GOLD

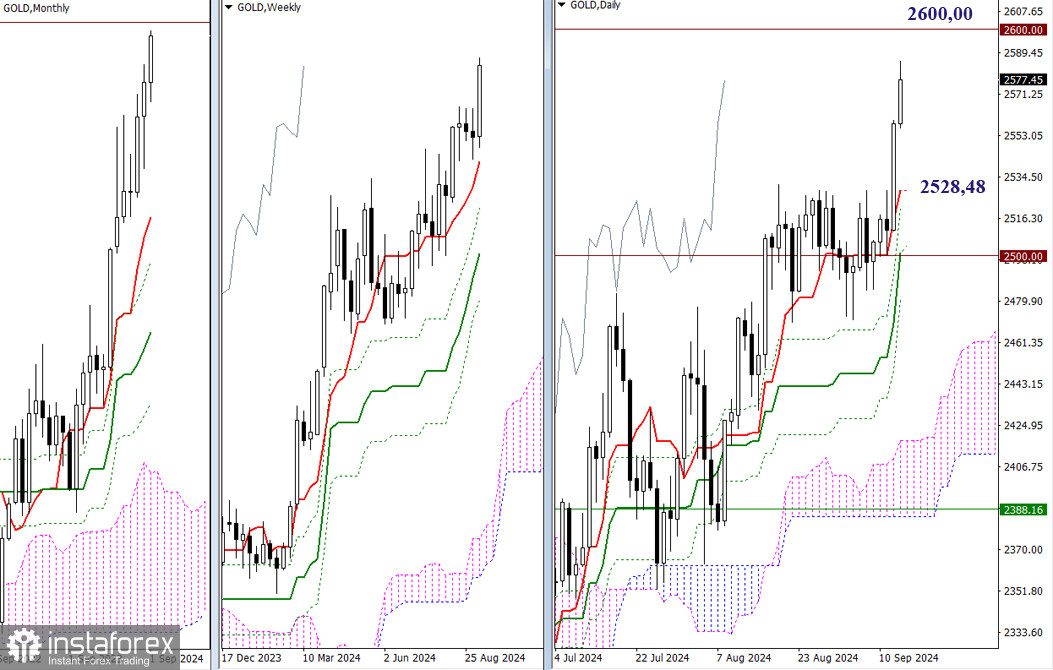

Gold is conquering new heights. Record highs are left behind, and freedom of choice and uncharted territory are ahead. For bullish players, forming a new all-time high is the primary objective. The nearest upward target in this section of the chart can be identified as being at the psychological level of 2600.00. Further resistance for bullish interests may be encountered around the 2650–2700–2750 (psychological levels). A slowdown and shift in sentiment could lead to a decline. In this case, the market would first meet the levels of the daily Ichimoku cross (2528.48–2501.00), strengthened by the psychological boundary of 2500.00. The 2500 area was tested for a long time before the bulls could break through, increasing the likelihood that this level could now be a good enough support.

H4 – H1

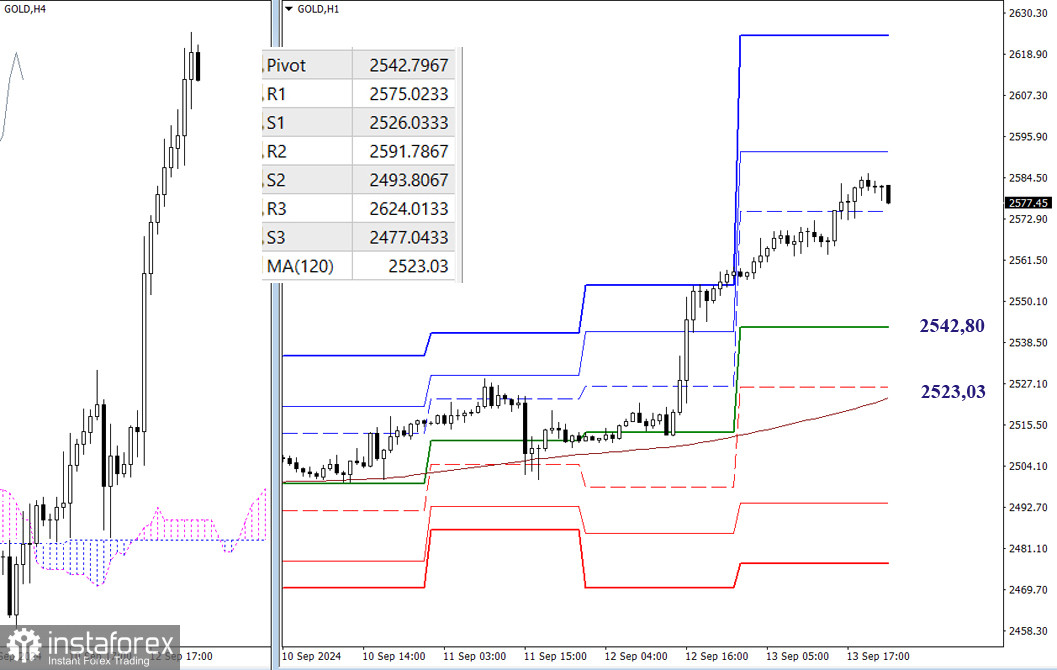

Bullish traders hold the upper hand on lower time frames and have successfully leveraged this, developing a large-scale trend movement. However, as the week closed on Friday, there was a slight downward correction, which may continue with the start of the new week. On the lower time frames, the most important reference point for the corrective decline is the weekly long-term trend (2523.03), which is responsible for the current distribution of forces. Trading above this trend typically corresponds with stronger bullish sentiment. A breakthrough and reversal of the trend often leads to a change in sentiment and priorities. New values for the classic Pivot levels, which will serve as reference points for Monday's trading, will appear at the market's opening.

***

Technical Analysis Includes:

- Higher time frames: Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

- H1: classic pivot points + 120-period Moving Average (weekly long-term trendline)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română