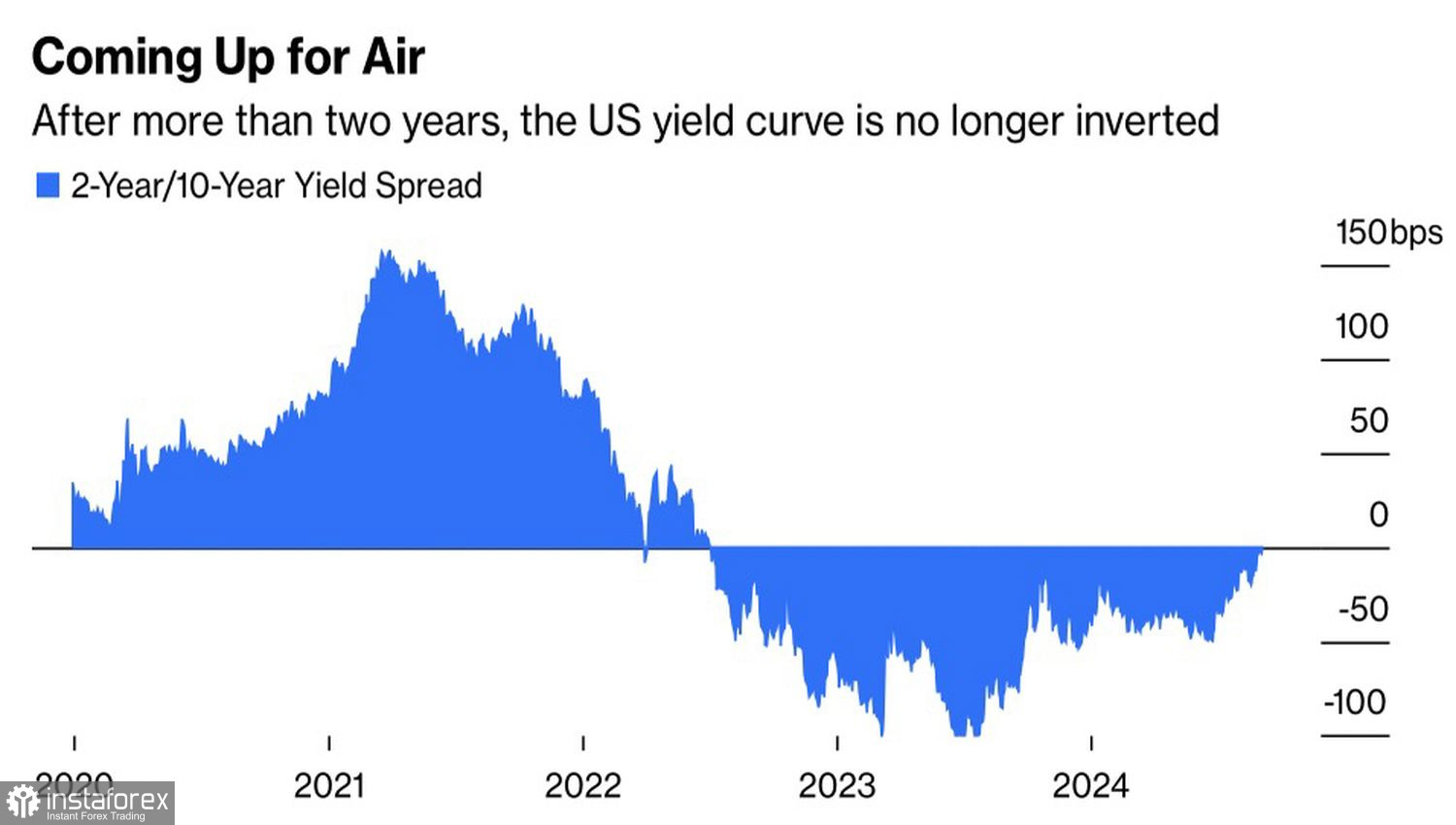

Fear has big eyes. As soon as data on job openings and layoffs confirmed the weakness of the US labor market, the chances of a 50 basis point cut in the federal funds rate in September jumped to nearly 50%, and the yield curve came out of the inversion state. The difference in rates on 2- and 10-year bonds was in it for 26 months. Usually, a return of the indicator above the zero mark signals a downturn in the US economy, which was immediately reflected in EUR/USD. The pair rose. But how long will the bulls' celebration last?

Dynamics of the Yield Curve in the US

Investors quickly recalled that the Federal Reserve had previously thrown the economy a lifeline during recessions. The central bank provided support by launching quantitative easing programs or sharply lowering the federal funds rate. Its balance sheet is already inflated, and the effectiveness of QE is in question, so it's no surprise that derivatives have increased the scale of the anticipated reduction in borrowing costs. They predict that rates will fall to 3% in 2024-2025.

Such expectations seem overly aggressive. The markets demanded approximately the same from the Fed during Saddam Hussein's invasion of Kuwait, the dot-com bubble, and the global financial crisis of 2008. The current situation has little in common with those events. Yes, the US economy is cooling, but it's too early to talk about a recession when GDP expands by 3% in the second quarter.

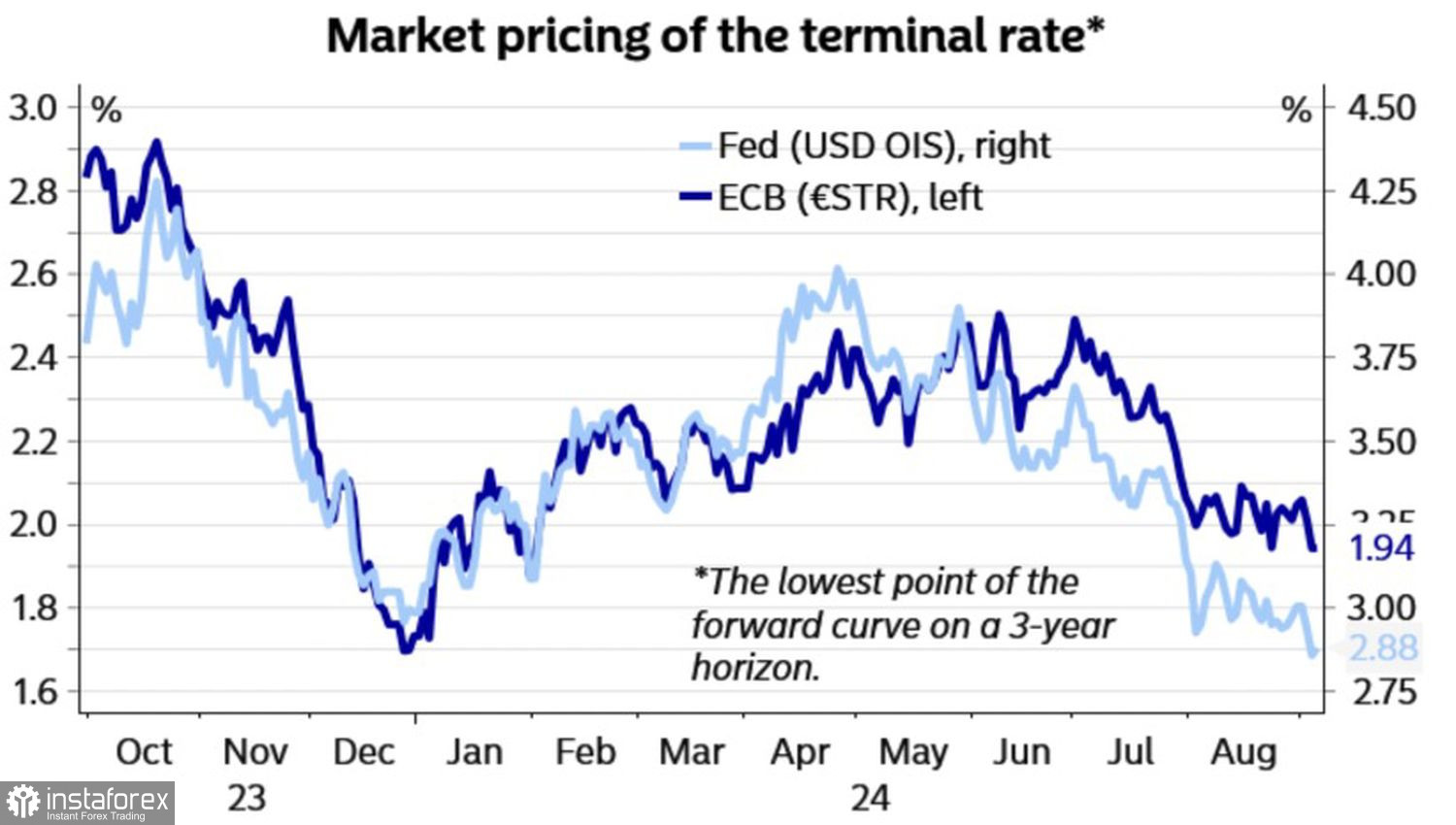

Dynamics of Market Expectations for Fed and European Central Bank Rates

The global economy is interconnected. Looking at the federal funds rate expectations, forecasts for the ECB monetary easing in 2024 began to rise. Markets demand its growth by 60 bps, implying two acts of monetary easing with a possible third. Borrowing costs in the Eurozone could fall to 3%, and maintaining a wide differential with its American counterpart will create a tailwind for EUR/USD bears.

It's no surprise that Reuters experts predict the main currency pair will fall to 1.10 by the end of November and recover to 1.11 by the end of February. Twelve months from now, experts believe the euro will be priced at $1.12, higher than it is now.

The likelihood of a storm in the markets in the next few days is high. Following the release of US employment data, heightened volatility could be triggered by the debates between Donald Trump and Kamala Harris on September 10 and the ECB meeting on September 12. Nordea Markets believes that EUR/USD will be sensitive to dovish surprises from the ECB. Christine Lagarde needs to be very careful not to plunge the euro.

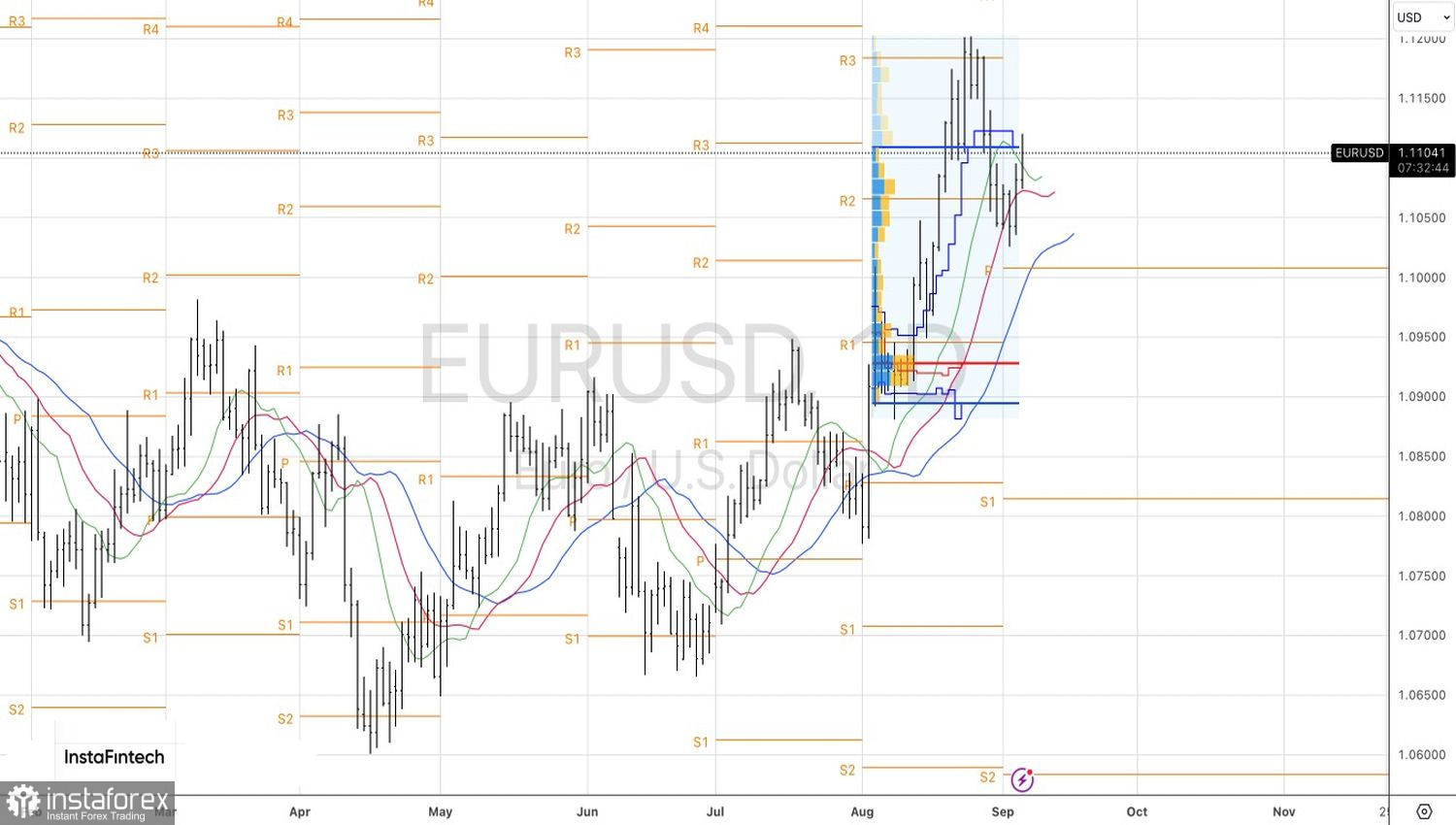

Technically, on the daily chart, EUR/USD bulls are trying to push the pair's quotes beyond the fair value range of 1.090-1.111. Failure to do so will show their weakness and provide grounds for forming short positions in the EUR/USD pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română