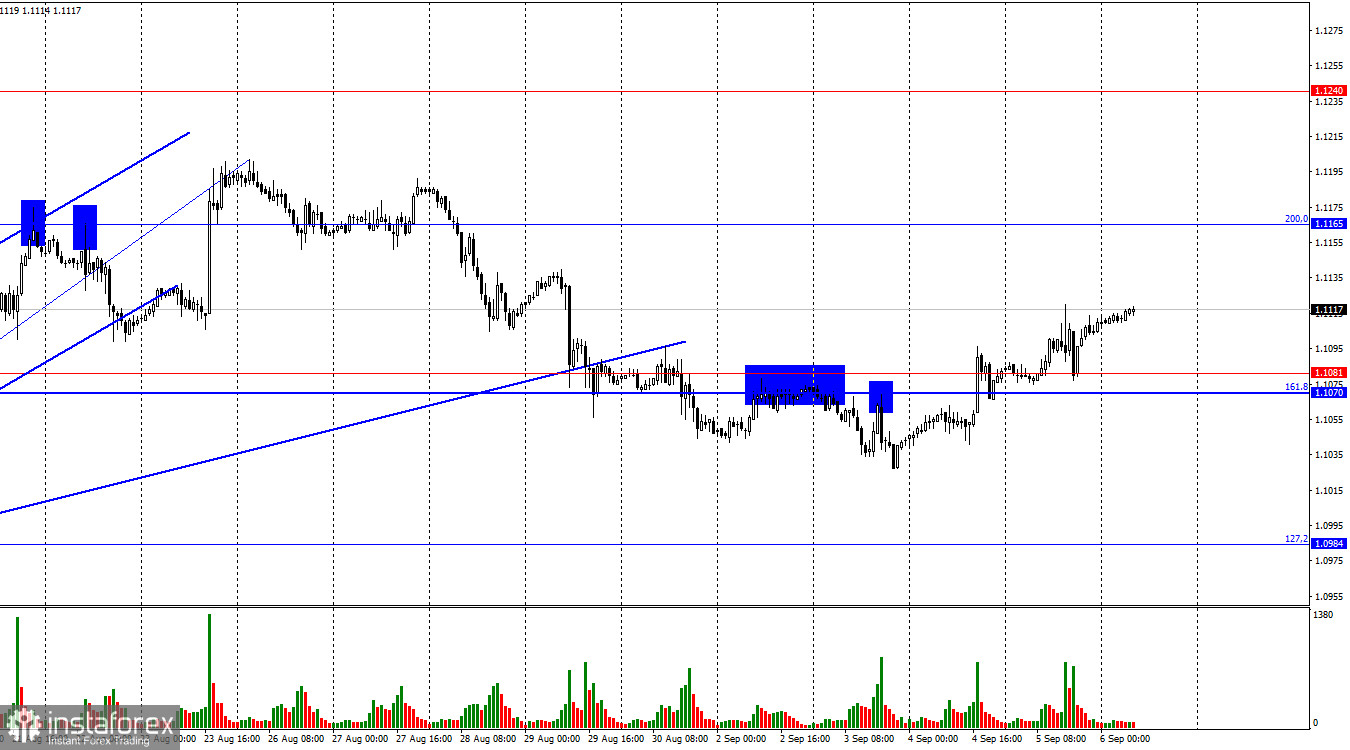

The wave structure has become slightly more complex, but overall it remains clear. The last completed upward wave broke the peak of the previous wave, and the new downward wave hasn't yet come close to the last low from August 15. Therefore, the bullish trend is still intact. For the bullish trend to be invalidated, the bears would need to break the low of the last downward wave, which is around the 1.0950 level. Alternatively, the current upward wave should not surpass the peak from August 26.

The news flow on Thursday, once again, brought no good news for the dollar. This time, the ISM Services PMI came in stronger than traders expected, but the ADP employment report released an hour and a half earlier showed a very weak result – only 99,000 new jobs in the private sector. Traders reasonably concluded that the labor market is more important than business activity right now, so they resumed selling the U.S. dollar. These sales could continue today. No one in the market expects strong results from the Nonfarm Payrolls and unemployment reports. Of course, this doesn't mean that these figures can't exceed forecasts, but few believe that at the moment. I'd like to remind you that this week, both the JOLTS and ADP reports fell short of expectations. If the scenario of weak data plays out, the bulls will continue their attack. It will not be the dollar bulls leading the charge. It's also worth noting that if the final GDP report exceeds expectations, it could cause the pair to rise.

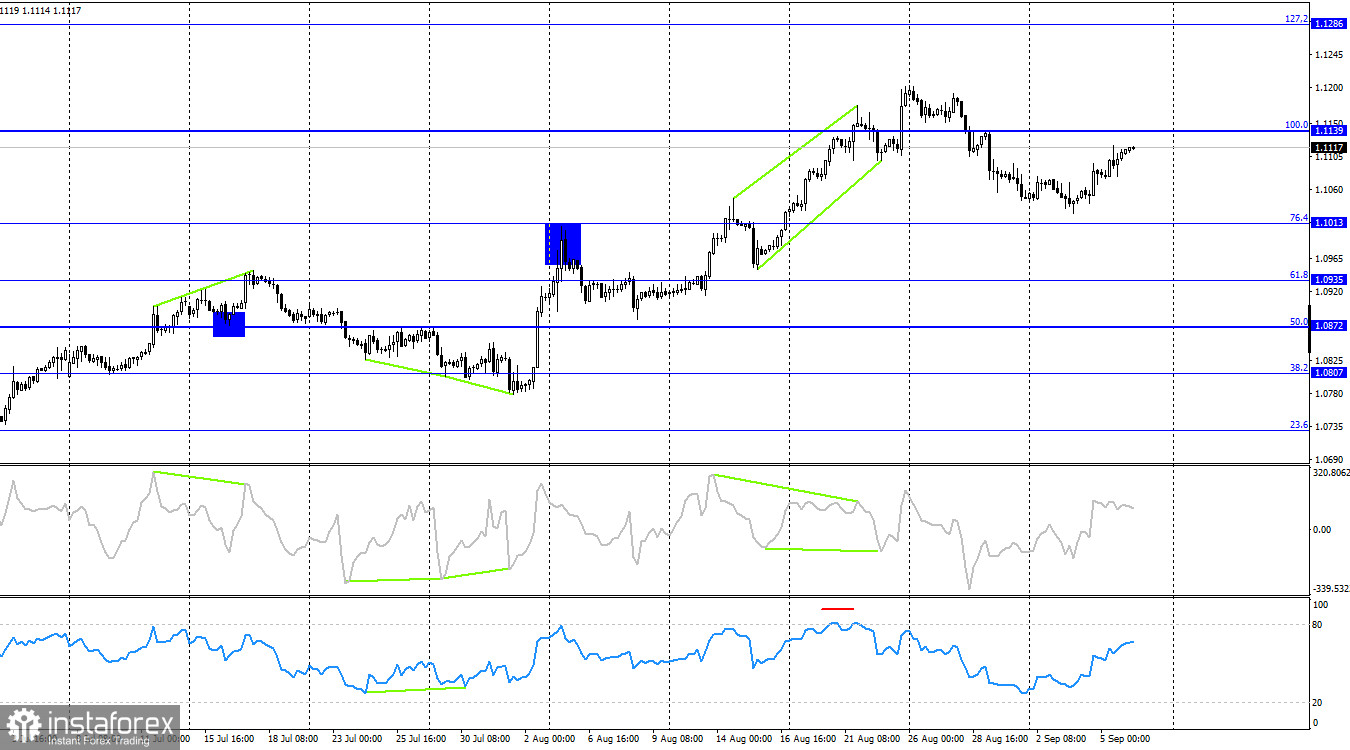

On the 4-hour chart, the pair reversed in favor of the euro, and began moving back toward the 100.0% retracement level at 1.1139. A rebound from this level would favor the US dollar and lead to a decline toward the Fibonacci level of 76.4% – 1.1013. If the pair consolidates above the 1.1139 level, the likelihood of continued growth toward the next retracement level of 127.2% – 1.1286 will increase. No emerging divergences are currently observed in any indicators.

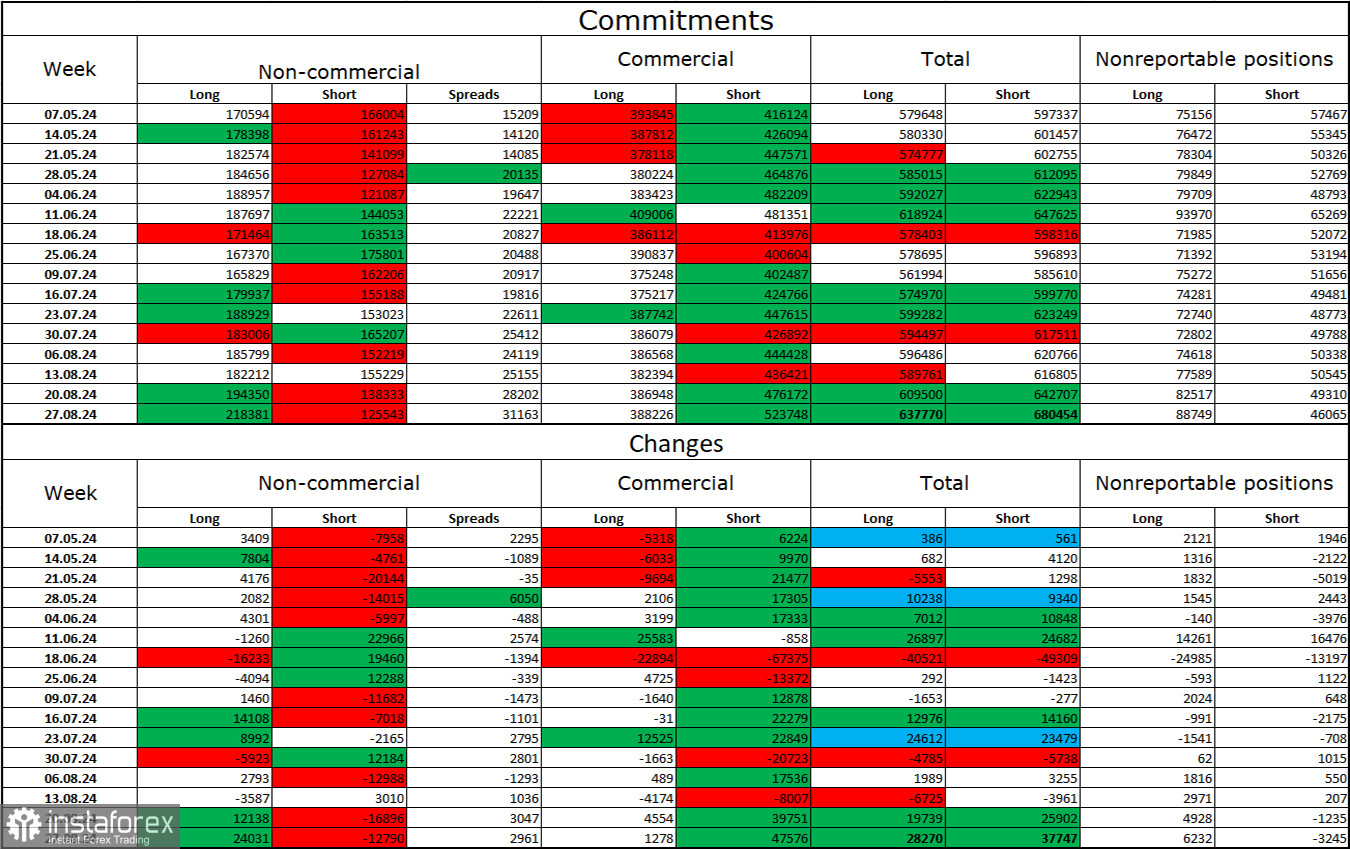

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 24,031 long positions and closed 12,790 short positions. The sentiment of the "Non-commercial" group turned bearish a few months ago, but now the bulls are dominating. The total number of long positions held by speculators is now 218,000, while short positions amount to 125,000.

I still believe that the situation will eventually turn in favor of the bears. I don't see any long-term reasons to buy the euro. I'd also like to point out that the FOMC rate cut in September has already been priced in by the market with a 100% probability. The potential for the euro to decline looks significant. However, we must not forget about chart analysis, which currently doesn't support a strong euro drop, as well as the news flow, which regularly "throws wrenches" into the dollar's path.

News Calendar for the US and Eurozone:

Eurozone – Industrial Production (06:00 UTC).Eurozone – GDP Change for Q2 (09:00 UTC).US – Nonfarm Payrolls (12:30 UTC).US – Unemployment Rate (12:30 UTC).US – Average Hourly Earnings (12:30 UTC).On September 6, the economic calendar is filled with many important events. The news background's influence on traders' sentiment today will be very strong.

Forecast for EUR/USD and trading advice:

Selling the pair is recommended after a rebound from the 1.1139 level on the 4-hour chart, with a target of 1.1070–1.1081. Buying was possible after the price closed above the 1.1070–1.1081 zone on the hourly chart, with a target of 1.1165. Today, the news background may have a significant impact on the pair's movement.

The Fibonacci levels are drawn from 1.0917 to 1.0668 on the hourly chart and from 1.1139 to 1.0603 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română