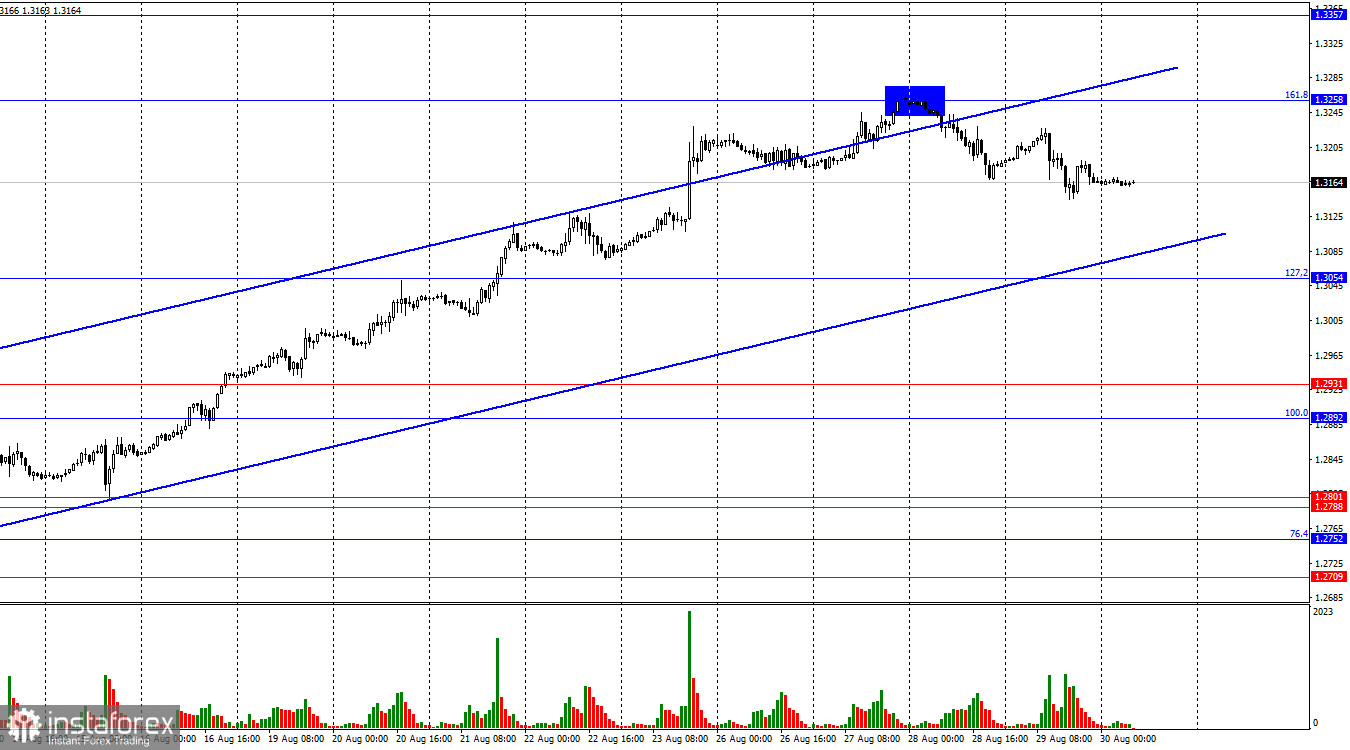

On the hourly chart, the GBP/USD pair continued its Thursday decline after rebounding from the 161.8% corrective level at 1.3258 towards the 127.2% corrective level at 1.3054. The pair stays within the boundaries of an upward trend channel, keeping market sentiment "bullish." A rebound from the lower line of the channel would support the pound and resume growth towards the 1.3258 level. A break below the channel would be the only signal of the formation of a "bearish" trend.

The wave structure is clear. The last completed wave down did not break the low of the previous wave, while the last wave up managed to break the peak of the previous wave. Thus, we are currently dealing with a "bullish" trend without any doubts, but all the waves are so large that a trend reversal can only be detected with a significant delay. I do not see any smaller wave patterns that could indicate a trend change. However, an upward trend channel remains intact, providing support for the pair.

Thursday's news helped strengthen the U.S. dollar, as the U.S. economy grew more than traders expected in the second quarter. The bears remain too weak. Even moving the pair towards the lower line of the channel may take considerable time. Each new report suggesting a possible easing of the Fed's monetary policy in September or by the end of the year could weigh on the dollar. Today, the PCE index will be released, and if it slows down, it will indicate that U.S. inflation continues to decrease. A slowdown in inflation increases the chances of a quicker rate cut by the Fed in the coming months. Currently, FOMC members are not certain about the need to ease at every meeting until the end of the year, but their opinion may change if inflation continues to decline and the labor market continues to show weak results alongside rising unemployment.

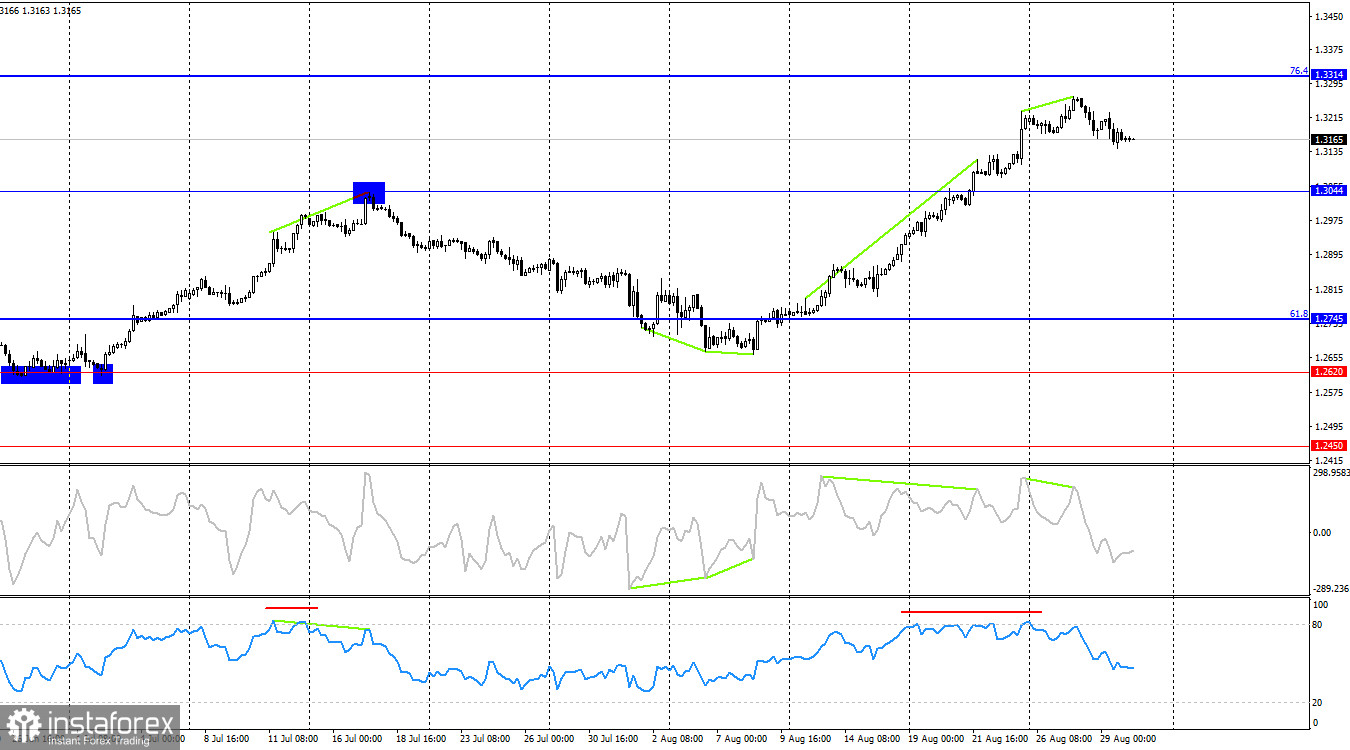

On the 4-hour chart, the pair has settled above the 1.3044 level. The CCI indicator has been warning of a "bearish" divergence for over a week, and the RSI indicator has been in overbought territory for a week, which is a rare occurrence. The likelihood of the pair declining in the coming days is high. However, for now, the pair's settlement above the 1.3044 level suggests continued growth towards the next Fibonacci level of 76.4% at 1.3314. The only signal for a decline in the pound is present on the hourly chart.

Commitments of Traders (COT) Report:

The sentiment of Non-commercial traders became much more bullish over the last reporting week. The number of long positions held by speculators increased by 23,031, while the number of short positions increased by 3,332 units. The bulls still have a solid advantage. The gap between the number of long and short positions is almost 67,000: 125,000 vs. 58,000.

In my opinion, the pound still has downward potential, but the COT reports currently suggest otherwise. Over the last 3 months, the number of long positions has grown from 51,000 to 125,000, while the number of short positions has decreased from 74,000 to 58,000. I believe that over time, professional players will start to reduce their long positions or increase their short positions, as all possible factors for buying the British pound have already been factored in. However, it should be remembered that this is just an assumption. Chart analysis suggests a likely decline in the near future, but for now, a clear "bullish" trend remains.

News Calendar for the US and the UK:

- US: Core PCE Price Index (12:30 UTC).

- US: Personal Income and Spending (12:30 UTC).

- US: University of Michigan Consumer Sentiment Index (14:00 UTC).

On Friday, the economic calendar contains three entries, each of which could put pressure on the dollar. The impact of the news background on market sentiment today will be moderate.

GBP/USD Forecast and Trading Advice:

Sales of the pair were possible after a rebound from the 1.3258 level on the hourly chart with a target of 1.3054. These trades can now be kept open. Buying was possible after a close above the 1.3054 level. The target was 1.3258, and this target has been reached. I would not rush with new purchases, even if the pair closes above the 1.3258 level.

Fibonacci levels are drawn from 1.2892 to 1.2298 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română