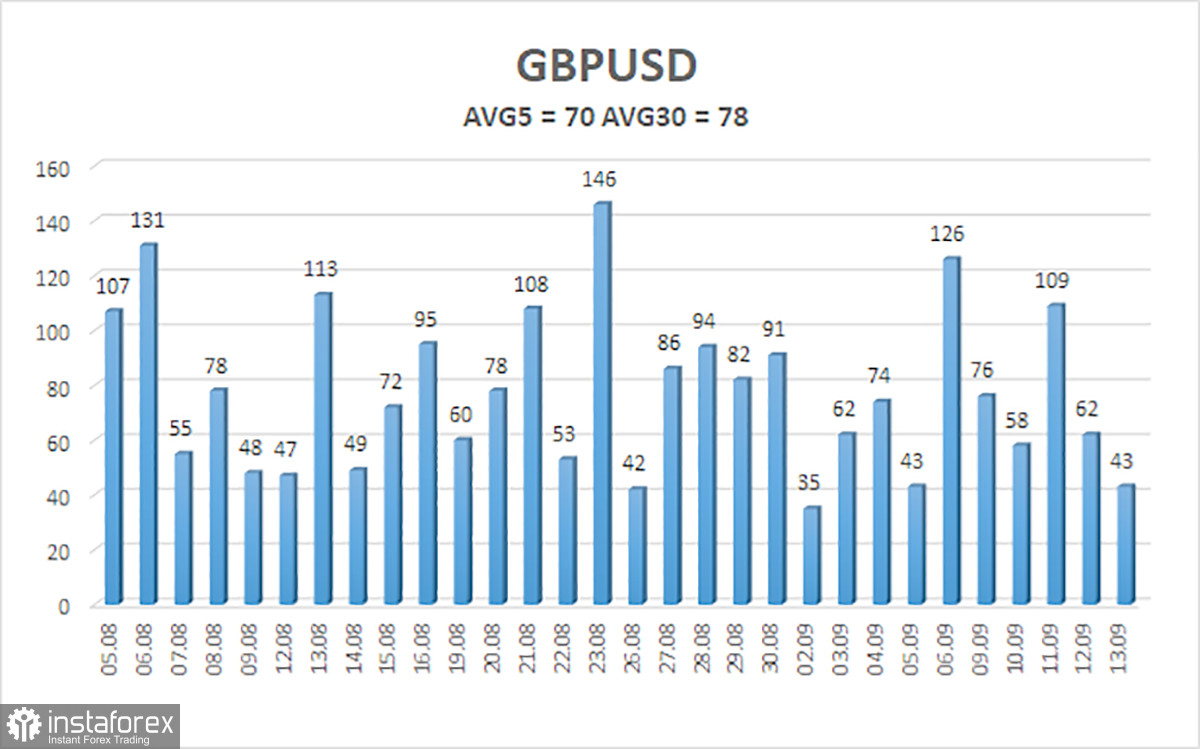

The GBP/USD pair also pretended to trade more than it did on Friday. The day's volatility amounted to 43 pips, which for the pound is even lower than 30 pips for the euro. Although low volatility is a more significant issue for the euro, we still remind you that a value of 100-110 pips a day is considered a normal range. We rarely see such values in 2024.

The technical outlook for the British currency looks almost identical to that of the euro. After struggling for several weeks, the pound corrected by 200 pips after quickly rising by 600. Last week, the market decided that the European Central Bank meeting was an excellent reason to start buying the British pound again. Market participants seemed to believe that the easing of monetary policy in the Eurozone was a good reason to repurchase the pound sterling. As a result, the British currency began to rise even before the potentially hawkish meeting of the Bank of England.

The BoE will hold its meeting this week, and the rates will likely remain unchanged. As a result, this outcome could be considered hawkish. More accurately, the market can interpret such an outcome as hawkish. However, we don't see anything particularly hawkish in keeping rates unchanged. It's important to remember that the BoE has already started an easing cycle, unlike the Federal Reserve. Nonetheless, this factor seems irrelevant. The market has been enthusiastically pricing in future Fed rate cuts since at least the beginning of 2024. The question is, when the easing finally begins, will the dollar continue to fall?

We believe the market is simply using any excuse to sell the U.S. dollar. Of course, such actions are driven by major players with their decision-making logic, which, as practice shows, is not based on macroeconomic or fundamental events. Therefore, this week, the Fed's decision to lower rates could easily trigger another drop in the dollar. The BoE's decision to leave the key rate unchanged could easily trigger new growth for the pound. The overbought conditions of the pair do not matter. In the 24-hour time frame, the price hasn't even managed to correct down to the Kijun-sen line.

Monday began with a new rise for the British currency. Only a few hours into the new workweek, the pound has already found a reason to rise another 35 pips. At the start of the week, it is clear which direction the market is leaning. As for the fundamental grounds, they can be interpreted and "spun" in any direction, as practice shows. Even the results of last week's ECB meeting were interpreted by some analysts as hawkish because ECB President Christine Lagarde did not promise to lower rates at future meetings. This shows how any news can be twisted against the dollar.

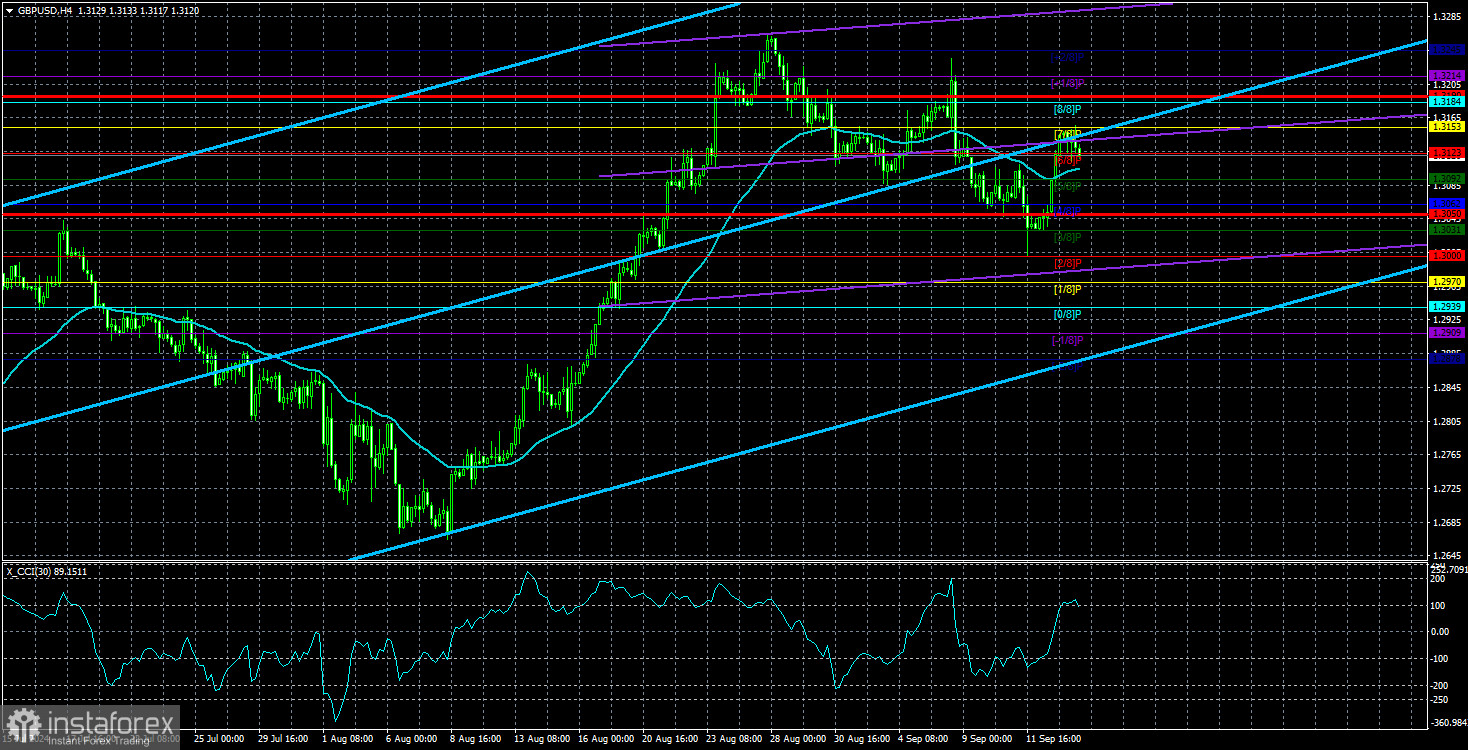

The average volatility of the GBP/USD pair over the past five trading days is 70 pips, which is considered average for this pair. Therefore, on Monday, September 16, we expect movement within a range limited by the levels of 1.3050 and 1.3190. The upper linear regression channel is directed upwards, indicating that the upward trend remains intact. The CCI indicator has formed four bearish divergences, suggesting a significant drop.

Nearest Support Levels:

- S1 – 1.3092

- S2 – 1.3062

- S3 – 1.3031

Nearest Resistance Levels:

- R1 – 1.3123

- R2 – 1.3153

- R3 – 1.3184

Trading Recommendations:

The GBP/USD pair has taken the first step towards a downtrend, and we hope this won't be the only one. We are not considering long positions now, as we believe that the market has repeatedly factored in all the bullish factors for the British currency (which are not much). However, it is hard to deny that the pound could continue to rise. Therefore, long positions are possible with targets at 1.3214 and 1.3245 if you trade based on pure technicals. Short positions can be considered with targets at 1.2939 and 1.2878 if the price consolidates below the moving average. However, the market may still resume pricing in the future easing of the Fed's monetary policy. Caution is advised.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it indicates a strong trend.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below -250) or the overbought area (above +250) indicates an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română