The U.S. dollar remains under significant pressure following the Federal Reserve's decision to lower interest rates by a half point, but this is not the only problem on the Forex market.

As anticipated, the Fed's unprecedented 0.50% rate cut has triggered high volatility in the markets. The continuing flow of economic data doesn't unanimously support aggressive monetary easing in the coming months.

For instance, data released on Thursday showed a sharp increase in the Philadelphia Fed Manufacturing Index, which jumped to 1.7 points in September, compared to a drop of 7 points in August and a forecasted decline of 0.8 points. In addition, while still in negative territory, the leading indicators for the U.S. economy improved to -0.2% in August from -0.6% in the previous period. Existing home sales fell to 3.86 million against the forecast of 3.92 million. However, the last figure was revised upward to 3.96 million. These figures remain within an acceptable range over the past five years, albeit at the lower end.

In fact, the incoming economic data shows no consistent directional trend, highlighting the fragile state of the economy, which could crack at any moment.

But let's return to the dollar's exchange rate. On the one hand, it's understandable why the U.S. currency didn't collapse under the pressure of a half-percentage point rate cut — previous active sell-offs by investors, conducted in anticipation of the Fed's meeting, have prevented this from happening. In addition, the unclear stance of Fed Chairman Jerome Powell regarding further rate cuts has played a role.

So why does the dollar remain under pressure and potentially continue its decline?

At this point, the blame may lie with other central banks whose currencies are traded against the dollar on the Forex market. Given the relationship and weight of the dollar and the currencies traded against it, it can be said that the Fed's half-percentage point rate cut can only be offset by a significantly greater rate cut by other central banks, such as the European Central Bank or the Bank of Canada. However, they don't seem to hurry to catch up with the U.S. central bank and lower rates more aggressively. Some, like the Bank of Japan and the Bank of England, may pause for a significantly longer period, which could contribute to their currencies strengthening against the dollar. In other words, by cutting rates by 0.50%, the Fed has considerably weakened the dollar, putting it ahead in the race to lower rates.

This means the dollar has a greater chance of falling against the major currencies on the Forex market rather than rising in the near future. In addition, the strong pressure from the fall in Treasury yields, which intensified after the Fed's meeting, is weighing heavily on the dollar.

What can we expect today in the markets?

I believe that the dollar's gradual weakening will continue in the markets, along with the rise in gold and crude oil prices.

Daily Forecast:

EUR/JPY

The pair makes a new attempt to continue rising, testing the resistance level of 1.1150. The pair is breaking through the 160.00 resistance level on the back of the yen weakening against the dollar and the euro strengthening against the U.S. currency. Consolidation above this level could lead the pair to a rise toward 162.70.

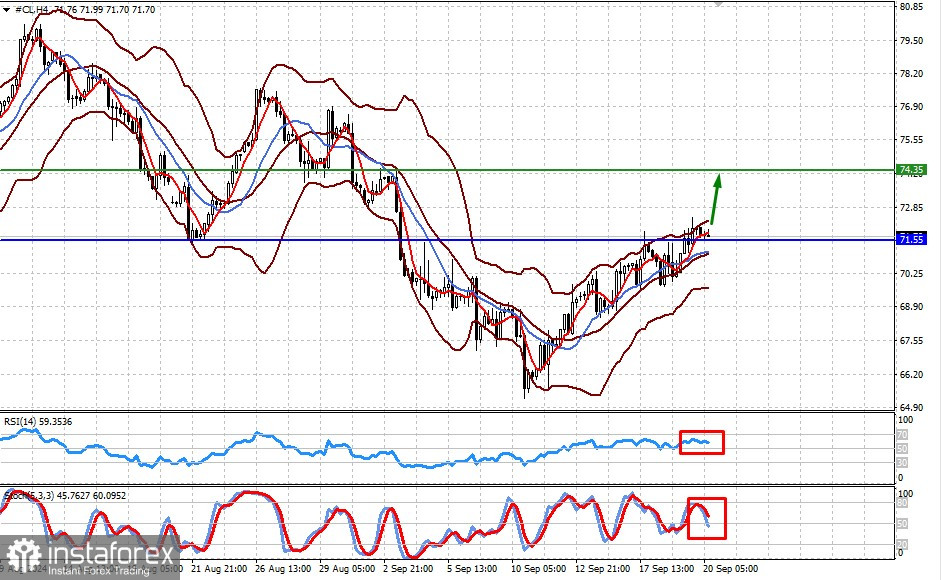

WTI Crude Oil

The price of U.S. crude oil is trading above 71.55. If it manages to consolidate above this mark, the price could rise to 74.35 amidst another escalation of the crisis in the Middle East.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română