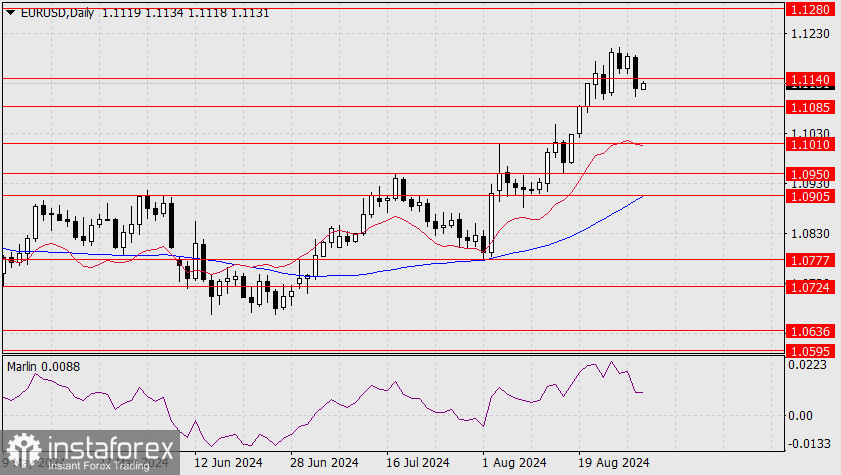

On Wednesday, according to the US business media, there was a broad market correction due to partial profit-taking in a calm external environment—there were no significant economic releases or political events. We agree with this assessment, and it supports our assumption that the euro is searching for a convenient range for consolidation before the European Central Bank meeting. So far, the euro is consolidating within the 1.1085-1.1140 range. The upper boundary may be adjusted to 1.1151, aligning with the lows of August 26 and 27.

The Marlin oscillator is declining ahead of the price, aiming to quickly reach the neutral zero level to balance the euro market. Visually, the balance of expectations seems to align with the 1.1085 level, which is the lower boundary of the range. A price consolidation below this level opens up the target of 1.1070. There might be an initial attempt today if investors decide to react to the strong US GDP figure for Q2.

In the 4-hour chart, the price has consolidated below both indicator lines, and the Marlin oscillator is firmly in the downtrend territory. The potential for a price decline to the lower boundary of the 1.1085-1.1140/51 range has increased.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română