Details from the Economic Calendar on September 20

On Friday, the data on retail sales in the UK were published, showing a 1% increase in August. The actual figure significantly exceeded the forecasts of analytical agencies.

Analysis of Trading Charts from September 20

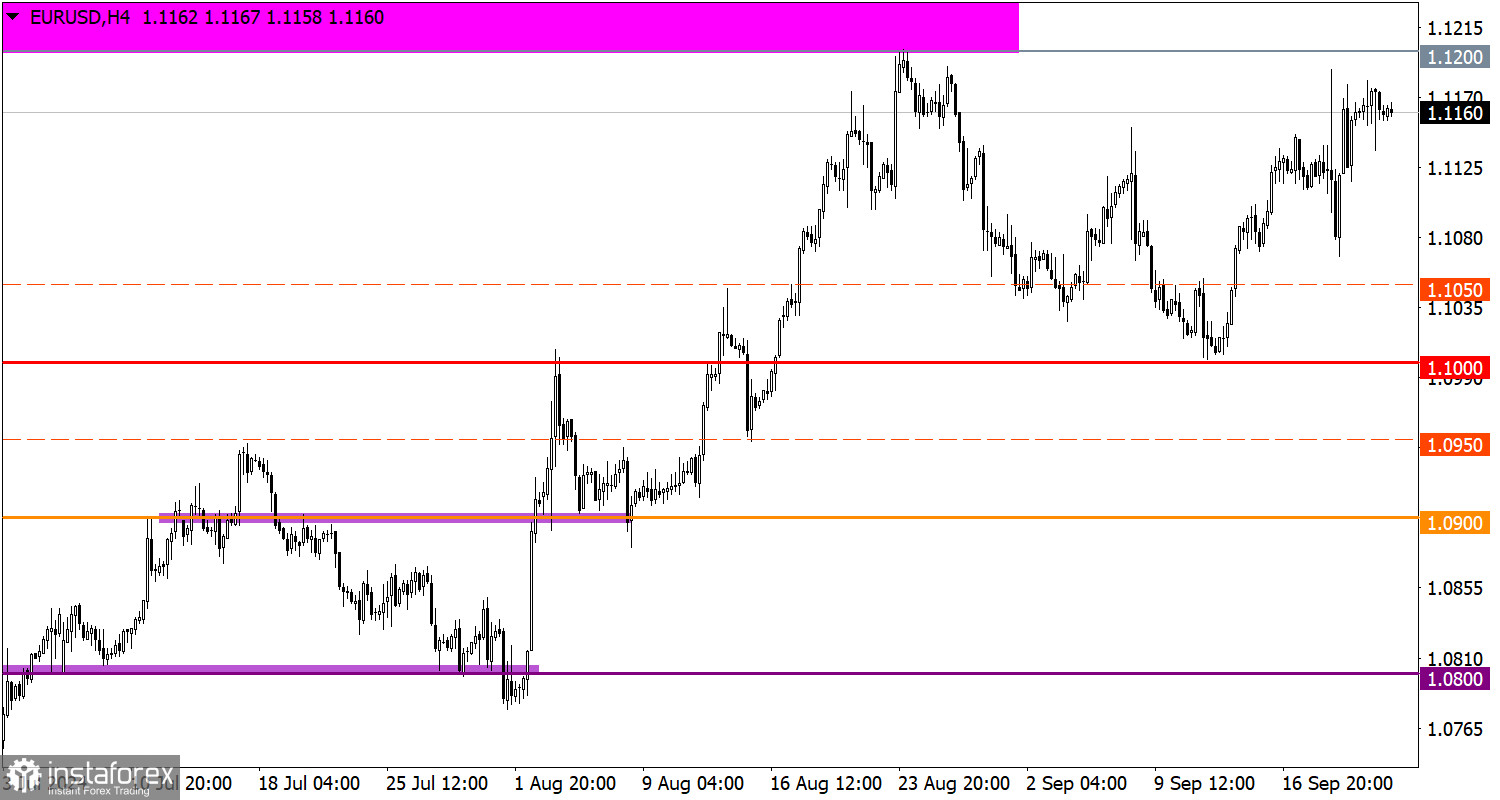

- EUR/USD Currency Pair

The movement around the local high of the mid-term trend indicates a prevailing bullish sentiment among market participants.

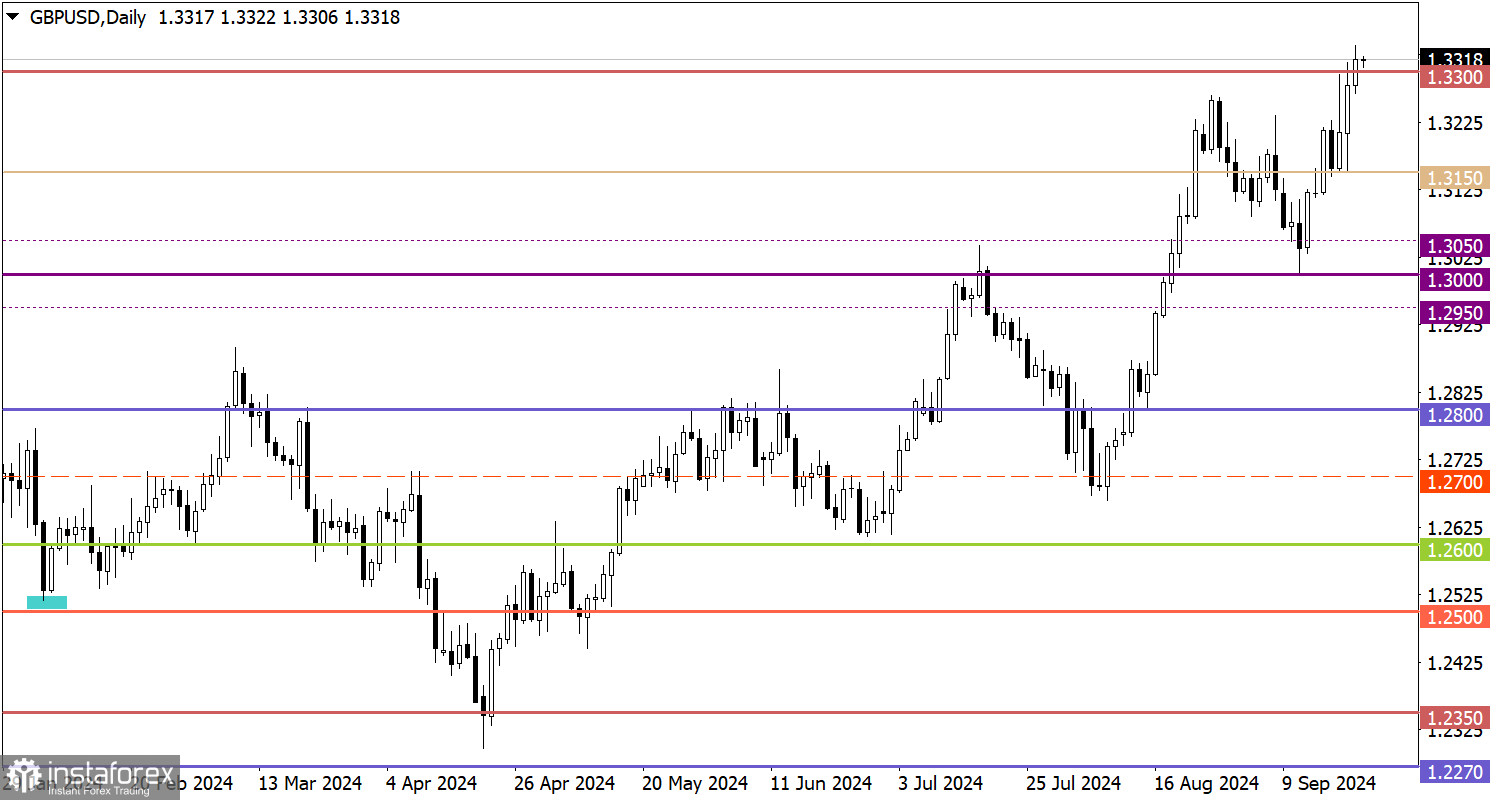

- GBP/USD Currency Pair

The close of the past trading week above the 1.3300 level indicates a prevailing bullish sentiment among market participants, which has already led to an update of the mid-term high.

Economic Calendar for September 23

The preliminary estimates of business activity indices are expected to be released today. In the Eurozone and the UK, no significant changes are anticipated for the main indicators, while in the United States, a noticeable decline is projected. Specifically, the composite business activity index in the US is expected to decrease from 54.6 points to 53.0 points.

Trading Plan – EUR/USD

Considering the potential for further selling of dollar positions in financial markets, the euro's upward momentum could lead the price to reach at least the resistance level of 1.1200/1.1280. For more significant price changes, it will be necessary to stabilize above these levels, which would indicate an update of the mid-term high. Until then, the resistance area will continue to exert pressure on buyers.

Trading Plan – GBP/USD

The price has stabilized above the 1.3300 level, which indicates the potential for further growth of the British pound. A gradual movement toward the 1.3600 level is possible if the upward cycle remains uninterrupted. However, if the price drops below 1.3300, a temporary stagnation or pullback may occur.

What Is Reflected on the Trading Charts?

- Candlestick Chart: This consists of rectangular white and black bars with lines at the top and bottom. By analyzing each candle in detail, you can observe its characteristics relative to a specific time period: opening price, closing price, highest price, and lowest price.

- Horizontal Levels: These represent price coordinates where the market might experience a pause or reversal. In trading, these levels are commonly referred to as support and resistance.

- Circles and Rectangles: These highlight examples where the price reversed in the past. The color highlights indicate horizontal lines that may exert pressure on the price in the future.

- Up/Down Arrows: These serve as indicators of potential future price direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română