Amid the dovish sentiment surrounding the USD, driven by the Fed, the price of gold remains at its weekly high, around $2520.

However, the upward potential is limited as traders remain cautious ahead of the U.S. Nonfarm Payrolls (NFP) report. This critical employment release could influence market expectations for a more substantial interest rate cut by the Federal Reserve in September. This report will play a key role in driving demand for the U.S. dollar, potentially providing new momentum to the underperforming yellow metal.

Currently, markets are pricing in a 40% chance that the Fed will cut borrowing costs by 50 basis points at the monetary policy meeting scheduled for September 17-18. Such expectations emerged following a combination of positive and negative U.S. employment data released earlier this week.

In fact, Wednesday's report showed that the number of job openings in the U.S. dropped to a three-and-a-half-year low of 7.673 million in July. On Thursday, ADP (Automatic Data Processing) reported that private sector employment saw its smallest growth since January 2021, increasing by just 99,000 jobs in August.

Additionally, Chicago Federal Reserve President Austan Goolsbee stated that the long-term trend of inflation data and labor market conditions justifies easing interest rate policy in the near term. This has kept U.S. Treasury yields at their lowest level in more than a year and pushed the U.S. dollar away from the two-week high it reached on Tuesday. As a result, this backdrop provides some support for the precious metal. Therefore, even slight disappointment from the monthly U.S. employment data could negatively impact the U.S. dollar, paving the way for a significant rise in gold prices.

Conversely, the market reaction to a better-than-expected report is likely to be limited, given the prospects of an imminent Fed rate-cutting cycle. Nonetheless, gold remains on track for modest weekly gains, with the fundamental backdrop strongly favoring the bulls.

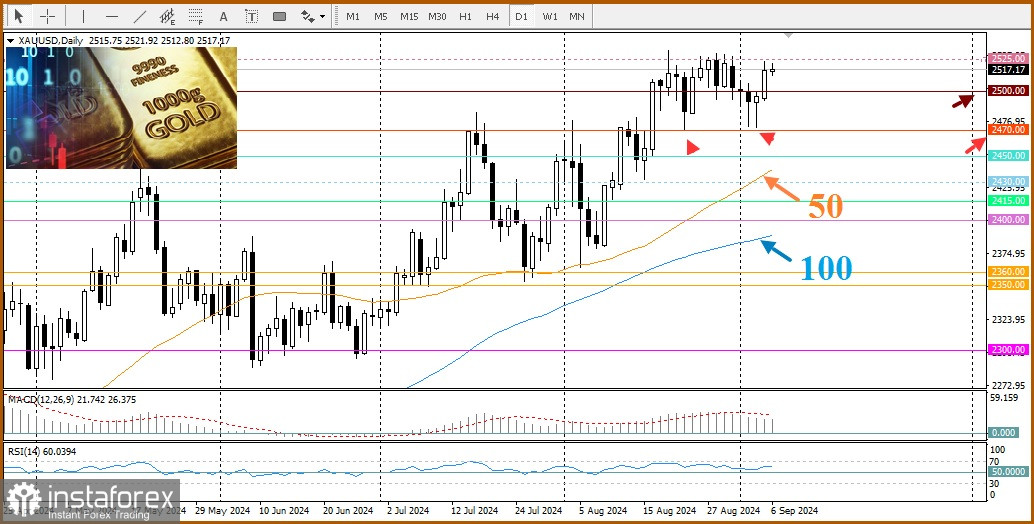

From a technical perspective, sustained strength above the $2525 resistance will confirm a short-term positive outlook. With the oscillators on the daily chart holding in positive territory and far from overbought levels, the precious metal will attempt to surpass the all-time high reached in August. A further upward move will pave the way for the resumption of the established uptrend observed over the past two months.

On the other hand, the psychological level of $2500 provides immediate support. A break below this level could push the price down to the horizontal support level of $2470. A convincing breach below the latter would set the stage for deeper losses, potentially targeting the 50-day Simple Moving Average (SMA) and heading toward the $2400 round level and the 100-day SMA.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română