To open long positions on EUR/USD:

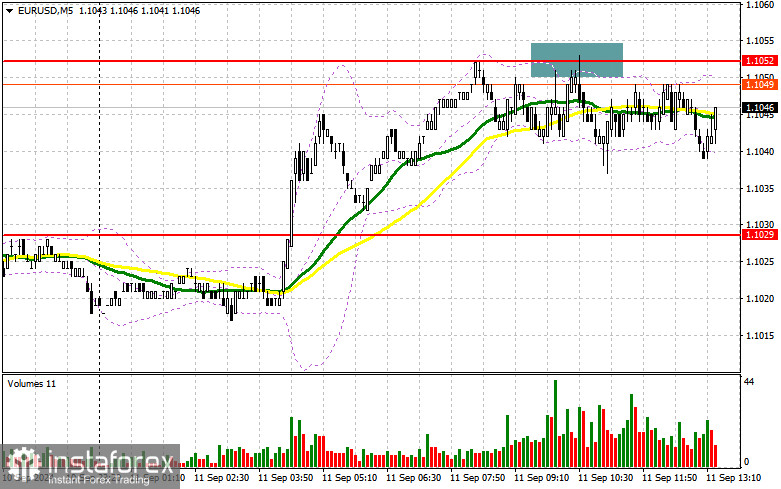

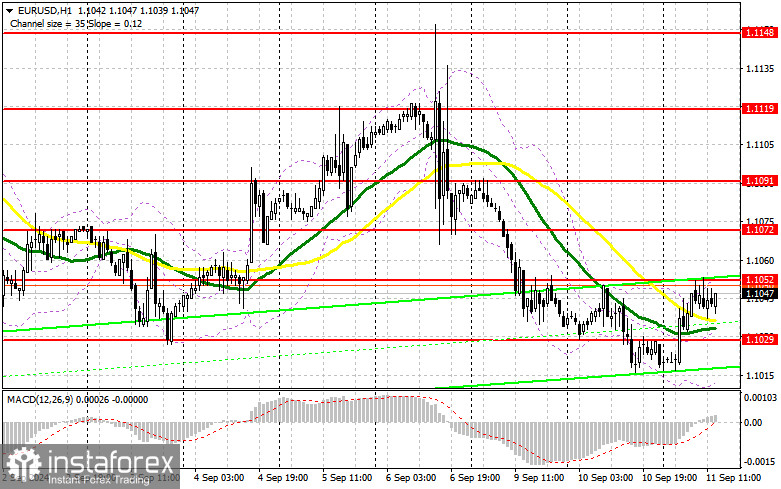

The absence of data from the eurozone kept the market in a state of equilibrium, which is likely to be disrupted by U.S. statistics. Upcoming reports on the U.S. Consumer Price Index for August, along with the core index, could lead to increased volatility. A faster decline in inflation would prompt the Federal Reserve to consider more aggressive monetary policy easing, which would provide a reason to sell the dollar and buy the euro. If inflation meets or exceeds economists' forecasts, pressure on EUR/USD will likely intensify. For this reason, I plan to open long positions only after a pullback and the formation of a false breakout around 1.1029, the weekly low, aiming for a correction and recovery towards 1.1052 – a resistance level that the pair has not yet been able to break. A breakout and consolidation above this range will lead to further growth in the pair, with a chance to test 1.1091. The furthest target will be the maximum of 1.1119, where I will take profits.

In the case of a decline in EUR/USD and a lack of activity around 1.1029 in the second half of the day, with the moving averages also passing through this area, sellers will fully regain control of the market, leading to a more substantial decline in the pair. In that case, I will enter only after a false breakout at the next support level of 1.1008. I plan to open long positions on a rebound from 1.0984, targeting an intraday correction of 30-35 points.

To open short positions on EUR/USD:

Sellers emerged in the first half of the day, but a major sell-off didn't materialize. If the euro rises following U.S. data, a false breakout around 1.1052 will serve as a good condition for opening short positions. The target would be retesting support at 1.1029, the weekly low. A breakout and consolidation below this range, amid rising inflation in the U.S., as well as a retest from the bottom upwards, will provide another selling opportunity, targeting 1.1008. The furthest target will be the area around 1.0984, which would completely nullify buyers' plans for a short-term rise in the euro. I will take profits there.

In case of a rise in EUR/USD, and if selling pressure fails to materialize at 1.1052, buyers will have a chance for a correction, with resistance at 1.1091 being tested. I will also sell there, but only after a failed consolidation. I plan to open short positions on a rebound from 1.1119, targeting a downward correction of 30-35 points.

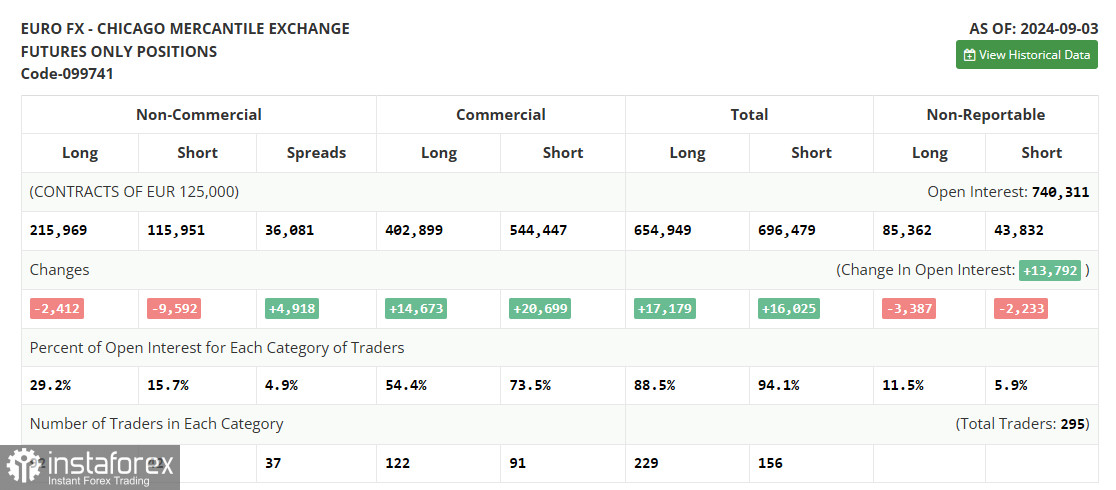

In the COT (Commitment of Traders) report for September 3, there was a reduction in both long and short positions. Despite the fact that the number of euro sellers has significantly decreased, it did not affect the pair's downward technical outlook. The euro is likely to continue losing ground against the dollar this week, as we have the upcoming European Central Bank meeting, where we will learn about another interest rate cut in the eurozone and further monetary policy. However, this does not cancel out the medium-term upward trend for the euro, and the lower the pair falls, the more attractive it becomes for buying. The COT report indicated that long non-commercial positions decreased by 2,412 to 215,969, while short non-commercial positions dropped by 9,592 to 115,951. As a result, the gap between long and short positions widened by 4,918.

Signals of indicators:

Moving Averages:

Trading is taking place slightly above the 30- and 50-day moving averages, indicating market equilibrium.

Note: The periods and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.1008 will serve as support.

Indicator Descriptions:

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 50 is marked in yellow on the chart.

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 30 is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open positions of non-commercial traders.

- Short non-commercial positions: Represent the total short open positions of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română