Analyzing Thursday's Trades:

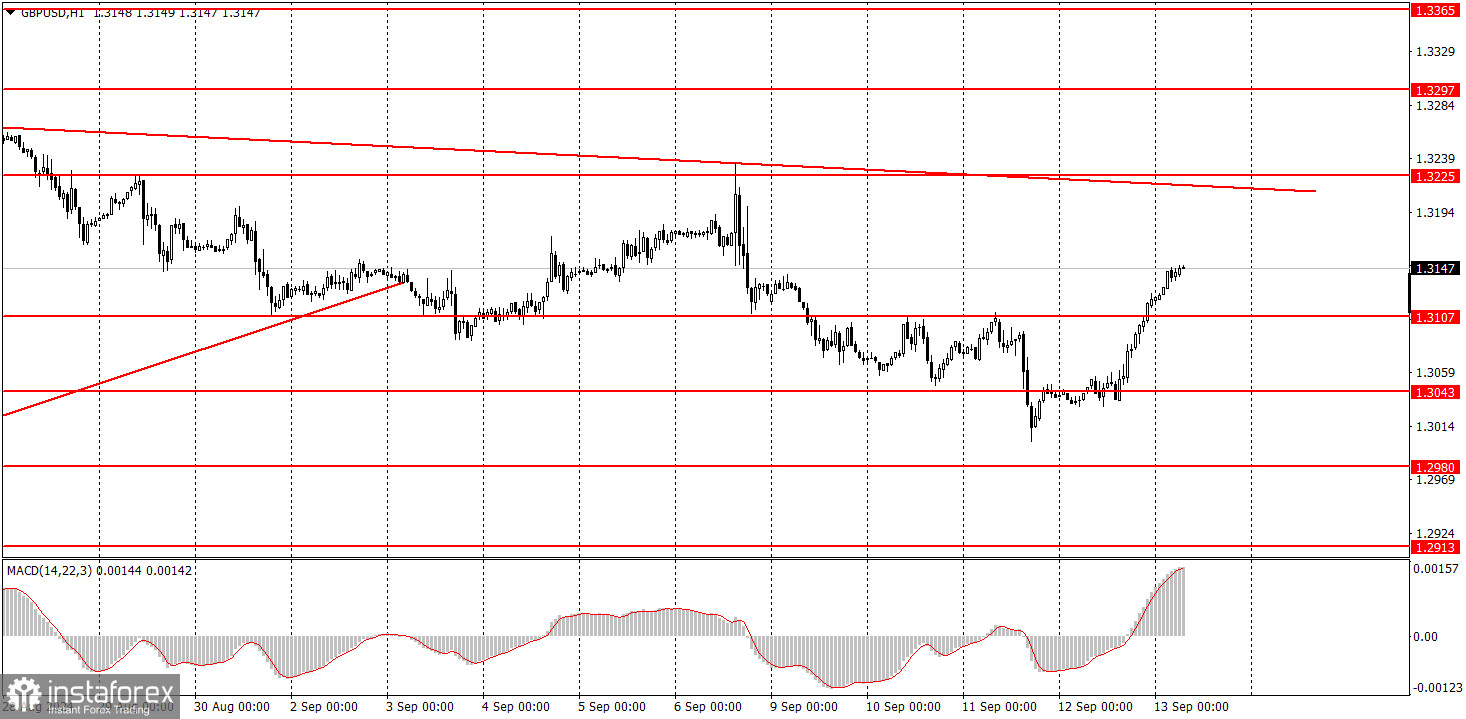

GBP/USD on 1H Chart

The GBP/USD pair also showed a strong upward movement on Thursday despite having no grounds or reasons. While the European Central Bank meeting in the Eurozone could have hypothetically supported the euro, there were no significant news events in the UK. The US published the Producer Price Index, which was 0.1% higher than forecasts in monthly terms. Does anyone honestly believe this index triggered a 100-pip drop in the dollar?

What do we have as a result? Yesterday, the market again demonstrated the "classic of 2024" – the British pound rose for no reason. It's still possible to assume that the downward trend remains and that a decline will resume. But it's already clear that the market is still not eager to buy the US dollar. Everything seems to be heading toward continuing the upward trend that has lasted for two years, and analysts will once again talk about the "rise of risk sentiment."

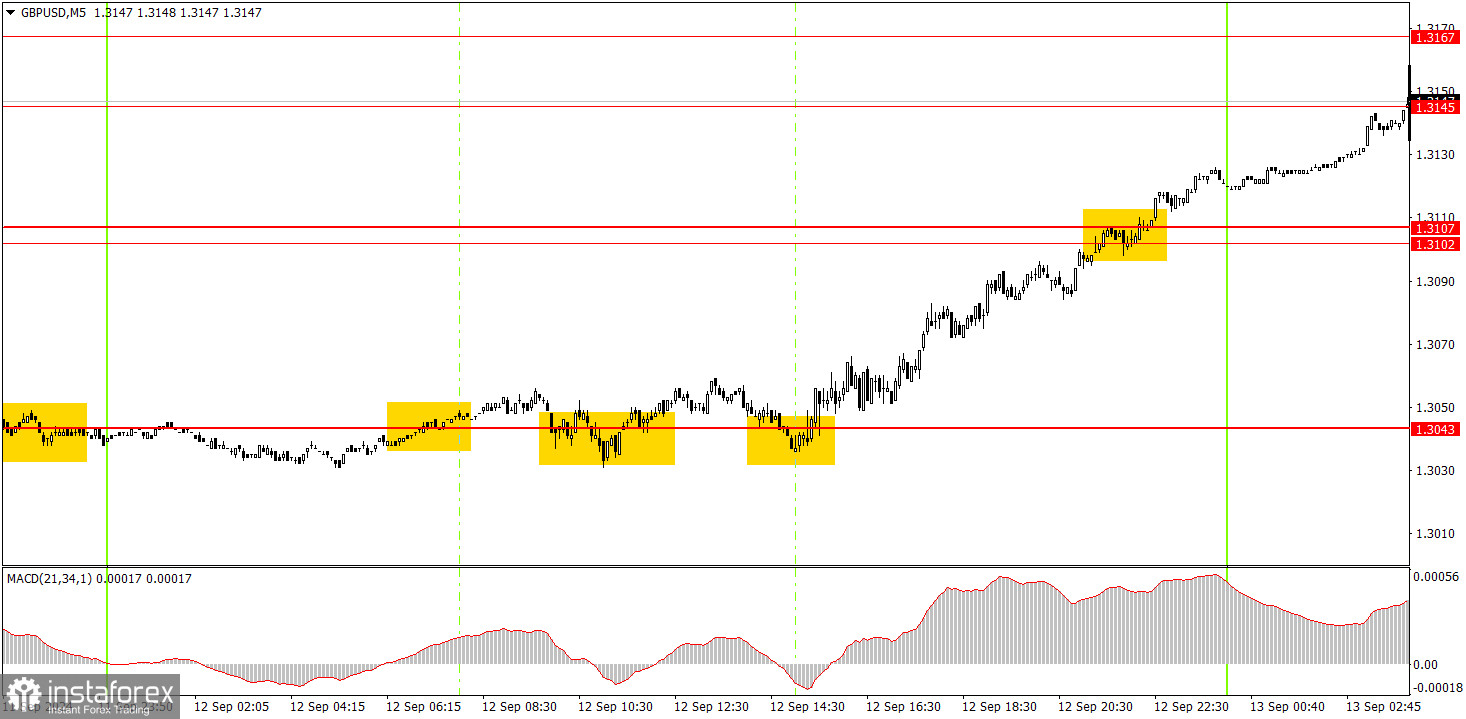

GBP/USD on 5M Chart

In the 5-minute time frame on Thursday, three buy signals were formed around the 1.3043 level. Since they all duplicated each other, only one long position should have been opened. Subsequently, the price reached the 1.3102-1.3107 area and even broke through it. The movement is currently stalled around the 1.3145 level. Novice traders could have closed their long positions at almost any point during the US session – they would have been profitable regardless.

How to Trade on Friday:

In the hourly time frame, GBP/USD has a good chance of resuming the global downtrend or at least seeing a significant correction. The British pound remains overbought, the dollar is undervalued, and the market is still much more inclined to sell the dollar than to buy it. So far, the pound only shows a minor bearish correction. It is too early to speak of a full-fledged downtrend. The much-anticipated Federal Reserve meeting will take place next week, and after that, conclusions can be made regarding the medium-term direction of the dollar.

On Friday, the pair may resume its decline, as it rose yesterday without any apparent reason. However, the market continues to show that it is ready to buy the pound even without justification.

In the 5-minute time frame, you can currently trade around the levels of 1.2605-1.2633, 1.2684-1.2693, 1.2748, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3225, 1.3272, and 1.3310. No significant events are scheduled in the UK for Friday, and in the US, there's only the University of Michigan Consumer Sentiment Index. Today, trading should be based on technical analysis.

Basic Rules of the Trading System:

1) The strength of a signal is determined by the time it takes for the signal to form (bounce or level breakthrough). The less time it took, the stronger the signal.

2) If two or more trades were opened around any level due to false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can form multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and midway through the U.S. session. After this period, all trades must be closed manually.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst good volatility and a trend confirmed by a trendline or trend channel.

6) If two levels are too close to each other (5 to 20 pips), they should be considered a support or resistance area.

7) After moving 20 pips in the intended direction, the Stop Loss should be set to break even.

What's on the Charts:

Support and Resistance price levels: targets for opening long or short positions. You can place Take Profit levels around them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD indicator (14,22,3): encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the movement of a currency pair. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to avoid sharp price reversals against the prevailing movement.

For beginners, it's important to remember that not every trade will yield profit. Developing a clear strategy and effective money management is key to success in trading over the long term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română