Analysis of Wednesday's Trades:

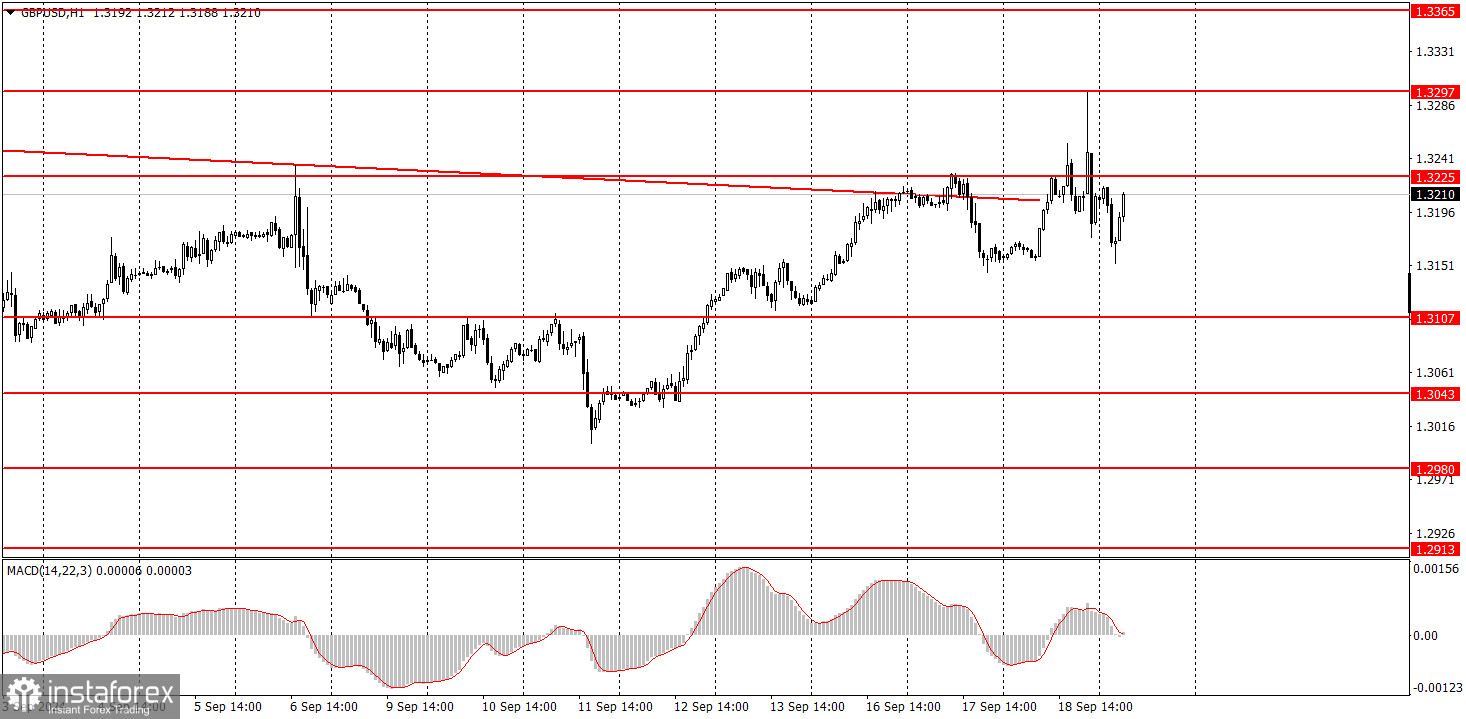

GBP/USD on 1H Chart

The GBP/USD pair also traded with increased volatility on Wednesday without a clear direction. Naturally, most of the volatility occurred in the evening. The Federal Reserve decided to lower the key rate by 0.5%, the most dovish option among all possible outcomes. However, there is a significant positive for the dollar in that it did not fall further. In the first hours after the Fed's decision, the dollar dropped, but then it quickly rose, indicating that the market had already priced in any dovish scenario. The pair needs to stay below the 1.3225 level to see a more substantial downward correction than we've observed in the past few weeks. The psychological factor of the Fed's first easing is off the table, allowing for calmer trading and not just in one direction.

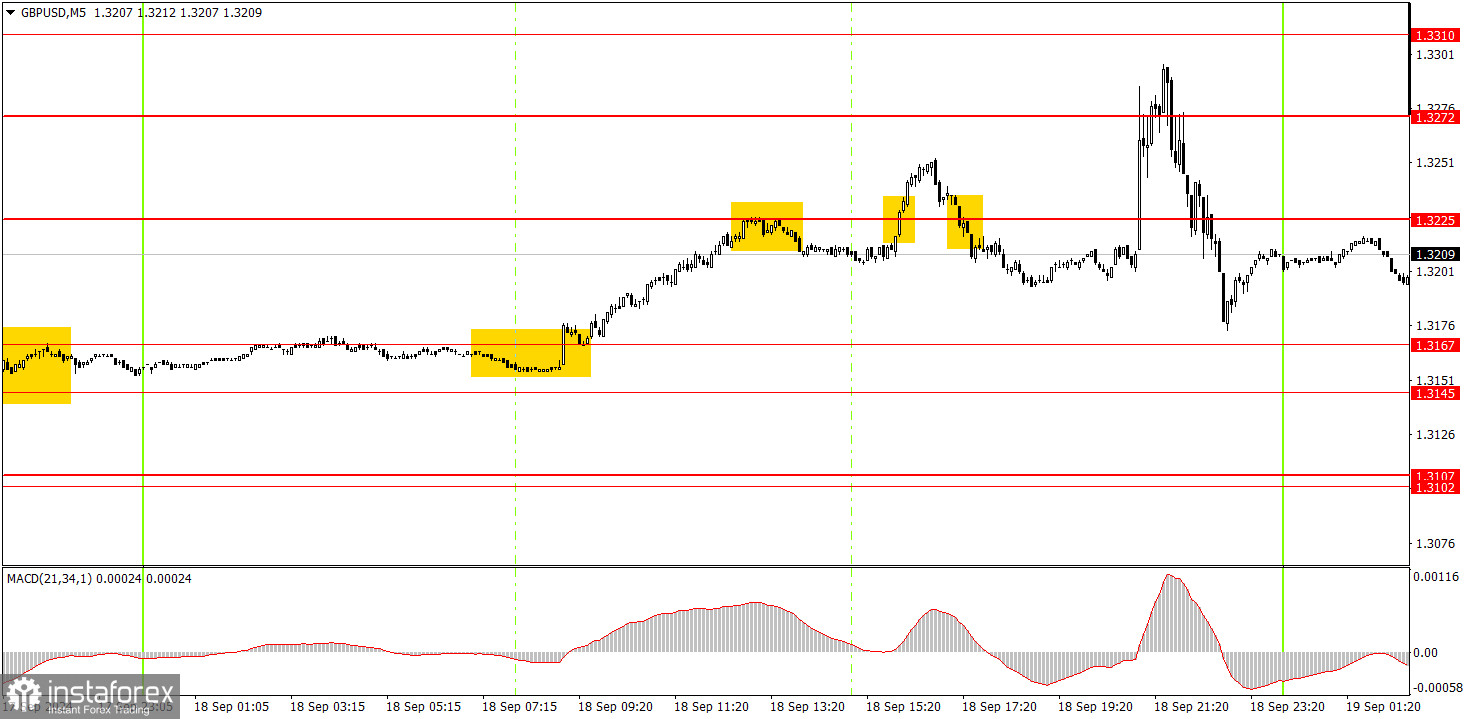

GBP/USD on 5M Chart

On the 5-minute timeframe on Wednesday, a good buy signal was formed in the morning around the 1.3167 level. The UK inflation report showed an acceleration, which triggered the rise in the British currency. The price climbed to the 1.3225 level and bounced off it, and this is where the long position could be closed. After that, it was risky to open new trades as the Fed meeting was approaching. We don't consider the "fluctuations" during and after the meeting. Today, the Bank of England will likely leave the rate unchanged, but the market has already priced this decision as of yesterday morning. Therefore, there should be no further rise in the pair.

How to Trade on Thursday:

In the hourly time frame, the GBP/USD pair has a good chance of resuming a global downtrend or at least showing a significant correction, but we haven't seen either. The British pound remains overbought, the dollar is undervalued, and the market is still much more inclined to sell the dollar than to buy it. So far, the pound has only slightly corrected downward. It's too early to talk about a full-fledged downtrend. If the price breaks through the 1.3225 level, it will further reduce the dollar's chances of growth in the near future.

On Thursday, the pair may attempt to resume its decline, as it has already failed three times to break through the 1.3225 level. The results of the BoE meeting could be more hawkish, which might lead to further pound growth.

In the 5-minute time frame, you can currently trade around the levels of 1.2748, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3225, 1.3272, 1.3310, and 1.3365. On Thursday, the BoE's decision on the interest rate will be announced, along with the results of the Monetary Policy Committee's vote on the rate. We believe the second event will be much more important than the first.

Basic Rules of the Trading System:

1) The strength of a signal is determined by the time it takes for the signal to form (bounce or level breakthrough). The less time it took, the stronger the signal.

2) If two or more trades were opened around any level due to false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can form multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and midway through the U.S. session. After this period, all trades must be closed manually.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst good volatility and a trend confirmed by a trendline or trend channel.

6) If two levels are too close to each other (5 to 20 pips), they should be considered a support or resistance area.

7) After moving 20 pips in the intended direction, the Stop Loss should be set to break even.

What's on the Charts:

Support and Resistance price levels: targets for opening long or short positions. You can place Take Profit levels around them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD indicator (14,22,3): encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the movement of a currency pair. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to avoid sharp price reversals against the prevailing movement.

For beginners, it's important to remember that not every trade will yield profit. Developing a clear strategy and effective money management is key to success in trading over the long term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română