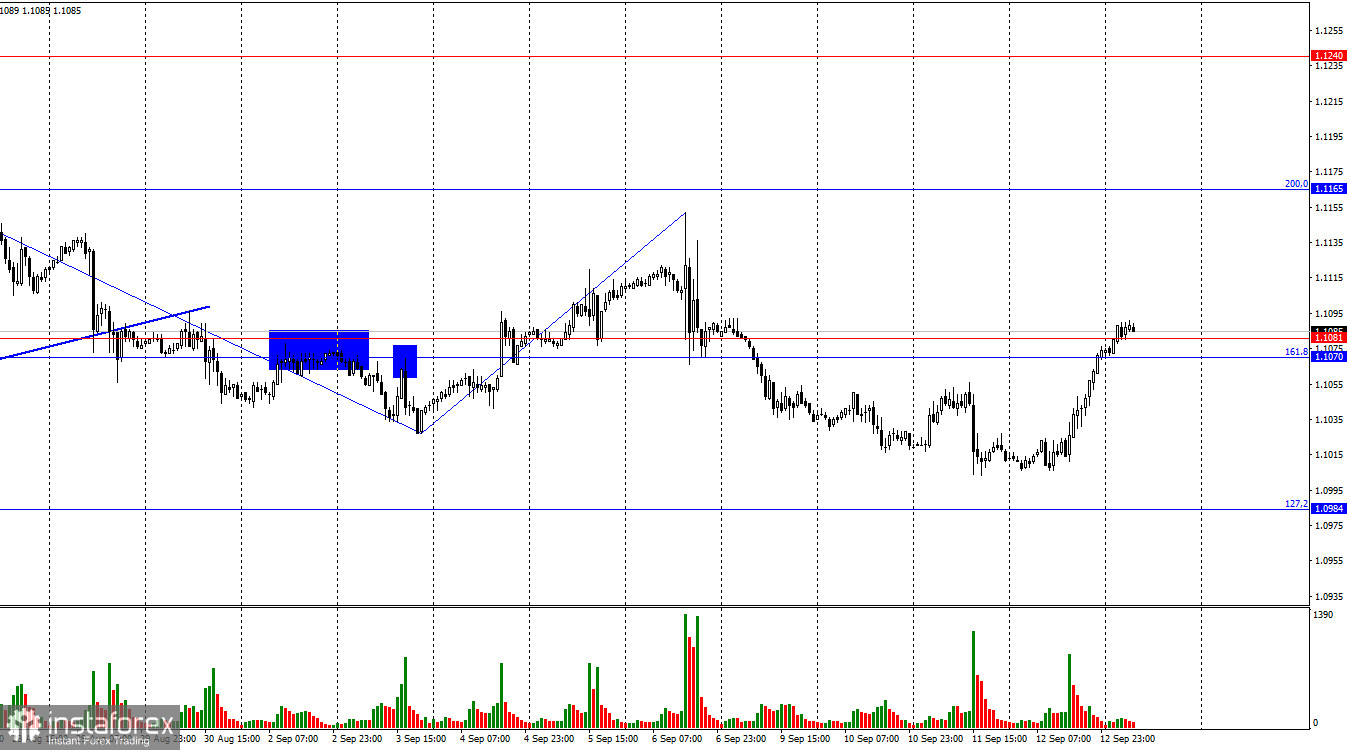

On Thursday, the EUR/USD pair reversed in favor of the euro and rose by 80 points, breaking through the resistance zone of 1.1070–1.1081. According to chart analysis, this growth may continue towards the 200.0% retracement level at 1.1165. However, I don't believe in this scenario, and I'll explain why below. I expect the pair to fall below the 1.1070–1.1081 zone and resume its decline towards the Fibonacci level of 127.2% – 1.0984.

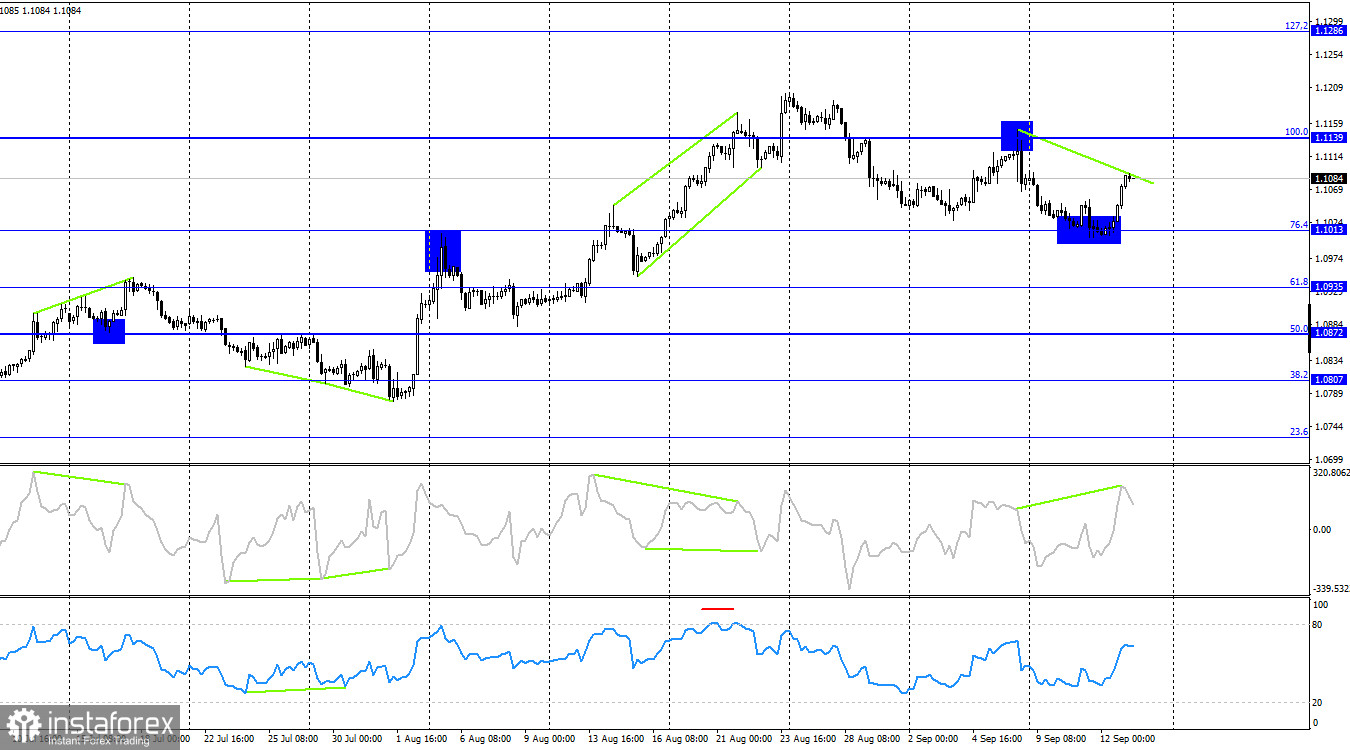

The wave pattern has become a bit more complicated but is still generally clear. The last completed downward wave did not break the low of the previous wave, and the last completed upward wave also failed to break the peak of the wave from August 26. Therefore, the "bullish" trend is canceled at this time. The current downward wave has confidently broken the low from September 3, confirming the formation of a "bearish" trend.

Thursday's news context was clear. The ECB lowered all three interest rates, with some cuts exceeding 0.25%. In my opinion, this alone should have triggered a bearish reaction. At the press conference, Christine Lagarde highlighted the persistent high inflation in the services sector and expressed concerns about a possible acceleration in consumer prices in the second half of 2024. GDP forecasts were also slightly lowered. In my view, Lagarde's speech cannot be interpreted as "dovish." Rates were lowered, inflation is falling, and while there are some issues, since when is a rate cut ignored, while concerns about inflation in services and GDP get priced in? I believe that the market's reaction yesterday was completely unusual. I expect to see the pair reverse today, correcting the gains made yesterday, which were unjustified. To confirm this assumption, we need to see the pair close below the 1.1070–1.1081 zone.

On the 4-hour chart, the pair rebounded from the 76.4% retracement level at 1.1013 and reversed in favor of the euro. Today, the CCI indicator is showing signs of a "bearish" divergence, suggesting a reversal in favor of the dollar and a return to the 1.1013 level. Following the ECB meeting, I am even less confident in the euro's potential for growth than I was before. A break below the 1.1013 level will increase the likelihood of further declines towards the 1.0935 level.

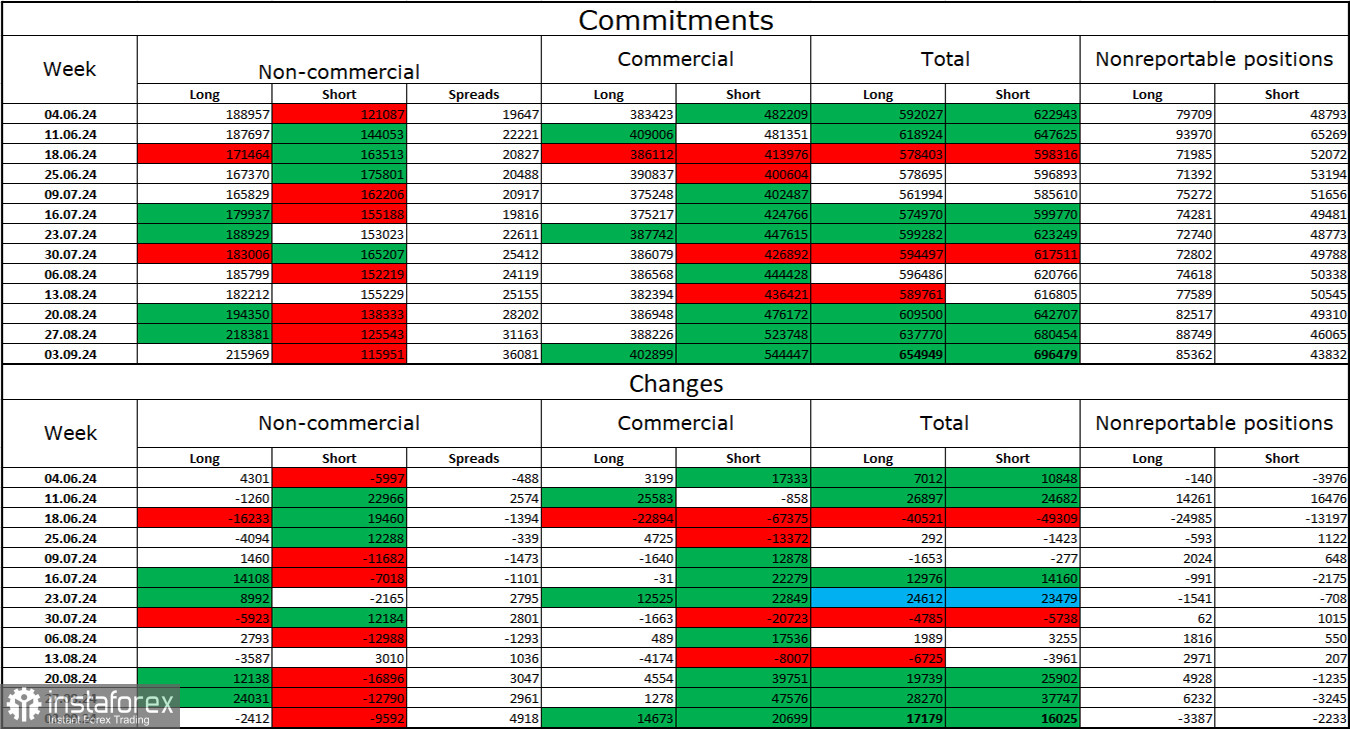

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 2,412 long positions and 9,592 short positions. The sentiment of the "Non-commercial" group shifted to "bearish" several months ago, but bulls still actively dominate. Speculators currently hold a total of 215,000 long positions, while short positions stand at 115,000.

I still believe that the situation will continue to favor the bears. I see no long-term reasons to buy the euro. Additionally, it's worth noting that the market has already fully priced in the likelihood of a rate cut by the FOMC in September, with a probability of 100%. The potential for a decline in the euro seems significant. However, we should not forget about chart analysis, which at the moment does not provide a clear signal for a strong fall in the euro, as well as the news background, which regularly throws obstacles in the dollar's path.

News Calendar for the U.S. and the Eurozone:

- Eurozone – Industrial Production Change (09:00 UTC).

- U.S. – University of Michigan Consumer Sentiment Index (14:00 UTC).

- Eurozone – ECB President Christine Lagarde's Speech.

On September 13, the economic event calendar contains only two relatively unimportant entries and Lagarde's speech. The influence of the news background on trader sentiment today will be weak.

Forecast for EUR/USD and Trading Tips:

New short positions are possible if the pair closes below the 1.1070–1.1081 zone on the hourly chart, with a target of 1.0984. I still wouldn't consider buying the pair, as the reasons behind the euro's rise in response to the ECB's monetary policy easing remain unclear.

Fibonacci levels are drawn from 1.0917–1.0668 on the hourly chart and from 1.1139–1.0603 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română