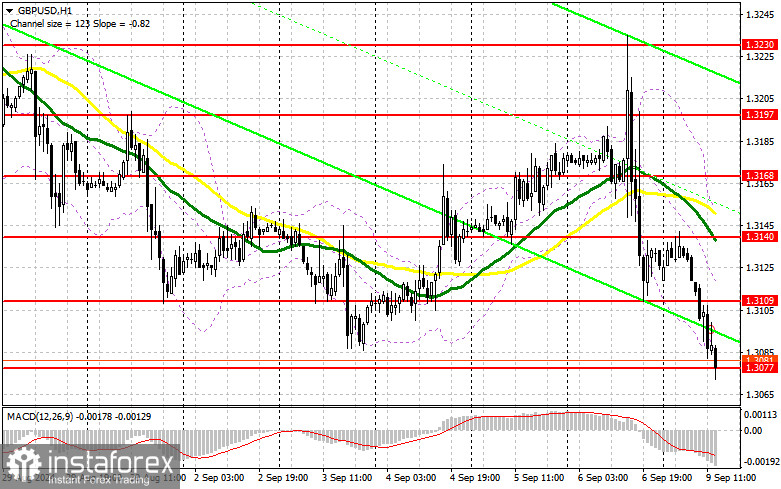

In my morning forecast, I highlighted the 1.3088 level and planned to make market entry decisions based on that level. Let's examine the 5-minute chart to see what transpired. The decline and formation of a false breakout provided an entry point to buy the pound, resulting in a 15-point rise in the pair, after which pressure returned. The technical outlook was revised for the second half of the day.

To open long positions on GBP/USD:

It's no surprise that after Friday's statistics and the sharp risk-off sentiment, the pound continued to decline during today's European session. The lack of important statistics from the UK appears to be deterring new buyers, even at these attractive prices. It is unlikely that anything will change in the second half of the day, as data on changes in wholesale inventories and consumer credit from the U.S. are not expected to significantly impact the market. For this reason, I plan to act on buying only after a false breakout forms around the new support level of 1.3077. Only this will provide a chance for a correction and recovery to the 1.3109 level. A breakout and retest of this range from top to bottom will strengthen the chances for an intraday upward trend, leading to stop-loss orders from sellers and providing a suitable entry point for long positions with a possible move towards 1.3140, where the moving averages, currently favoring sellers, are located. The furthest target will be the 1.3168 level, where I plan to take profits. If GBP/USD falls and there is no bullish activity around 1.3077 in the second half of the day, which is more likely, the pressure on the pair will increase. This could lead to a decline and the update of the next support level at 1.3045, which would nullify all buyer plans. A false breakout at this level will be the only condition for opening long positions. I plan to buy GBP/USD on a rebound from the 1.3012 low, targeting a 30-35 point correction within the day.

To open short positions on GBP/USD:

Sellers continue to control the market and have already achieved a new low for the week, raising doubts about the bullish trend observed at the end of this summer. In the event of weak U.S. data, the main task for the bears will be to defend the 1.3109 resistance, where a false breakout will provide a good opportunity to open new short positions, aiming for a new trend and retesting the 1.3077 support. A breakout and retest of this range from bottom to top will hit the buyers' positions, leading to stop-loss orders and a move towards 1.3045, where I expect more active trading from major players. The furthest target will be the 1.3012 level, where I will take profits. If GBP/USD rises and there is no bearish activity around 1.3109 in the second half of the day, buyers will have a chance to confine the pair to a sideways channel. Bears will then have no choice but to retreat to the 1.3140 resistance area, where the moving averages are limiting the pair's upward potential. I will sell there only after a false breakout. If there is no downward movement, I will look for short positions on a rebound from 1.3168, aiming for a 30-35 point intraday downward correction.

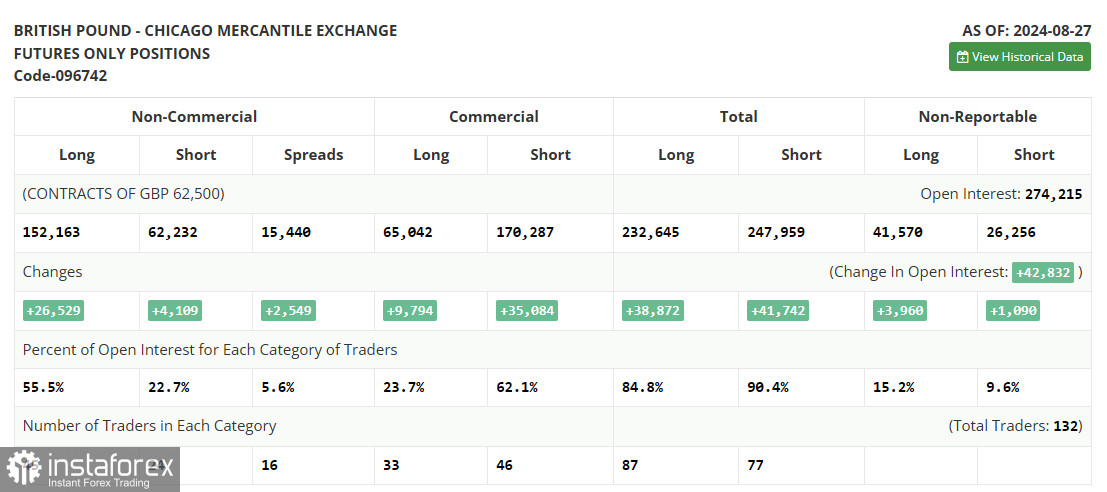

The COT (Commitment of Traders) report for August 27 showed a sharp increase in long positions and a slight increase in short positions. Traders are confident that interest rate cuts in the U.S. are a much more significant event than similar actions by the Bank of England, which is why the market continues to shift towards buyers of the British pound, who are becoming increasingly numerous. This week, a lot of important U.S. statistics will be released, which could further weaken the dollar and return the GBP/USD pair to a bullish trend. Labor market reports will be especially important. The latest COT report shows that long non-commercial positions rose by 26,529 to 152,163, while short non-commercial positions increased by 4,109 to 62,323. As a result, the gap between long and short positions increased by 2,549.

Indicator Signals:

Moving Averages:

Trading is occurring below the 30- and 50-day moving averages, indicating a further decline for the pair.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart, which differs from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator near 1.3077 will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing volatility and noise. 50-period, marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing volatility and noise. 30-period, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes.

- Long Non-commercial Positions: The total long open position of non-commercial traders.

- Short Non-commercial Positions: The total short open position of non-commercial traders.

- Total Non-commercial Net Position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română