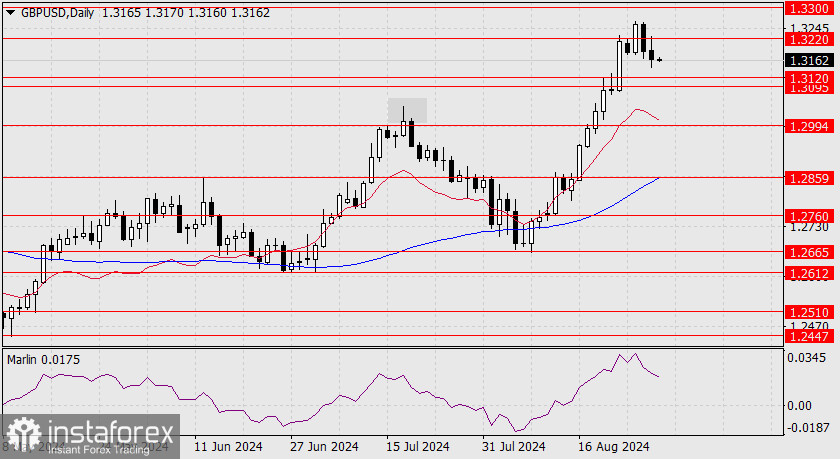

The British pound traded in a range of just over 80 pips yesterday. The final result was a 21-pip decline, with the price settling below the 1.3220 level. The Marlin oscillator sustains its rapid decline, with the target range of 1.3095-1.3120 now open. A breakout of this range opens up the target at 1.2994.

In the 4-hour chart, the price has settled below the MACD line. The Marlin oscillator is slightly contracting to build a new downward momentum as it senses the strength of the target range.

Today, the pound could be affected by data on total and mortgage lending in England, US inflation, and retail sales. Net lending in the UK is forecast to decrease from £3.82 billion to £3.40 billion in July, while the US personal consumption expenditures (PCE) price index may increase from 2.5% year-on-year to 2.6% year-on-year. Personal spending is expected to rise by 0.5% in July.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română