Analysis of GBP/USD 5M

The GBP/USD pair also slightly declined on Tuesday, but this drop can be considered formal. The ascending trend line has been breached, but the price has yet to consolidate below the Senkou Span B line. If we move away from technical analysis, which allows for further fall of the pound sterling, what kind of downward movement would you expect to see after a substantial rise if you were anticipating the start of a new downward trend? Likely a firm one, where sellers exert daily pressure and macroeconomic data provide support. We are not seeing anything like that at the moment. The price barely edges downward and could resume its illogical rise at any moment. Therefore, consolidation below the Senkou Span B line would increase the likelihood of further decline, but so far, it all looks as though we might see a minor correction, and then the pound will start to rise again.

From the past day's macroeconomic events, there is nothing significant to highlight. The U.S. ISM Manufacturing PMI for August was 47.2 points. Although this value is higher than in July, the important comparison is not to the previous value but to the forecast, which was 47.5 points. Thus, once again, the actual value of an important indicator was below the forecast.

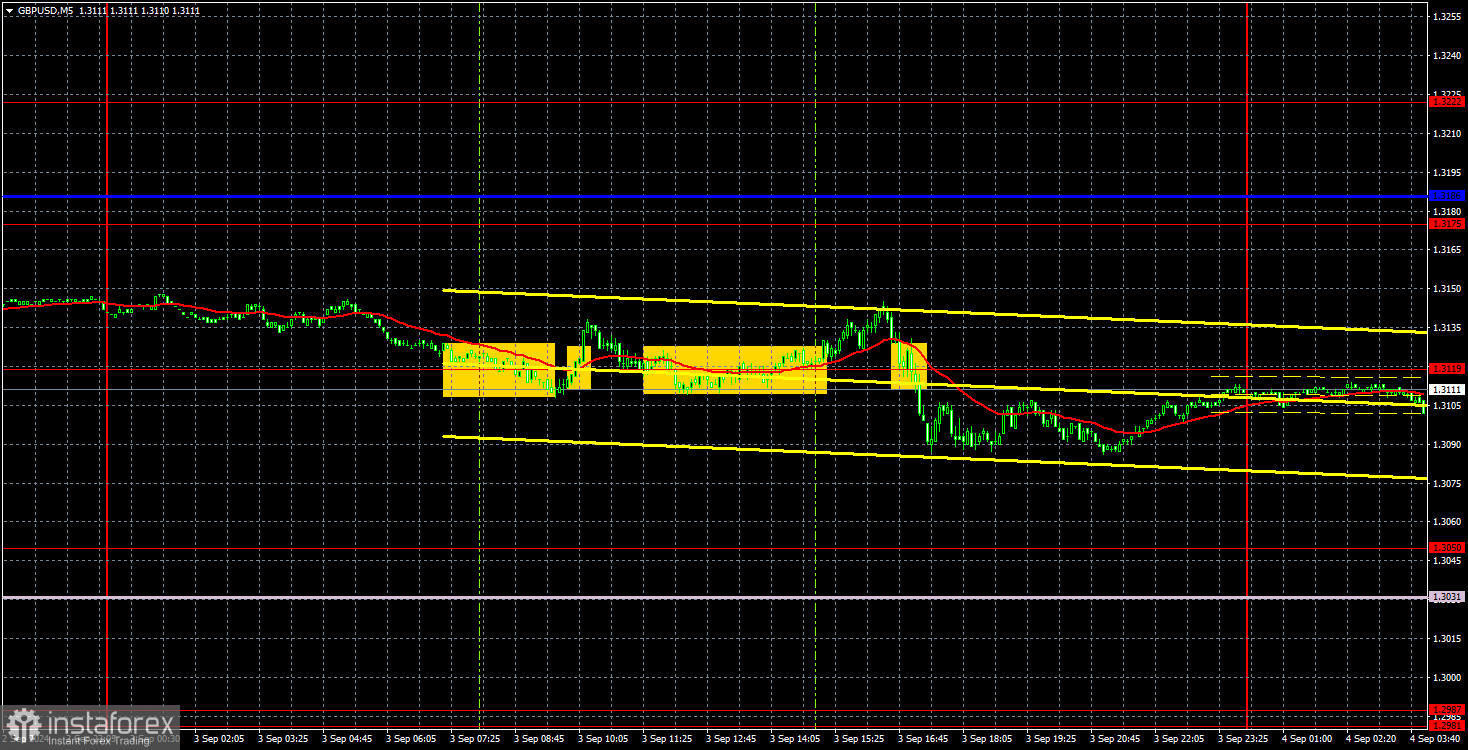

While several trading signals were formed yesterday, the pair moved erratically and sideways for most of the day. The level of 1.3119 was breached several times in both directions. The price eventually settled below it, but now the Senkou Span B line, which lies at the 1.3100 level, is supporting the price from below. It is still very difficult to count on a solid downward movement.

COT report:

The COT reports for the British pound indicate that the sentiment of commercial traders has been subject to frequent changes in recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, are constantly intersecting and often close to the zero mark. We also see that the last downward trend occurred when the red line was below zero. Therefore, a downturn could be expected around the level of 1.3154, but this assumption will need regular confirmation over time.

According to the latest report on the British pound, the non-commercial group opened 26,500 buy contracts and 4,100 short ones. As a result, the net position of non-commercial traders increased by 22,400 contracts over the week, but overall, it is still rising rather than falling.

The fundamental background still does not provide any grounds for long-term purchases of the pound sterling, and the currency has a real chance to resume the global downward trend. However, an ascending trend line formed in the weekly time frame. Therefore, a long-term decline in the pound is unlikely unless the price breaches this trend line. Despite almost everything, the pound continues to rise. Even when COT reports show that major players are selling the pound, it continues to rise.

Analysis of GBP/USD 1H

In the hourly time frame, GBP/USD continues to correct, but this correction could end at any moment. A decline is the only consistent and logical scenario in the medium term, considering all factors: technical, fundamental, and macroeconomic. However, the market buys pounds and sells dollars, disregarding the lack of corrections or news on specific days. Moreover, economic reports from overseas are once again mediocre, and under such conditions, it will take much work for the dollar to sustain its growth.

For September 4, we highlight the following important levels: 1.2605-1.2620, 1.2691-1.2701, 1.2796-1.2816, 1.2863, 1.2981-1.2987, 1.3050, 1.3119, 1.3175, 1.3222, 1.3273, 1.3367. The Senkou Span B (1.3100) and Kijun-sen (1.3156) lines can also serve as sources of signals. Setting the Stop Loss to break even when the price moves in the intended direction by 20 pips is recommended. The Ichimoku indicator lines may shift during the day, which should be considered when determining trading signals.

On Wednesday in the UK, a secondary index of business activity in the services sector will be published in its second assessment, but the JOLTs report in the U.S. will be of greater importance. If the number of job openings in July turns out to be below forecasts, the dollar will again fail to show any growth.

Explanation of illustrations:

Support and resistance levels: Thick red lines near which the trend may end.

Kijun-sen and Senkou Span B lines: These Ichimoku indicator lines, transferred from the 4-hour timeframe to the hourly chart, are strong lines.

Extreme levels: Thin red lines from which the price previously bounced. These provide trading signals.

Yellow lines: Trend lines, trend channels, and other technical patterns.

Indicator 1 on COT charts: The net position size for each category of traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română