Although the European trading session saw the market fluctuate back and forth, the situation remained unchanged overall. The high range of fluctuations was mainly due to the significant weakening of the U.S. dollar the day before. Nevertheless, it's too early to speak about the end of the dollar's decline. This trend may continue today due to the preliminary estimates of business activity indices. These indices are expected to remain unchanged in Europe, whereas a noticeable decline is anticipated in the United States. In particular, the U.S. Composite PMI will likely decrease from 54.6 points to 53.0 points.

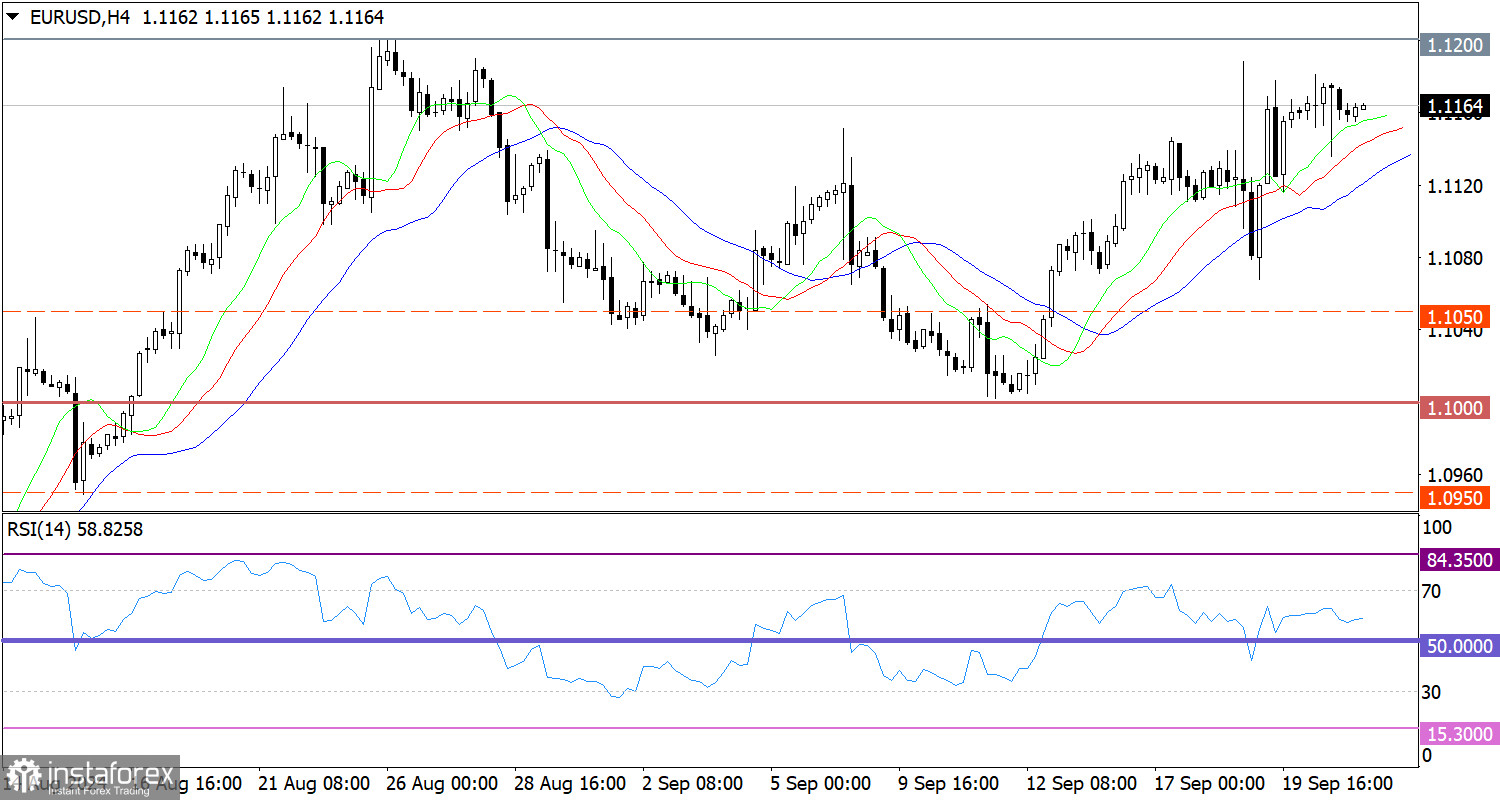

The EUR/USD pair is moving around the local high of the medium-term trend, indicating a prevailing bullish sentiment among market participants.

In the four-hour chart, the RSI technical indicator moves in the buyers' zone of 50/70, signaling an upward trend.

Regarding the Alligator indicator in the same time frame, the moving average lines point upward, aligning with the direction of price movement.

Expectations and Prospects

If we proceed from the prospect of further U.S. dollar sell-offs in the financial markets, the euro's upward potential could at least reach the resistance area of 1.1200/1.1280. For more significant price changes, it's necessary to stabilize quotes above these levels, indicating an update of the medium-term high. Until then, the resistance area may continue to exert pressure on buyers.

The complex indicator analysis indicates an upward cycle in the short-term, intraday, and medium-term periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română