Analysis of macroeconomic reports:

There are quite a few macroeconomic events scheduled for Friday. The day should start with reports on retail sales and unemployment in Germany. While these data are not crucial, they could set the tone for trading in the euro from the start of the day. Next, the crucial report on inflation in the Eurozone will be published. The Consumer Price Index (CPI) is expected to slow down in August from 2.6% to 2.2%. In our view, this would provide grounds for the European Central Bank to lower rates for the second time in September, and the euro should continue to decline in this case. In addition, the unemployment rate in the EU will be released. The University of Michigan Consumer Sentiment Index and the PCE Index will be published in the US. The PCE Index significantly impacts core inflation as it reflects changes in personal consumption expenditure prices. It is expected to rise from 2.6% to 2.7%, which could reduce the likelihood of a Federal Reserve rate cut in September and dampen market hopes for an immediate 0.5% cut.

Analysis of fundamental events:

There is nothing particularly noteworthy in terms of fundamental events on Friday. The euro and the pound seem to have started moving downwards, which should be utilized, but it's important to remember that the market might resume dollar sales even without substantial reasons. We cannot say that the market has fully accounted for the future Fed rate cut, but it continues to ignore much of the positive data for the dollar.

General conclusions:

During the last trading day of the week, both currency pairs may continue to retrace downwards, but only within the framework of a correction. If the European inflation report shows a slowdown below 2.2%, it will be a solid basis for the sustained decline of the euro. The pound sterling could also continue to correct, having risen without a pause for over three weeks. The US PCE Index will support the dollar if it increases compared to the previous month.

Basic rules of the trading system:

1) The strength of a signal is determined by the time it takes for the signal to form (bounce or level breakthrough). The less time it took, the stronger the signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can form multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and midway through the U.S. session. After this period, all trades must be closed manually.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst substantial volatility and an established trend confirmed by a trendline or trend channel.

6) If two levels are too close to each other (5 to 20 pips), they should be considered support or resistance.

7) After moving 15-20 pips in the intended direction, the Stop Loss should be set to break even.

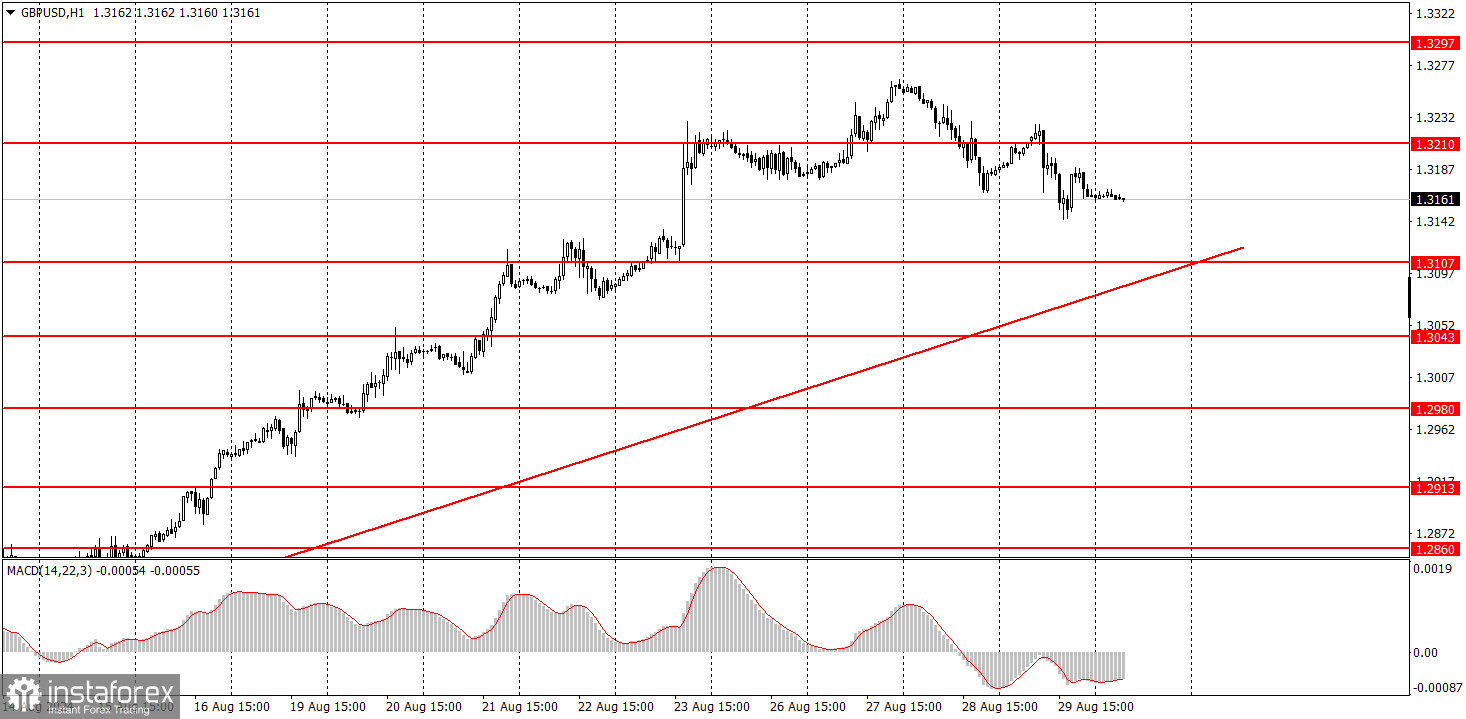

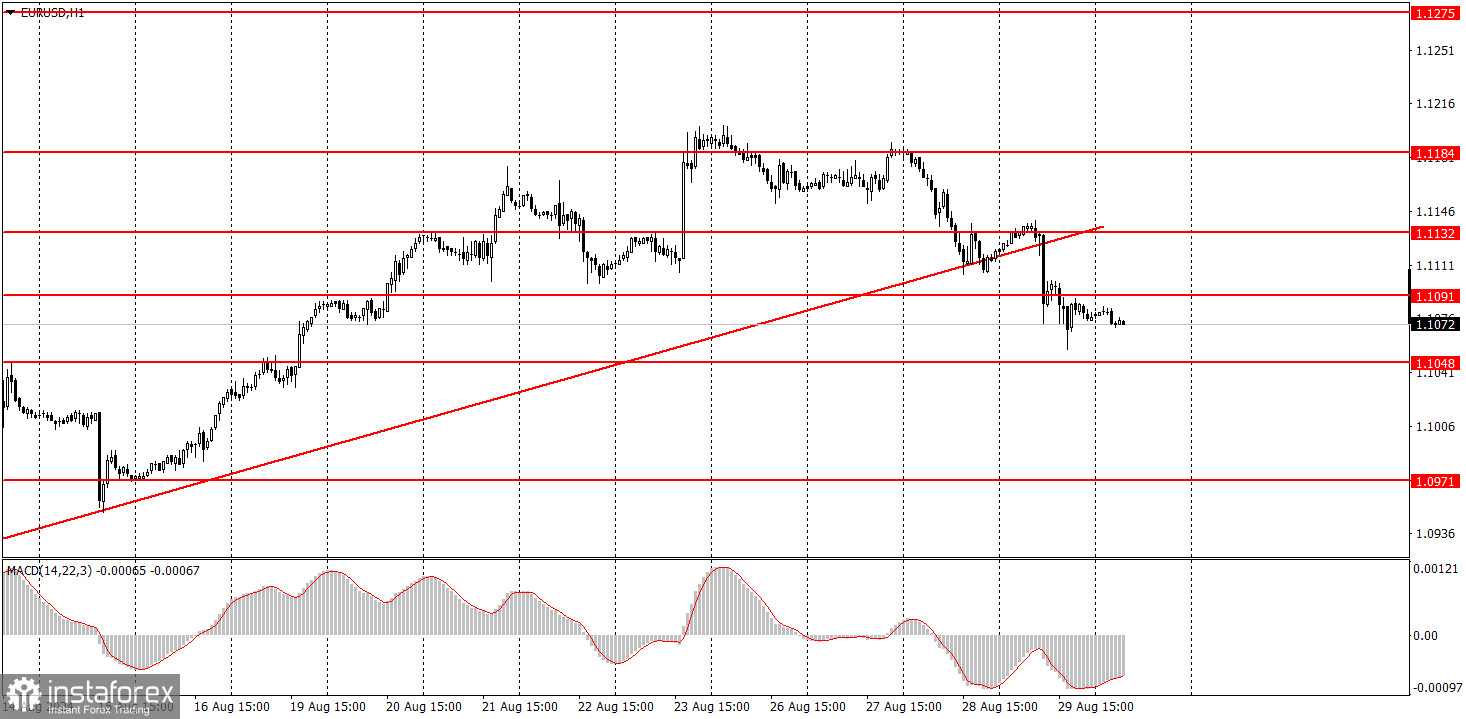

What's on the charts:

Support and Resistance price levels: targets for opening long or short positions. You can place Take Profit levels near them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD (14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the movement of a currency pair. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Developing a clear strategy and effective money management is key to success in trading over a long period.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română