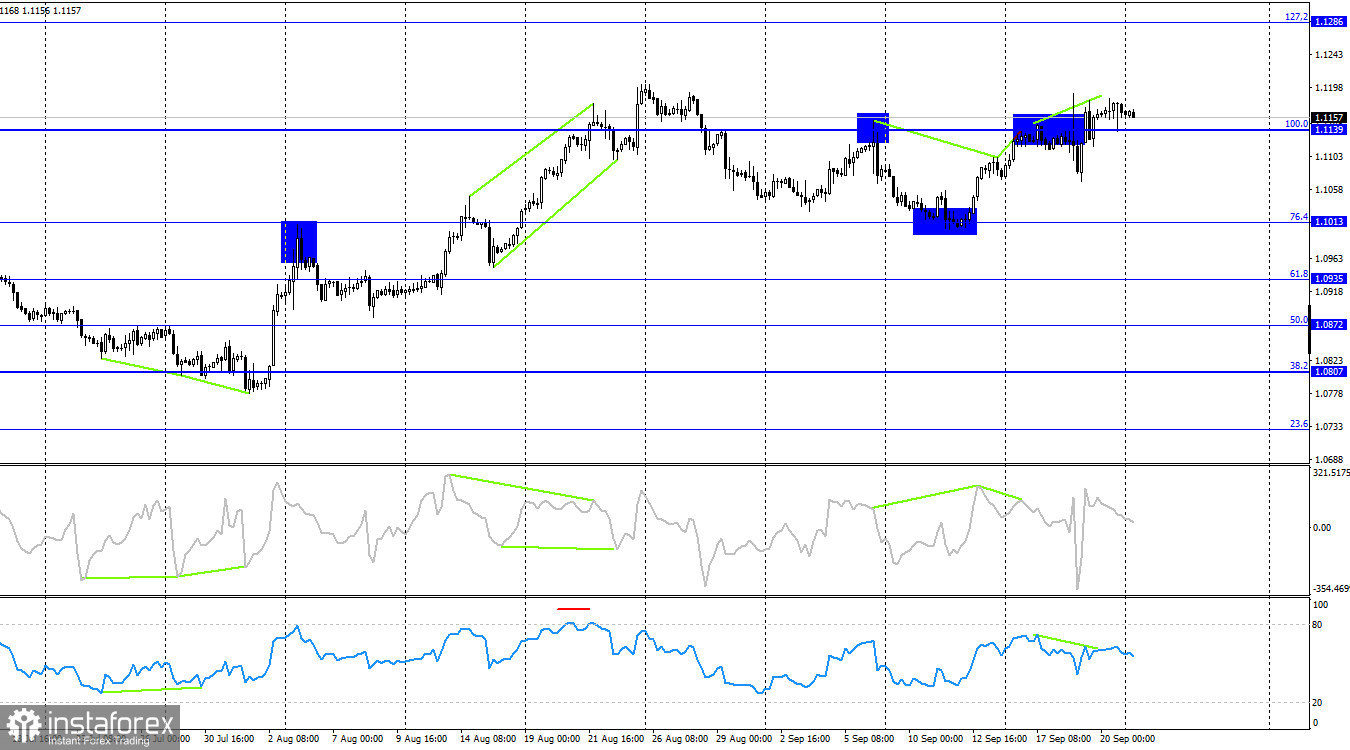

On the 4-hour chart, the pair rebounded from the 76.4% Fibonacci level at 1.1013 and rose to the 100.0% Fibonacci level at 1.1139. Two "bearish" divergences have appeared on the CCI indicator, and another has formed on the RSI, which moved into the overbought zone several weeks ago. Although a decline may begin, given the strength of the bulls, it's hard to expect a significant drop just yet. In any case, the pair needs to break below 1.1139 to anticipate a move toward 1.1013.

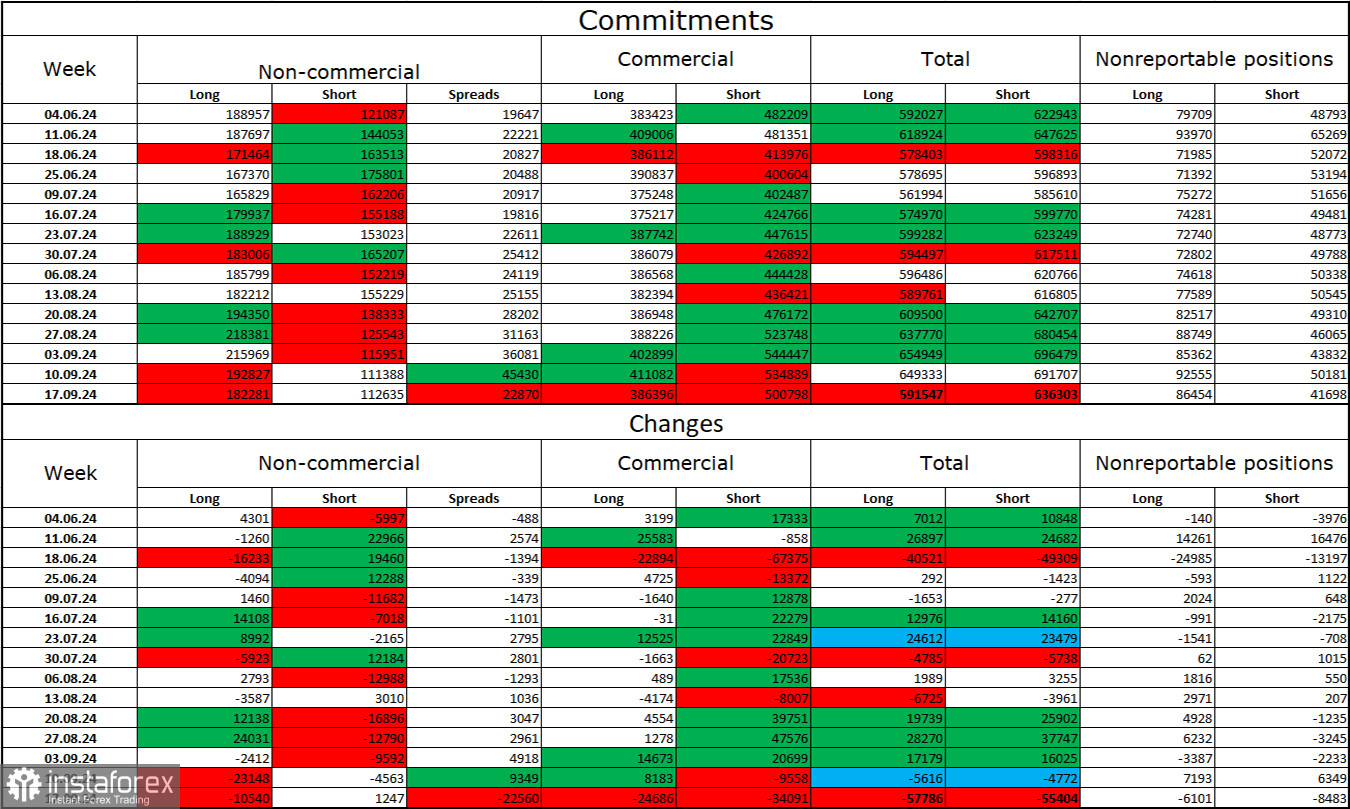

Commitments of Traders (COT) Report:

During the latest reporting week, speculators closed 10,540 long positions and opened 1,247 short positions. The sentiment among the "Non-commercial" group turned bearish several months ago, but now, the bulls have regained active dominance. The total number of long positions held by speculators now stands at 182,000, while short positions amount to only 112,000.

However, for the second consecutive week, large players have been reducing their holdings of the euro, which, in my opinion, could be a precursor to a new bearish trend or at least a correction. The key factor behind the dollar's decline—the anticipation of the FOMC's monetary policy easing—has already been priced in, and the dollar no longer has reasons to fall. While new factors could emerge over time, for now, a rise in the U.S. currency seems more likely. Significant selling of the euro hasn't started yet, but if it does, the chances of a bearish trend will increase.

News Calendar for the U.S. and the Eurozone:

- Eurozone – Germany Services PMI (07:30 UTC)

- Eurozone – Germany Manufacturing PMI (07:30 UTC)

- Eurozone – Services PMI (08:00 UTC)

- Eurozone – Manufacturing PMI (08:00 UTC)

- U.S. – Services PMI (13:45 UTC)

- U.S. – Manufacturing PMI (13:45 UTC)

The economic calendar for September 23 includes six entries, but none of them are particularly significant. The impact of the news background on trader sentiment throughout the day might be moderate or weak.

EUR/USD Forecast and Trading Advice:

- Selling: New sales of the pair are possible if it closes below 1.1139 on the 4-hour chart, targeting 1.1081 and 1.0984.

- Buying: Buying opportunities can be considered on a rebound from the 1.1070–1.1081 support zone on the hourly chart, aiming for 1.1139, but caution is advised with any buying actions at this time.

The Fibonacci levels are plotted between 1.0917–1.0668 on the hourly chart and 1.1139–1.0603 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română